Coal price forecast: How will the price change in 2026 and beyond?

One of the world’s major commodities, coal, is a must-have resource in pretty much every country because it is widely used in a number of important industries. Its price depends on a number of factors, including geopolitics, energy consumption, and technical progress, so making coal price forecasts is no easy task.

This article provides insights into coal price performance and related news over the last years, explains what it depends on, how coal consumption trends are changing over the globe, and what to expect from the coal price in 2026 and further on.

Table of Contents

KEY TAKEAWAYS

COAL PRICE FORECAST SUMMARY

COAL TECHNICAL ANALYSIS

FACTORS THAT SHAPE COAL PRICES

WHERE IS COAL USED?

COAL PRICE PREDICTIONS 2025

HISTORICAL COAL PRICE PERFORMANCE

COAL PRICE PREDICTIONS 2026

COAL PRICE PREDICTIONS 2027

COAL PRICE PREDICTIONS 2028

COAL PRICE PREDICTIONS 2029

COAL PRICE FORECASTS 2030

FAQ

Key Takeaways

- Current outlook: Coal markets are experiencing a transitional phase, with prices expected to stabilize after recent volatility, moving from initial pressure in 2026 toward gradual recovery and long-term equilibrium through 2030.

- Key price drivers: Coal prices are shaped by the global energy transition, environmental regulations, demand from major consumers like China and India, competition with natural gas, steel industry activity, seasonal consumption patterns, and geopolitical factors.

- Market trajectory: Following a downward trend from 2024 peaks, thermal coal and coking coal prices are projected to recover moderately in 2026-2027 before stabilizing in 2028-2030, indicating a shift from volatility to market equilibrium.

- Historical performance: In 2024, thermal coal averaged around $140/ton at Newcastle, while coking coal reached $211/ton, both declining from earlier peaks. Throughout 2025, prices continued their adjustment phase with notable fluctuations.

- Future outlook: The next five years will see coal maintaining its role in global energy and steel production despite structural headwinds from renewable energy adoption, with prices finding a sustainable equilibrium rather than experiencing sharp declines.

Coal Price Forecast Summary

The coal price forecast indicates a multi-phase trajectory, with thermal coal prices expected to experience volatility in 2026 before entering a period of gradual recovery and stabilization through 2030. Coking coal prices are anticipated to remain volatile in the near term, followed by strengthening and eventual stabilization in the later years.

India's demand growth and additional electricity demand could provide some support for the market. However, the overall trajectory suggests initial pressure on prices, particularly in the spot market, before transitioning to a more stable equilibrium.

Coal consumption patterns will continue to evolve in key markets like China, the world's largest coal consumer, and parts of the European Union, despite displacing coal with alternatives like natural gas and hydropower.

While coal will not disappear overnight, analysts from the Prospects Group at the World Bank suggest that the market will experience a period of adjustment and stabilization, particularly as investments shift away from fossil fuels. The coal price projection for the next five years suggests a transition from volatility to equilibrium, with structural changes initially weighing on prices before stabilization sets in.

Keep an eye on spot prices and long-term forecasts for key insights.

Coal Technical Analysis

Recent Price Movements

Throughout 2025, coal prices have demonstrated continued volatility, with thermal coal fluctuating between $97.50/ton in April and $115.50/ton in January. Coking coal has ranged from $174.25/ton in March to $197.50/ton at the year's start, reflecting ongoing market adjustments amid shifting global demand patterns.

Key Influencing Factors

Several critical factors are currently shaping coal price movements in the market. The global energy transition continues to exert downward pressure on thermal coal demand, as countries accelerate their shift toward renewable energy sources and implement stricter carbon emission policies. China's domestic production expansion has significantly impacted import dynamics, while India's growing electricity needs provide partial support to the market.

Supply-side dynamics remain complex, with production levels staying robust at approximately 8.6 billion metric tons annually. However, geopolitical tensions, transportation costs, and infrastructure constraints continue to create regional price disparities. The competition between coal and natural gas for power generation intensifies during periods of gas price volatility, occasionally providing temporary relief to coal markets.

Industrial demand patterns, particularly from the steel sector, drive coking coal price fluctuations, while seasonal variations in heating and cooling requirements create predictable demand cycles for thermal coal. Looking forward, the balance between short-term market volatility and long-term structural decline will determine price trajectories through 2026 and beyond.

