Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

NextEra Energy NEE announced that its subsidiary, Florida Power & Light Company (FPL), has received approval from Florida Public Service Commission to lower utility rates again in May. May utility rates for a residential customer using 1,000 kilowatt-hours (kWh) of electricity will be nearly $14 lower than the amount paid in March. The market has reacted positively to the development. This is evident from the upside in share price since the approval was granted to the NextEra unit on Apr 2.

The Commission has earlier approved a rate decline, effective in April, which was $7 less than March, for a typical residential customer using 1,000 kWh of electricity.

While consumers generally expect rates to go up, FPL customers are used to the unusual. At FPL, the monthly residential bill for a typical customer is expected to go down by nearly 10.7% from March to $121.19 per month in May.

This back-to-back rate declines in April and May were primarily due to the fall in prices for natural gas used for power generation. Thanks to these rate cuts, the average electricity bill for a typical FPL residential customer is nearly 13% below the national average.

Even with prices of products and services going up in the past decade, the company’s long-term strategic initiatives have ensured that prices remain at modest levels. The decision to shut down older plants and invest in new state-of-the-art power projects has boosted energy efficiency. In particular, the company's investments in high-efficiency combined cycle natural gas plants have resulted in fuel savings and consequent rate reduction for its customers.

The ongoing emphasis across the United States to enhance energy efficiency lowers electricity generation expenses and helps consumers to minimize usage. The installment of smart meters is actually helping customers to manage usage and lower electricity bills. Installation of utility scale clean energy units and usage of natural gas is significantly lowering the input cost and customers are getting benefit of the same. The utilities do not profit from fuel costs, so when the fuel prices fall, the utility rate declines.

Duke Energy’s DUK unit Duke Energy Florida has announced its plan to file for a rate reduction. If approved, customer bill be lower by about $5 a month for a typical residential customer using 1,000 kWh of electricity from June or July 2024.

The reduction of rates also benefits the utilities. This allows the companies to retain and attract new customers, which expands demand and revenues. Other utilities are also making applications for rate declines.

Per U.S. Energy Information Administration (EIA), the United States retail electricity prices will fall marginally in 2024 to 15.73 cents per kWh. EIA forecasts a decline in price is primarily due to softness in natural gas prices. From this scenario it is expected that other utilities in the United States will also file appeal to reduce rates who uses natural gas to produce electricity.

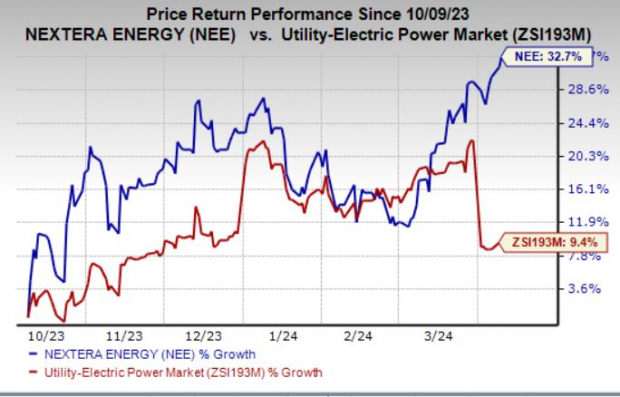

In the past six months, shares of NextEra Energy have gained 32.7% compared with the industry’s 9.4% growth.

Image Source: Zacks Investment Research

NextEra Energy currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the utility industry are National Grid Plc. NGG and NiSource Inc. NI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term (three-to-five years) earnings growth rate of National Grid and NiSource is currently pinned at 2.7% and 6%, respectively.

The Zacks Consensus Estimate for National Grid’s fiscal 2025 earnings per share has moved up by 1.3% in the past 60 days.

The Zacks Consensus Estimate for NiSource’s 2024 earnings per share suggests growth of 6.9% from the year-ago levels.

Free – 5 Dividend Stocks to Fund Your Retirement

Zacks Investment Research has released a Special Report to help you prepare for retirement with 5 diverse stocks that pay whopping dividends. They cut across property management, upscale outlets, financial institutions, and a couple of strong energy producers.

5 Dividend Stocks to Include in Your Retirement Strategy is packed with unconventional wisdom and insights you won’t get from your neighborhood financial planner.

Download Now – Today It’s FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.