Tesla (TSLA) Stock Forecast & Price Prediction

Tesla, one of the world’s most notable automobile brands, is a bone of contention between bears and bulls. Today, the company’s market cap is $1.351 trillion, which is more than many other competitors have. In this guide, we will take a look at TSLA stock price performance, what forms its cost, and how it will be impacted by market sentiments, changes within the company, and competitors’ products.

Table of Contents

Key Takeaways

Tesla price History of 2025

Tesla Forecast for 2026

Tesla Forecast for 2027

Tesla Forecast for 2028

Tesla Forecast for 2029

Tesla Forecast for 2030

Tesla Technical Analysis

About Tesla (TSLA) Stock Rate Forecast

What Affects Tesla Stock Price

How to Predict the Tesla Stock Price

FAQs

Key Takeaways

-

In 2026 Tesla stock prices are estimated to range from $421.59 to $752, with strong sales and market momentum driving potential gains.

- For 2026-2030 term, Projected prices peak at $3,601.58 by 2029, reflecting TSLA’s upside potential as market capitalization grows. Notable price targets include $2,738.40 in 2028 and $3,486.56 in 2029.

- Tesla stock remains a dynamic opportunity for traders and investors, with strong buy ratings supported by bullish technical analysis.

| Year |

Average Price ($) |

| 2026 | $600.88 |

| 2027 | $426.44 |

| 2028 | $509.20 |

| 2029 | $2,615.33 |

| 2030 | $2,624.18 |

Tesla price History of 2025

Tesla's stock (TSLA) price history of 2025 presented an intriguing investment opportunity, highlighting significant potential for returns, especially in the latter months of the year. According to CoinCodex projections, TSLA stocks showed that potential ROI will exceed 184% in November and 161% in October.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January 2025 | $538.11 | $675.04 | $738.14 | 75.30% |

| February 2025 | $456.08 | $590.32 | $711.81 | 69.05% |

| March 2025 | $345.10 | $433.06 | $491.41 | 16.71% |

| April 2025 | $469.24 | $511.99 | $565.32 | 34.26% |

| May 2025 | $316.83 | $383.36 | $463.96 | 10.19% |

| June 2025 | $350.23 | $406.63 | $477.87 | 13.49% |

| July 2025 | $417.92 | $446.73 | $512.65 | 21.75% |

| August 2025 | $457.60 | $506.23 | $545.88 | 29.64% |

| September 2025 | $537.79 | $568.85 | $608.93 | 44.62% |

| October 2025 | $601.39 | $749.58 | $1,102.74 | 161.90% |

| November 2025 | $916.10 | $1,053.52 | $1,198.56 | 184.65% |

| December 2025 | $781.06 | $915.59 | $1,061.46 | 152.09% |

January 2025

Tesla's stock showed strong potential, with an average price of $675.04 and a potential ROI of 75.30%. This month represented a solid start with robust investor confidence.

February 2025

Average and maximum prices declined slightly in February compared to January, with an ROI of 69.05%. The market exhibited cautious optimism amid volatility.

March 2025

March has been expected to come with a significant drop in prices and ROI to 16.71%. This indicated a bearish trend, suggesting potential market corrections or reduced investor enthusiasm.

April 2025

A recovery phase in the Tesla market was expected in April, with average prices improving to $511.99 and ROI rising to 34.26%. Positive momentum began to return to the stock.

May 2025

Another decline happened in May, with ROI dropping to 10.19% and the average price at $383.36.

June 2025

A slight uptick in prices and ROI was expected in June, signaling stabilization but still limited growth. Investors remained on edge.

July 2025

Experts predicted moderate recovery with an ROI of 21.75% and a small rise in prices. The stock showed resilience, regaining some market confidence.

August 2025

A steady upward trend with average prices reaching $506.23 and ROI increasing to 29.64% has been expected. The market sentiment appeared more optimistic.

September 2025

This month stood out with a stronger performance. TSLA prices continued to rise and ROI was expected to reach 44.62%. This marked a period of sustained growth.

October 2025

Analysts suggested a significant surge in the value of Tesla stock, with a maximum price over $1,100. Investor enthusiasm has reached its peak, likely driven by major positive developments or announcements.