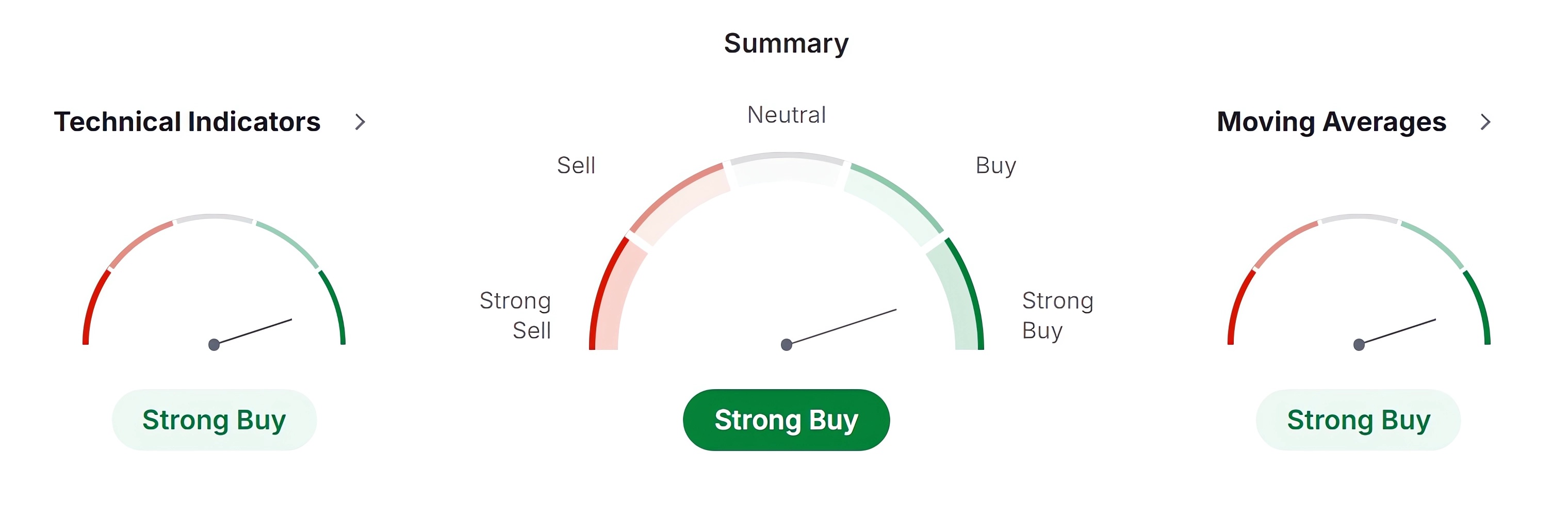

Technical Indicators

)

From a technical analysis perspective, coal markets are displaying mixed signals that warrant careful monitoring. The current technical setup reveals a combination of bullish momentum indicators alongside overbought conditions, suggesting potential short-term volatility ahead.

The Relative Strength Index (RSI) sits in neutral territory, while momentum oscillators like MACD and CCI signal buying opportunities. However, the STOCHRSI reaching overbought levels at 100 and Williams %R indicating overextension suggest caution may be warranted. The Average True Range (ATR) points to relatively low volatility, which could precede a significant price move in either direction.

Below is a comprehensive breakdown of key technical indicators and their current readings:

| Name |

Value |

Action |

| RSI(14) |

69.157 |

Buy |

| STOCH(9,6) |

50.145 |

Neutral |

| STOCHRSI(14) |

75.312 |

Overbought |

| MACD(12,26) |

0.17 |

Buy |

| ADX(14) |

29.626 |

Buy |

| Williams %R |

0 |

Overbought |

| CCI(14) |

154.9344 |

Buy |

| ATR(14) |

0.0927 |

Less Volatility |

| Highs/Lows(14) |

0.1926 |

Buy |

| Ultimate Oscillator |

57.629 |

Buy |

| ROC |

1.592 |

Buy |

| Bull/Bear Power(13) |

0.5124 |

Buy |

Factors that shape coal prices

The coal price significantly depends on demand in different countries. Here is what impacts it:

- Global economic growth drives industrialization and increased energy consumption. During upswings, industries require more energy, often sourced from coal. Conversely, economic downturns can lead to reduced industrial activity and a decline in energy demand.

- Stringent environmental policies and regulations, aimed at reducing carbon emissions, may favor cleaner energy sources over coal. Governments implementing policies such as carbon pricing, emissions standards, or renewable energy mandates can directly influence the demand for the asset.

- Advances in renewable energy, storage and efficiency can make alternative sources more cost-competitive. As cleaner innovations become more accessible and affordable, industries and power generators may shift away from coal.

