Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Ball Corporation BALL is scheduled to report first-quarter 2024 results on Apr 26, before the opening bell.

In the last reported quarter, Ball Corp’s earnings increased year over year and beat the Zacks Consensus Estimate. However, the top line fell year over year and missed the sameestimate. BALL surpassed the consensus estimate in three of the four trailing quarters and missed once, the average surprise being 11.7%.

The Zacks Consensus Estimate for BALL’s first-quarter earnings per share is pegged at 56 cents, suggesting a decrease of 18.9% from the prior-year quarter’s reported levels. The consensus estimate for total sales is pegged at $3.26 billion, indicating a year-over-year decline of 6.4%.

Ball Corp has lately been witnessing weaker-than-expected demand, as customer spending has been muted amid higher retail prices, particularly in the United States. This is likely to get reflected in the company’s first-quarter results. High input and labor costs due to supply constraints are anticipated to have impacted the company’s performance in the quarter.

However, BALL has been focused on improving its efficiency and reducing costs, which is likely to have negated these impacts and aided margins in the to-be-reported quarter.

Our estimate for the Beverage packaging, North and Central America segment’s net sales is pegged at $1.36 billion for the March-end quarter, indicating a 9.8% year-over-year fall. The segment’s operating income is estimated at $123 million, suggesting a fall of 32.7% from the year-ago quarter’s actual.

We expect the segment’s volume to decrease 5.9% year over year in the quarter due to lower demand.

Our model predicts the Beverage Packaging, Europe segment’s sales to be $860 million for the to-be-reported quarter, indicating a 3% drop from the year-ago quarter’s reported figure. We expect volume growth of 0.3% for this segment. The focus on reducing costs is likely to have partially negated some headwinds. The segment’s operating income is projected at $51 million, suggesting a 30% year-over-year fall.

We expect the Beverage Packaging, South America segment’s net sales to be $455 million, suggesting 1% growth from the year-ago period’s reported level. The consensus estimate for the segment’s operating income is pegged at $32 million, suggesting a 35.7% decline from the year-ago quarter’s reported level. Our model predicts a volume increase of 2.8% for the segment.

Ball Corp, on Feb 16, 2024, announced that it completed the previously announced sale of its aerospace business for $5.6 billion to BAE Systems, Inc.

The company will use approximately $2 billion of the after-tax proceeds to reduce net debt and roughly $2 billion of the after-tax proceeds to return value to shareholders through share repurchases and utilize the remaining proceeds to further strengthen the balance sheet.

Our model predicts an earnings beat for Ball Corp this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is precisely the case here.

You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Earnings ESP: BALL has an Earnings ESP of +1.35%.

Zacks Rank: Currently, the company carries a Zacks Rank #3.

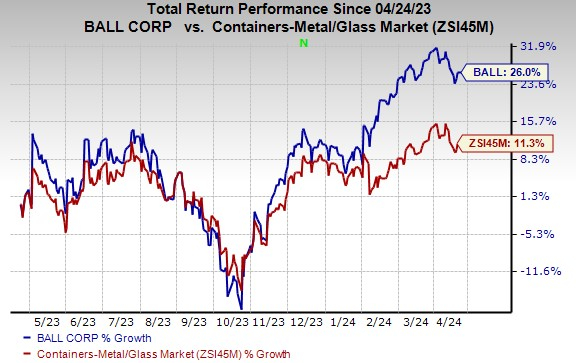

Shares of Ball Corp have gained 26% in the past year compared with the industry's 11.3% growth.

Image Source: Zacks Investment Research

Here are some companies with the right combination of elements to post an earnings beat in their upcoming releases.

Eaton Corporation plc ETN, expected to release earnings soon, has an Earnings ESP of +1.95%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Eaton’s earnings for the first quarter of 2024 is pegged at $2.28 per share. ETN currently carries a Zacks Rank of 2. It has a trailing four-quarter average surprise of 4.8%

Ingersoll Rand Inc. IR, scheduled to release its first-quarter 2024 on May 2, has an Earnings ESP of +1.82% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Ingersoll Rand’s first-quarter 2024 earnings is pegged at 69 cents per share. It has a trailing four-quarter average surprise of 15.9%.

AptarGroup, Inc. ATR is scheduled to release its first-quarter 2024 results on Apr 25. It has an Earnings ESP of +0.59% and a Zacks Rank #3 at present.

The Zacks Consensus Estimate for ATR’s first-quarter earnings is pegged at $1.13 per share. It has a trailing four-quarter average surprise of 7.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks' free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.