November 2025

The rally continued with ROI hitting 184.65%, the highest in the analysis. Tesla's stock was at its peak, reflecting heightened market excitement and robust performance.

December 2025

A slight pullback from November's highs happened, but ROI remained strong at 152.09%. This suggests consolidation with the stock maintaining substantial value.

Tesla Forecast for 2026

Tesla Inc.'s TSLA stock forecast for 2026 outlines a wide price range. Analysts' average price target represents significant volatility. Estimates project a high of $1,117.03 in January and a downside to $18.63 in December.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January 2026 | $691.76 | $907.30 | $1,117.03 | 165.29% |

| February 2026 | $586.03 | $731.65 | $804.34 | 91.03% |

| March 2026 | $605.00 | $780.32 | $1,025.24 | 143.49% |

| April 2026 | $726.15 | $900.07 | $1,054.13 | 150.35% |

| May 2026 | $417.10 | $580.51 | $784.88 | 86.41% |

| June 2026 | $435.65 | $502.21 | $577.54 | 37.16% |

| July 2026 | $466.60 | $583.21 | $773.38 | 83.67% |

| August 2026 | $662.82 | $745.30 | $795.89 | 89.02% |

| September 2026 | $639.29 | $720.33 | $798.61 | 89.67% |

| October 2026 | $392.75 | $463.18 | $594.90 | 41.29% |

| November 2026 | $245.62 | $332.76 | $489.75 | 16.31% |

| December 2026 | $18.63 | $187.31 | $344.16 | 18.26% |

Tesla Forecast for 2027

Tesla's TSLA stock forecast for 2027 highlights calculated market opportunities, with potential upsides like a high of $733.46 in July and an average of $562.03 in June, reflecting a 74.19% ROI. Despite the high risk, technical analysis suggests strategic positioning for growth, especially as TSLA's market capitalization develops on Nasdaq.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January 2027 | $0.150788 | $113.52 | $313.69 | 25.50% |

| February 2027 | $325.19 | $365.25 | $408.12 | 3.07% |

| March 2027 | $248.13 | $316.12 | $371.14 | 11.86% |

| April 2027 | $191.97 | $268.00 | $361.97 | 14.03% |

| May 2027 | $213.18 | $278.76 | $400.00 | 5.00% |

| June 2027 | $421.10 | $562.03 | $682.50 | 62.09% |

| July 2027 | $587.76 | $651.77 | $733.46 | 74.19% |

| August 2027 | $432.01 | $526.59 | $598.30 | 42.09% |

| September 2027 | $523.03 | $592.03 | $662.04 | 57.23% |

| October 2027 | $361.33 | $507.61 | $626.41 | 48.77% |

| November 2027 | $400.41 | $482.97 | $550.76 | 30.80% |

| December 2027 | $502.51 | $555.28 | $605.28 | 43.75% |

Tesla Forecast for 2028

Tesla stock forecast for 2028 presents exceptional upside potential, with December's average price projected at $1,799.37 and a maximum of $2,738.40.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January 2028 | $301.83 | $410.88 | $523.77 | 24.39% |

| February 2028 | $284.82 | $337.66 | $372.59 | 11.51% |

| March 2028 | $219.77 | $259.04 | $294.17 | 30.14% |

| April 2028 | $134.33 | $232.34 | $322.17 | 23.49% |

| May 2028 | $249.91 | $273.02 | $298.71 | 29.06% |

| June 2028 | $243.76 | $322.05 | $535.88 | 27.27% |

| July 2028 | $375.35 | $525.90 | $610.97 | 45.10% |

| August 2028 | $350.90 | $401.12 | $455.74 | 8.24% |

| September 2028 | $438.67 | $517.61 | $603.60 | 43.35% |

| October 2028 | $429.80 | $516.55 | $633.82 | 50.53% |

| November 2028 | $549.62 | $853.83 | $982.37 | 133.31% |

| December 2028 | $971.97 | $1,799.37 | $2,738.40 | 550.36% |

Tesla Forecast for 2029

The 2029 TSLA stock forecast highlights strong bullish potential, with December's average price at $3,298.81 and a maximum of $3,486.56, reflecting a 728.04% growth. Investors should prioritize risk management given the inherent uncertainty of long-term forecasts.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January 2029 | $2,777.48 | $2,957.00 | $3,035.91 | 621.02% |