- Political factors, including changes in government policies, international relations, and geopolitical tensions, can affect the stability of coal markets. Countries’ decisions may impact investments in the coal industry and influence the overall demand for coal. Coal competes with natural gas for electricity generation. When natural gas prices are low, it can become a more attractive option, leading to reduced demand for coal. Conversely, high natural gas prices may make coal a more competitive option.

- Infrastructure projects, such as construction and urbanization, drive demand for electricity, which is often met by coal. The demand for coal can increase in regions undergoing rapid development.

- Seasonal variations impact energy consumption patterns. Cold winters or hot summers increase the demand for heating or cooling, affecting the need for electricity generated from coal.

- The cost of extracting coal and transporting it to consumers influences its overall pricing. High mining and transportation costs can make coal less competitive compared to other energy sources.

- The increasing adoption of renewable energy sources, driven by advancements in technology and environmental awareness, can reduce the reliance on coal for electricity generation.

- International trade relationships and policies affect the flow of coal across borders. Changes in trade dynamics, tariffs, or trade agreements can impact coal exports and imports, influencing global coal markets.

- The implementation of carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, makes coal more expensive compared to low-carbon alternatives, influencing investment decisions and demand.

- Availability of funding and investment for coal projects affects coal production capacity and can influence the overall supply of coal, impacting its pricing and demand.

Where is coal used?

Among the various uses for coal, producing electricity is the most significant. The leftovers of dead flora buried beneath layers of dirt gave rise to this fossil fuel millions of years ago. The United States Geological Survey classifies coal into four categories based on how well it heats:

- Hard coal, or anthracite, is ranked highest. It has a low amount of volatile matter and a high percentage of fixed carbon.

- Bituminous coal is utilized to make steel due to its high heating value.

- Sub-bituminous coal, with a low to moderate heating value, comes in third. Both lignite and sub-bituminous coal are utilized to produce energy.

- Lignite coal (grade four) has a high moisture content and low heating value.

79% of the global coal trade accounts for thermal coal, often known as power station coal. It is burned to produce steam, which drives turbines connected to generators. Rotating generators then convert mechanical energy into electricity. This process, known as combustion, harnesses the energy released from burning coal to generate a significant portion of the world's electrical power.

The remaining coking coal is used in metallurgy primarily as a reducing agent in the process of extracting metals from their ores. During smelting, coal undergoes combustion, producing carbon monoxide, which reacts with metal oxides to form pure metal. Additionally, coal provides the necessary heat for these high-temperature processes. Its abundant carbon content facilitates the reduction of metal compounds, making it a vital resource in the production of various metals like iron and steel.

Historical coal price performance

)

In 2024, coal markets experienced notable fluctuations. Thermal coal prices, particularly at Newcastle, averaged approximately $140 per metric ton (t) in December 2024, reflecting a decline from earlier in the year.

Conversely, coking coal prices exhibited volatility, with Australian FOB prices averaging around $211/t in the 2024/2025 financial year, influenced by shifts in global request and supply dynamics.

China, the world's largest coal consumer, increased domestic production, impacting import levels and global coal consumption patterns. India's demand growth also played a role in shaping market trends.

The transition to sustainable energy, with a shift towards renewable sources like hydropower, exerted additional downward pressure on coal prices. Despite these challenges, coal remained integral to power generation in several regions.

Average Monthly Coal Prices in 2024:

| Month |

Thermal Coal (Newcastle FOB) |

Coking Coal (Australia FOB) |

| January 2024 |

$124.90 |

$306.00 |

| February 2024 |

$124.22 |

$243.00 |

| March 2024 |

$131.49 |

$212.00 |

| April 2024 |

$134.97 |

$203.00 |

| May 2024 |

$142.01 |

$203.00 |

| June 2024 |

$135.10 |

$203.00 |

| July 2024 |

$137.55 |

$203.00 |

| August 2024 |

$145.76 |

$203.00 |

| September 2024 |

$139.20 |

$203.00 |

| October 2024 |

$146.63 |

$203.00 |

| November 2024 |

$142.12 |

$203.00 |

| December 2024 |

$129.81 |

$203.00 |

This table illustrates the negative trend in steam coal prices throughout 2024, while coking coal prices showed more stability, influenced by factors such as industrial demand and supply constraints. Understanding these trends is crucial for stakeholders navigating the evolving energy landscape.

