Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Apogee Enterprises, Inc. APOG is slated to release fourth-quarter fiscal 2024 results on Apr 18, before the opening bell.

The Zacks Consensus Estimate for Apogee’s earnings per share is pegged at 0.97 cents for the fiscal fourth quarter, suggesting growth of 12.8% from the prior-year quarter's reported figure. The consensus estimate has been unchanged over the past 60 days. The same for revenues is pegged at $342.9 million, indicating a 0.4% year-over-year decline.

Let’s see how things have shaped up for this announcement.

Apogee’s fiscal fourth-quarter performance is likely to have benefited from the ongoing momentum in the Architectural Glass segment over the past few quarters. The impacts of improved pricing and product mix (reflecting the company’s strategic shift toward more premium products) are likely to get reflected in the segment’s top-line results in the quarter under review. Our model predicts the segment’s revenues to increase 16.7% year over year to $95 million.

The segment is also likely to have registered productivity gains from its Lean program. However, supply-chain challenges and inflation are likely to have impacted the segment’s performance. We expect the segment’s adjusted operating income to fall 25.4% from the prior-year reported figure to $7.1 million.

The Architectural Framing Systems segment is expected to reflect gains from pricing actions, and the benefits of completed restructuring and cost-saving actions. However, inflationary pressures, supply-chain disruptions and labor constraints are expected to have negatively impacted the segment’s performance.

We expect the segment’s quarterly revenues to be $143 million, suggesting a decline of 4% from the year-ago reported figure. Our model predicts Architectural Framing Systems’ adjusted operating income to be $14.3 million, indicating a year-over-year decline of 8.4%.

The Architectural Services segment's revenues are pegged at $89 million, indicating a year-over-year decline of 10.1%. The segment’s results will likely reflect the impacts of lower volumes from project executions. We predict the segment’s adjusted operating income to come in at $19.6, implying a rise from the prior-year quarter’s actual of $3.7 million.

The Large-Scale Optical segment’s results are likely to reflect lower volumes, partly offset by positive pricing. We predict net sales of $28 million, suggesting year-over-year growth of 0.4%. Our model predicts the segment's adjusted operating income to fall 53.8% to $2.7 million.

Our proven model does not conclusively predict an earnings beat for Apogee this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Apogee is 0.00%.

Zacks Rank: APOG currently carries a Zacks Rank of 3.

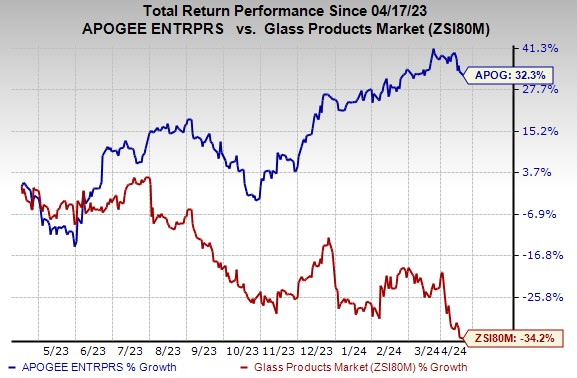

The company’s shares have gained 32.3% in the past year against the industry’s 34.2% decline.

Image Source: Zacks Investment Research

Here are some stocks that have the right combination of elements to post an earnings beat this quarter.

Crane Company CR is scheduled to release its first-quarter 2024 results on Apr 22. It has an Earnings ESP of +0.28% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CR’s first-quarter earnings is pegged at $1.12 per share. It has a trailing four-quarter average surprise of 25.1%.

Eaton Corporation plc ETN, expected to release earnings soon, has an Earnings ESP of +2.05%.

The consensus estimate for Eaton’s earnings for the first quarter of 2024 is pegged at $2.28 per share. ETN currently carries a Zacks Rank of 2. It has a trailing four-quarter average surprise of 4.5%

Deere & Company DE, expected to release earnings results soon, has an Earnings ESP of +0.76% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Deere’s fiscal second-quarter of 2024 earnings is pegged at $7.82 per share. It has a trailing four-quarter average surprise of 17.1%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.