| February 2029 | $2,489.21 | $2,782.94 | $2,996.61 | 611.68% |

| March 2029 | $2,449.11 | $2,589.38 | $2,667.56 | 533.53% |

| April 2029 | $2,626.42 | $2,695.94 | $2,777.90 | 559.74% |

| May 2029 | $2,406.92 | $2,495.39 | $2,623.23 | 523.01% |

| June 2029 | $2,466.63 | $2,552.91 | $2,650.21 | 529.41% |

| July 2029 | $2,557.83 | $2,605.28 | $2,708.72 | 543.31% |

| August 2029 | $2,617.08 | $2,692.13 | $2,748.87 | 552.84% |

| September 2029 | $2,736.79 | $2,789.83 | $2,856.16 | 578.33% |

| October 2029 | $2,839.00 | $3,103.11 | $3,629.70 | 762.04% |

| November 2029 | $3,301.60 | $3,497.32 | $3,723.30 | 784.27% |

| December 2029 | $3,099.99 | $3,298.81 | $3,486.56 | 728.04% |

Tesla Forecast for 2030

Tesla stock forecast for 2029 projects a price range from a low of $1,951.42 in December to a high of $3,601.58 in January, with average prices showing a slight decline through the year. Analysts highlight strong buy ratings early in the year, where trading opportunities align with peak prices.

