Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Elevance Health Inc.’s ELV brand, Anthem Blue Cross and Blue Shield, recently entered into a multi-year deal with the Georgia-based integrated healthcare system, Piedmont. The agreement, effective from the very beginning of April 2024, serves as a sign of the continued collaboration between the ELV brand and Piedmont.

This, in turn, is expected to equip the partners in continuing to offer high quality care services to the mutually served 400,000-plus members residing across metro Atlanta, Athens, Augusta, Columbus, Macon and Rome regions of Georgia.

The benefits of the contract extension can be reaped by Anthem Blue Cross and Blue Shield members who are enrolled in employer-based, Health Insurance Exchange and Medicare Advantage plans. The pursuit of a continued collaborative approach renders the targeted members an opportunity to avail cost-effective and enhanced access to quality care at the extensive provider network of Piedmont. Therefore, better health outcomes remain an inevitable result for Georgians.

Piedmont’s clinically-integrated network comprises 24 hospitals, 1,755 locations, and 3,200 providers, on the back of which it caters to the health needs of 80% of the state’s population. This makes Piedmont an apt partner to complement Elevance Health’s endeavor to ensure a healthy life for its membership base.

Additionally, as part of the new agreement, both the organizations will join forces to bring about digital advancements that assure the easier understanding of system requirements and make the way for simplified business processes. Joint efforts to develop value-based programs and innovative care delivery models by the partners also remain underway.

Access to a widespread healthcare network, like that of Piedmont, is expected to lure more customers and result in the higher adoption of Elevance Health's health insurance plans. Increased enrollment in plans may boost the medical membership and subsequently, premium revenues for ELV. Premiums usually account for the most significant chunk of ELV’s overall operating revenue and the percentage was around 84% in 2023.

Elevance Health is an independent licensee of the independent health benefit plan association, Blue Cross and Blue Shield Association (“BCBSA”). In this capacity, ELV utilizes the Blue Cross and Blue Shield names for carrying out insurance operations across specific geographic regions. In return, the health insurer has to pay a yearly license fee to the BCBSA on the basis of enrollment figures.

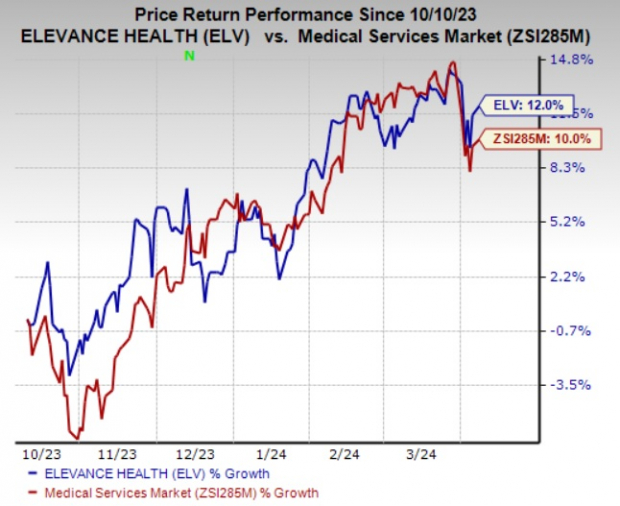

Shares of Elevance Health have gained 12% in the past six months compared with the industry’s 10% growth. ELV currently carries a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Some other top-ranked stocks in the Medical space are DaVita Inc. DVA, Edwards Lifesciences Corporation EW and IDEXX Laboratories, Inc. IDXX. While DaVita currently sports a Zacks Rank #1 (Strong Buy), Edwards Lifesciences and IDEXX Laboratories carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 35.57%. The Zacks Consensus Estimate for DVA’s 2024 earnings indicates a rise of 9%, while the consensus mark for revenues suggests an improvement of 3.5% from the corresponding year-ago reported figures. The consensus mark for DVA’s 2024 earnings has moved 2.96% north in the past 30 days.

The bottom line of Edwards Lifesciences beat estimates in two of the trailing four quarters and matched the mark twice, the average surprise being 0.80%. The Zacks Consensus Estimate for EW’s 2024 earnings indicates a rise of 10% while the consensus mark for revenues suggests an improvement of 8.6% from the corresponding year-ago reported figures. The stock has witnessed two upward estimate revisions in the past 30 days against none in the opposite direction.

IDEXX Laboratories’ earnings outpaced estimates in each of the trailing four quarters, the average surprise being 8.30%. The Zacks Consensus Estimate for IDXX’s 2024 earnings indicates a rise of 10.8% while the consensus mark for revenues suggests an improvement of 9% from the corresponding year-ago reported figures. The consensus mark for IDXX’s 2024 earnings has moved 0.2% north in the past 60 days.

Shares of DaVita, Edwards Lifesciences and IDEXX Laboratories have gained 46.8%, 25.2% and 13.6%, respectively, in the past six months.

Free – 5 Dividend Stocks to Fund Your Retirement

Zacks Investment Research has released a Special Report to help you prepare for retirement with 5 diverse stocks that pay whopping dividends. They cut across property management, upscale outlets, financial institutions, and a couple of strong energy producers.

5 Dividend Stocks to Include in Your Retirement Strategy is packed with unconventional wisdom and insights you won’t get from your neighborhood financial planner.

Download Now – Today It’s FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.