Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Nordson Corporation’s NDSN unit, Nordson Electronics Solutions, introduced Synchro 3 for high-volume printed circuit board assembly applications.

Nordson’s SELECT Synchro is a multi-station selective soldering system that increases throughput by using a unique, synchronous motion. The new Synchro 3 Soldering System can accommodate a maximum of three soldering stations for various alloys and different or singular nozzles, and can handle board sizes up to 2500 x 460 millimeters (mm). The SELECT Synchro selective soldering equipment series earlier included Synchro 5 and Synchro 5 XL models. The Synchro 5 system can also handle boards up to 2500 x 460 mm, while the Synchro 5 XL handles 2500 x 680 mm boards.

The SELECT Synchro system uses a patent-pending synchronous motion technology, which lowers conveyance time significantly. The product also increases throughput by 20-40% for most applications while reducing carbon footprint by a maximum of 60%. Also, the product will help electronics manufacturers to replace traditional wave soldering with faster, more flexible and more efficient operations.

Nordson currently carries a Zacks Rank #3 (Hold).

The company’s diversified business structure is a boon. Strong customer demand for the industrial coatings, polymer processing and non-wovens product lines is aiding the Industrial Precision Solutions segment.

However, weakness in the Advanced Technology Solutions segment raises concerns for the company. A decrease in demand for electronics dispensing product lines, serving in the cyclical semiconductor end market, is weighing on the Advanced Technology Solutions segment.

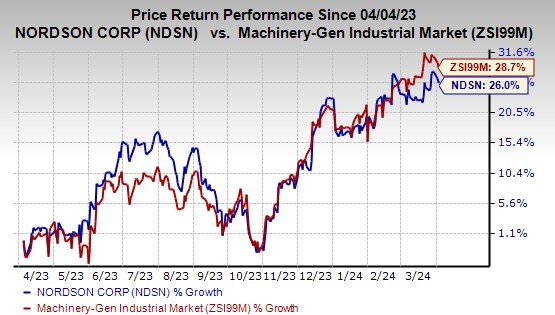

In the past year, the stock has risen 26% compared with the industry’s 28.7% growth.

Image Source: Zacks Investment Research

Some better-ranked companies from the Industrial Products sector are discussed below:

Belden Inc. BDC presently has a Zacks Rank #2 (Buy) and a trailing four-quarter earnings surprise of 12.3%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BDC’s earnings estimates have remained steady for 2024 in the past 60 days. Shares of Belden have risen 5.6% in the past year.

A. O. Smith Corporation AOS currently carries a Zacks Rank of 2. It has a trailing four-quarter average earnings surprise of 12%.

The Zacks Consensus Estimate for AOS’ 2023 earnings increased 0.7% in the past 60 days. Shares of A. O. Smith have jumped 34.5% in the past year.

Applied Industrial Technologies, Inc. AIT presently has a Zacks Rank of 2. It has a trailing four-quarter average earnings surprise of 10.4%.

The Zacks Consensus Estimate for AIT’s fiscal 2024 earnings has increased 1.7% in the past 60 days. The stock has gained 41.9% in the past year.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.