| Date |

Min Price ($) |

Average Price ($) |

Max Price ($) |

Potential ROI (%) |

| January 2030 | $2,966.67 | $3,261.31 | $3,601.58 | 755.36% |

| February 2030 | $2,808.82 | $3,019.01 | $3,134.75 | 644.49% |

| March 2030 | $2,837.14 | $3,127.97 | $3,464.54 | 722.81% |

| April 2030 | $3,018.01 | $3,252.46 | $3,507.67 | 733.06% |

| May 2030 | $2,556.62 | $2,782.48 | $3,105.70 | 637.59% |

| June 2030 | $2,584.30 | $2,673.10 | $2,751.82 | 553.54% |

| July 2030 | $2,652.41 | $2,835.20 | $3,113.90 | 639.54% |

| August 2030 | $2,905.75 | $3,034.13 | $3,122.13 | 641.49% |

| September 2030 | $2,785.77 | $3,002.09 | $3,126.19 | 642.46% |

| October 2030 | $2,520.25 | $2,615.01 | $2,765.73 | 556.85% |

| November 2030 | $2,300.59 | $2,417.45 | $2,596.25 | 516.60% |

| December 2030 | $1,951.42 | $2,181.95 | $2,436.63 | 478.69% |

Tesla technical analysis

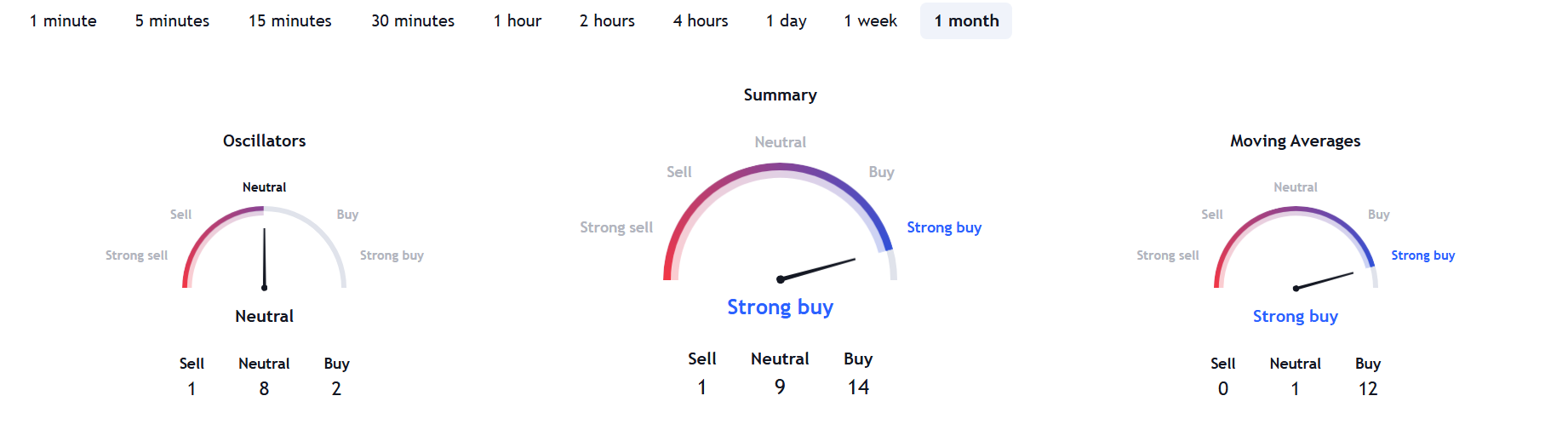

Tesla's technical analysis on the monthly chart highlights bullish momentum, with moving averages signaling upward trends and oscillators showing a neutral stance. The overall signal is a strong buy, reflecting confidence in TSLA's continued growth potential. This setup positions Tesla stock as an attractive opportunity for both short- and long-term traders.

| Name |

Value |

Action |

| Relative Strength Index (14) |

65.98 |

Neutral |

| Stochastic %K (14, 3, 3) |

86.92 |

Neutral |

| Commodity Channel Index (20) |

143.00 |

Neutral |

| Average Directional Index (14) |

23.27 |

Neutral |

| Awesome Oscillator |

136.34 |

Neutral |

| Momentum (10) |

186.92 |

Buy |

| MACD Level (12, 26) |

53.63 |

Buy |

| Stochastic RSI Fast (3, 3, 14, 14) |

79.80 |

Neutral |

| Williams Percent Range (14) |

−6.65 |

Neutral |

| Bull Bear Power |

176.88 |

Neutral |

| Ultimate Oscillator (7, 14, 28) |

64.38 |

Neutral |

| Name |

Value |

Action |

| Exponential Moving Average (10) |

389.65 |

Buy |

| Simple Moving Average (10) |

365.89 |

Buy |

| Exponential Moving Average (20) |

342.05 |

Buy |

| Simple Moving Average (20) |

321.96 |

Buy |

| Exponential Moving Average (30) |

313.89 |

Buy |

| Simple Moving Average (30) |

288.42 |

Buy |

| Exponential Moving Average (50) |

274.88 |

Buy |

| Simple Moving Average (50) |

274.30 |

Buy |

| Exponential Moving Average (100) |

207.13 |

Buy |

| Simple Moving Average (100) |

180.23 |

Buy |

| Exponential Moving Average (200) |

— |

— |

| Simple Moving Average (200) |

— |

— |

| Ichimoku Base Line (9, 26, 52, 26) |

318.82 |

Neutral |

| Volume Weighted Moving Average (20) |

318.09 |

Buy |

| Hull Moving Average (9) |

487.88 |

Sell |

About Tesla (TSLA) stock rate forecast

Tesla (TSLA) stock forecast for 2026 suggests significant growth, with estimates highlighting a price range of $691.76 to $1,117.03. The chart indicates strong sales potential, positioning TSLA as a leading stock in the EV market. Strategic investments could capitalize on this range for profitable sales.

What Affects Tesla stock price

Here are the main market events that can push TSLA price up or influence it to go downward.

-

Earnings Reports, such as Tesla's quarterly performance and sales figures.

- Market trends, such as changes in EV demand and industry competition.

- Regulations, for example, government policies on clean energy and subsidies.

- Innovation, including product launches and technological advancements.

How to predict the Tesla stock price

To predict Tesla's stock price, focus on key factors:

-

Analyze financial performance, market trends, and industry demand.

- Monitor macroeconomic indicators, global EV sales, and regulatory changes.

- Evaluate technical charts, moving averages, and trading volumes for insight into future movements.