Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Piedmont Lithium Inc. PLL announced that it received approval for a mining permit for the construction, operation and reclamation of the proposed Carolina Lithium project from the North Carolina Department of Environmental Quality’s Division of Energy, Mineral and Land Resources. The approval of the North Carolina mining permit serves as a prerequisite to the project's county rezoning.

Construction would begin after the company obtains all necessary permits, rezoning approvals and project financing.

Carolina Lithium project, based in Gaston County, NC, aims to become one of the world's lowest-cost, most sustainable lithium hydroxide operations, as well as a crucial component of the American electric vehicle supply chain. It is a highly strategic project that will involve fully integrated mining, spodumene concentrate and lithium hydroxide production. There are currently no such integrated sites running elsewhere in the world, and the economic and environmental benefits of this strategy remain compelling.

The project is further aided by the competitive corporate tax framework available in the United States, the lack of hefty royalties and the benefits implicit in the Inflation Reduction Act of 2022.

The project is expected to generate billions of dollars in economic production and create several hundred jobs in Gaston County and North Carolina's booming electrification industry. Piedmont Lithium looks forward to continuing to work with the local community and the Gaston County Board of Commissioners.

In the fourth quarter of 2023, the company reported a loss of $1.38 per share, missing the Zacks Consensus Estimate of earnings of 38 cents. It reported a loss of 62 cents in the prior-year quarter.

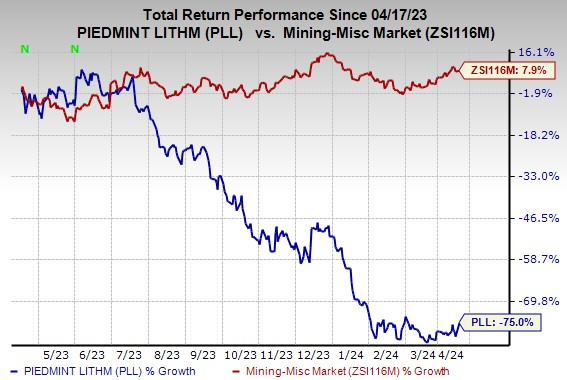

PLL shares have lost 75% in the past year against the industry’s 7.9% growth.

Image Source: Zacks Investment Research

Piedmont Lithium currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Ecolab Inc. ECL, Carpenter Technology Corporation CRS and Innospec Inc. IOSP. ECL and CRS sport a Zacks Rank #1 (Strong Buy) at present, and IOSP has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.39 per share, indicating an increase of 22.7% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.7%. ECL shares have gained 41.8% in a year.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 33.5% in a year.

The Zacks Consensus Estimate for Innospec’s 2024 earnings is pegged at $6.72 per share, indicating a year-over-year rise of 10.3%. The Zacks Consensus Estimate for IOSP’s current-year earnings has been revised 2% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 10.5%. The company’s shares have rallied 19.3% in the past year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.