In 2025, coal markets were expected to maintain their downward trajectory. Thermal coal prices have shown continued weakness, averaging around $106 per metric ton throughout the first three quarters, reflecting persistent pressure from renewable energy expansion and reduced industrial demand.

Coking coal prices have exhibited notable volatility, with Australian FOB prices fluctuating between $174/t and $197/t, largely driven by shifting steel production levels in major manufacturing economies. The ongoing energy transition and policy shifts continue to reshape market dynamics, setting the stage for further price adjustments in the coming months.

Average Monthly Coal Prices in 2025:

| Month |

Thermal Coal (Newcastle FOB) |

Coking Coal (Australia FOB) |

| January 2025 |

$115.50 |

$197.50 |

| February 2025 |

$102.05 |

$187.75 |

| March 2025 |

$103.00 |

$174.25 |

| April 2025 |

$97.50 |

$184.00 |

| May 2025 |

$100.80 |

$191.75 |

| June 2025 |

$109.90 |

$180.50 |

| July 2025 |

$115.15 |

$178.50 |

| August 2025 |

$111.50 |

$193.50 |

| September 2025 |

$106.20 |

$188.50 |

| October 2025 |

$104.55 |

$192.00 |

| November 2025 |

$106.20 |

$194.25 |

| December 2025 |

$107.50 |

$197.75 |

Coal Price Predictions 2026

Looking into 2026, coal markets are forecast to enter a period of gradual stabilization and modest growth. Thermal coal prices are expected to trend upward throughout the year, progressing from $108.65/ton in January to approximately $117.45/ton by December, driven by sustained demand from developing economies and potential supply adjustments.

Coking coal is projected to demonstrate stronger price appreciation, climbing from $201.50/ton to $215.75/ton as steel production activities normalize and supply chain efficiencies improve. The following projections outline the anticipated monthly price trajectory:

| Month |

Thermal Coal (Newcastle FOB) |

Coking Coal (Australia FOB) |

| January 2026 |

$108.65 |

$201.50 |

| February 2026 |

$109.60 |

$204.25 |

| March 2026 |

$110.45 |

$207.00 |

| April 2026 |

$110.70 |

$209.00 |

| May 2026 |

$110.90 |

$210.00 |

| June 2026 |

$111.75 |

$211.00 |

| July 2026 |

$113.30 |

$213.00 |

| August 2026 |

$114.60 |

$214.00 |

| September 2026 |

$115.45 |

$215.00 |

| October 2026 |

$116.25 |

$215.75 |

| November 2026 |

$117.05 |

$215.75 |

| December 2026 |

$117.45 |

$215.75 |

Coal Price Predictions 2027

For 2027, coal price forecasts indicate a transition toward greater market stability with minimal month-to-month fluctuations. Thermal coal is projected to hover in the $118-$121 range throughout the year, suggesting a mature market reaching equilibrium as supply and demand dynamics balance out.

Coking coal prices are expected to plateau at approximately $222/ton across all months, reflecting stable steel industry demand and established supply networks. This price consolidation marks a shift from the volatility seen in previous years:

| Month |

Thermal Coal (Newcastle FOB) |

Coking Coal (Australia FOB) |

| January 2027 |

$118.20 |

$222.00 |

| February 2027 |

$118.60 |

$222.00 |

| March 2027 |

$118.85 |

$222.00 |

| April 2027 |

$119.15 |

$222.00 |

| May 2027 |

$119.35 |

$222.00 |

| June 2027 |

$119.45 |

$222.00 |

| July 2027 |

$119.75 |

$222.00 |

| August 2027 |

$120.05 |

$222.00 |

| September 2027 |

$120.45 |

$222.00 |

| October 2027 |

$120.85 |

$222.00 |

| November 2027 |

$121.05 |

$222.00 |

| December 2027 |

$121.15 |

$222.00 |

Coal Price Predictions 2028

The 2028 outlook anticipates a slight correction in thermal coal prices, with values expected to peak at $121.25/ton in January before gradually declining to approximately $119.15/ton by year-end. This modest downward adjustment reflects the continued maturation of renewable energy infrastructure and incremental shifts in global energy consumption patterns.

