Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Sandstorm Gold Ltd. SAND announced preliminary revenues and cash operating margins for the first quarter of 2024. Revenues in the quarter fell 2.7% year over year. The company’s cash operating margins moved up 7.8%.

SAND sold nearly 20,300 attributable gold equivalent ounces (GEOs) in the quarter. This marks a 28.4% decline from the 28,368 ounces of GEOs sold in first-quarter 2023. Sandstorm Gold delivered preliminary revenues of $42.8 million, down from the prior-year quarter’s $44 million.

SAND reported a preliminary cost of sales (excluding depletion) of $5.7 million, lower than the $6.5 million reported in the first quarter of 2023. The cash operating margin was $1,781 per attributable GEO in the quarter under review, higher than the prior-year quarter's $1,652.

The company will report its first-quarter results for 2024 on May 2, 2024.

At the end of the fourth quarter of 2023, Sandstorm Gold announced expectations of attributable gold equivalent ounces of 75,000-90,000 for 2024. Within the next five years, the company anticipates producing 125,000 attributable gold-equivalent ounces.

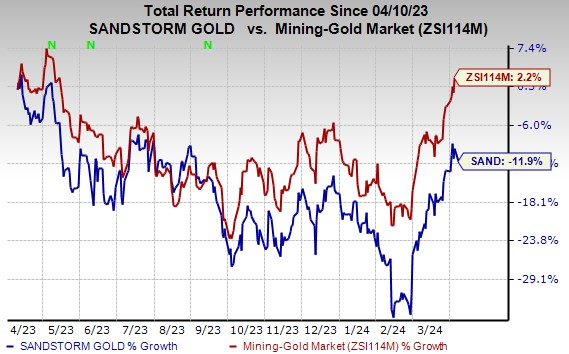

Shares of the company have lost 11.9% in the past year against the industry’s growth of 2.2%.

Image Source: Zacks Investment Research

Sandstorm Gold currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Ecolab Inc. ECL, Carpenter Technology Corporation CRS and Innospec Inc. IOSP. ECL and CRS sport a Zacks Rank #1 (Strong Buy) at present, and IOSP has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.39 per share, indicating an increase of 22.7% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.7%. ECL shares have gained 41.8% in a year.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.00 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 33.5% in a year.

The Zacks Consensus Estimate for Innospec’s 2024 earnings is pegged at $6.72 per share, indicating a year-over-year rise of 10.3%. The Zacks Consensus Estimate for IOSP’s current-year earnings has been revised 2% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 10.5%. The company’s shares have rallied 19.3% in the past year.

Free – 5 Dividend Stocks to Fund Your Retirement

Zacks Investment Research has released a Special Report to help you prepare for retirement with 5 diverse stocks that pay whopping dividends. They cut across property management, upscale outlets, financial institutions, and a couple of strong energy producers.

5 Dividend Stocks to Include in Your Retirement Strategy is packed with unconventional wisdom and insights you won’t get from your neighborhood financial planner.

Download Now – Today It’s FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.