Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Global Water Resources Inc.’s GWRS strategic investments, planned acquisitions, spreading operations in new service areas and expansion through organic means will further drive its performance. Given its growth opportunities, GWRS makes for a solid investment option in the utility sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) company a strong investment pick at the moment.

The Zacks Consensus Estimate for 2024 earnings per share has moved up 3.3% in the past 60 days to 31 cents.

GWRS’ long-term (three-to-five years) earnings growth rate is 15%. The company delivered an average earnings surprise of 28.8% in the last four quarters.

Return on equity (ROE) indicates how efficiently a company has been utilizing the funds to generate higher returns. Currently, Global Water Resources’ ROE is 13.64%, higher than the industry’s average of 9.68%. This indicates that the company has been utilizing the funds more constructively than its peers in the water-supply utility industry.

The times interest earned ratio or solvency ratio is used to measure how well a company can cover its interest obligations. This ratio at the end of fourth-quarter 2023 was 3.2, which, being greater than one, indicates that GWRS is in a good position to meet its interest obligations.

GWRS has consistently increased the value of its stockholders by paying dividends. Currently, its monthly cash dividend is 2.508 cents per share, resulting in an annualized dividend of 30.1 cents. The company’s current dividend yield is 2.47%, better than the Zacks S&P 500 Composite's average of 1.6%.

Management expects to increase its long-term investments in existing utilities to boost revenues, reduce expenses and build a rate base to provide safe, reliable services. During the fourth quarter of 2023, it invested $3.7 million in infrastructure projects to support existing utilities and continued growth. For the full year, it invested $22.3 million in infrastructure projects.

The improving economic condition in Arizona resulted in a growing customer base and fresh demand for GWRS’ services. It invested $91.9 billion in Arizona during 2020-2023, which is likely to create more demand and opportunity for the company.

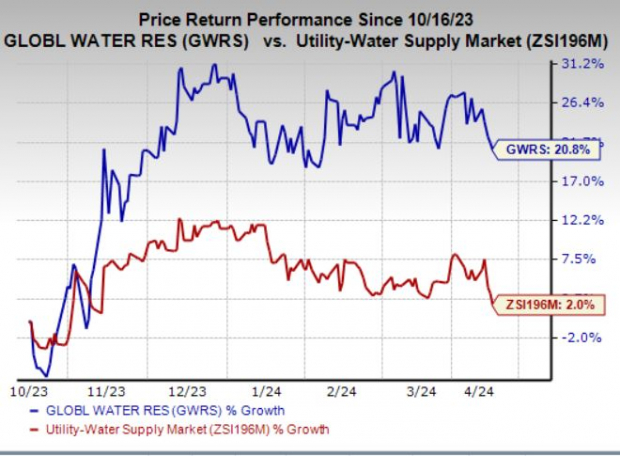

In the last six months, GWRS stock returned 20.8% compared with the industry’s 2% growth.

Image Source: Zacks Investment Research

A few other top-ranked stocks from the same industry are American Water Works AWK, American States Water AWR and Consolidated Water CWCO, each presently carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AWK’s long-term earnings growth rate is 8%. It delivered an average earnings surprise of 6% in the last four quarters.

AWR’s long-term earnings growth rate is 6.3%. It delivered an average earnings surprise of 3.1% in the last four quarters.

CWCO’s long-term earnings growth rate is 8%. It delivered an average earnings surprise of 61.6% in the last four quarters.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s an American AI company that’s riding low right now, but it has rounded up clients like BMW, GE, Dell Computer, and Bosch. It has prospects for not just doubling but quadrupling in the year to come. Of course, all our picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.