Coking coal prices are forecast to maintain their stability at $222/ton throughout 2028, indicating sustained equilibrium in the metallurgical coal market. The projected monthly dynamics are detailed below:

| Month |

Thermal Coal (Newcastle FOB) |

Coking Coal (Australia FOB) |

| January 2028 |

$121.25 |

$222.00 |

| February 2028 |

$121.00 |

$222.00 |

| March 2028 |

$120.50 |

$222.00 |

| April 2028 |

$119.90 |

$222.00 |

| May 2028 |

$119.30 |

$222.00 |

| June 2028 |

$118.90 |

$222.00 |

| July 2028 |

$118.50 |

$222.00 |

| August 2028 |

$118.30 |

$222.00 |

| September 2028 |

$118.40 |

$222.00 |

| October 2028 |

$118.60 |

$222.00 |

| November 2028 |

$119.00 |

$222.00 |

| December 2028 |

$119.15 |

$222.00 |

Coal Price Predictions 2029

As coal markets approach 2030, price projections for 2029 suggest continued stability with minimal variation. Thermal coal is expected to fluctuate narrowly between $118.20/ton and $119.30/ton, reflecting a mature market nearing its long-term equilibrium point amid the global energy transition.

Coking coal prices show a slight uptick in the second quarter, moving from $222/ton to $224/ton, potentially driven by selective steel production increases in key manufacturing regions. The month-by-month forecast is presented below:

| Month |

Thermal Coal (Newcastle FOB) |

Coking Coal (Australia FOB) |

| January 2029 |

$119.10 |

$222.00 |

| February 2029 |

$119.00 |

$222.00 |

| March 2029 |

$118.80 |

$222.00 |

| April 2029 |

$118.50 |

$224.00 |

| May 2029 |

$118.30 |

$224.00 |

| June 2029 |

$118.20 |

$224.00 |

| July 2029 |

$118.30 |

$224.00 |

| August 2029 |

$118.50 |

$224.00 |

| September 2029 |

$118.80 |

$224.00 |

| October 2029 |

$119.10 |

$224.00 |

| November 2029 |

$119.20 |

$224.00 |

| December 2029 |

$119.30 |

$224.00 |

Coal Price Forecasts 2030

By 2030, thermal coal price forecasts indicate a stabilized market with prices consistently ranging between $118.30/ton and $119.30/ton throughout the year. This narrow price band reflects a market that has largely adjusted to the realities of the global energy transition, with coal maintaining a diminished but persistent role in the energy mix.

Notably, coking coal projections are unavailable for 2030, reflecting the increased uncertainty surrounding long-term metallurgical coal demand as steel production technologies evolve. The thermal coal outlook for 2030 is detailed in the following table:

| Month |

Thermal Coal (Newcastle FOB) |

Coking Coal (Australia FOB) |

| January 2030 |

$119.20 |

– |

| February 2030 |

$119.00 |

– |

| March 2030 |

$118.80 |

– |

| April 2030 |

$118.60 |

– |

| May 2030 |

$118.50 |

– |

| June 2030 |

$118.30 |

– |

| July 2030 |

$118.50 |

– |

| August 2030 |

$118.70 |

– |

| September 2030 |

$118.80 |

– |

| October 2030 |

$119.10 |

– |

| November 2030 |

$119.20 |

– |

| December 2030 |

$119.30 |

– |

FAQ

-

How will coal prices shape up the beginning of 2026?

At the start of 2026, coal prices will rise in higher trend with thermal coal averaging around $108/ton and coking coal near $201/ton.

-

What will the price of coal be in 2026?

By the end of 2025, coal prices are expected to show modest recovery from earlier lows, with thermal coal projected at approximately $107.50/ton and coking coal near $197.75/ton. These prices reflect a transitional period as markets adjust to shifting demand patterns and prepare for the gradual stabilization anticipated in 2026-2027.

-

How is coal expected to develop in the future?

Coal markets are expected to follow a multi-phase trajectory over the coming years. After experiencing volatility in 2025, prices are projected to enter a recovery phase in 2026-2027, with thermal coal climbing to the $117-$121 range and coking coal strengthening to $215-$222/ton. By 2028-2030, the market is anticipated to reach long-term equilibrium with stable prices around $118-$119/ton for thermal coal.

-

What is the coal supply in 2026?

As of early 2026, global coal supply remains robust, with production levels closely aligning with demand. In 2025, coal production stood at approximately 8.6 billion metric tons, maintaining stability compared to 2024.

-

What is the prediction for the coal market?

From 2026 to 2030, the coal market is expected to transition from volatility to stabilization. After initial pressure in 2025, thermal coal prices are forecast to recover to approximately $117-$121/ton in 2026-2027 before stabilizing around $118-$119/ton through 2030. Coking coal is projected to strengthen to $215-$222/ton in 2026-2027, with continued stability thereafter.