Forex Market Hours

(2))

If you are an experienced forex trader or just planning to get into this financial market, you can’t do so without knowing how to open and close forex market hours. Understanding the timing of forex trading sessions will help you plan your strategies and make the most of this highly liquid and dynamic market. In this article, we will outline all the details to keep you well informed.

Table of Contents

Key Takeaways

What Are Forex Market Hours?

Understanding the Impact of Forex Market Hours on Your Trading Strategy

Understanding the Relationship Between Currency Pairs, Trading Volume, and Time Zones

Why You Should Trade During Certain Forex Trading Hours

Why Some of the Forex Trading Hours are More Active Than Others

The Choice of Your Forex Market Hours Depends on Your Strategy

Forex Market Hours Based Strategy # 1: Trading Price Gaps During Market Open on Monday

Forex Market Hours Based Strategy # 2: Breakout Trading at London Opening Hours

Forex Market Hours Based Strategy # 3: Intraday Trading During Second Half of London Session

Bottom Line

FAQs

Key Takeaways

-

Forex, in contrast to the stock market, operates over the clock 5 days a week.

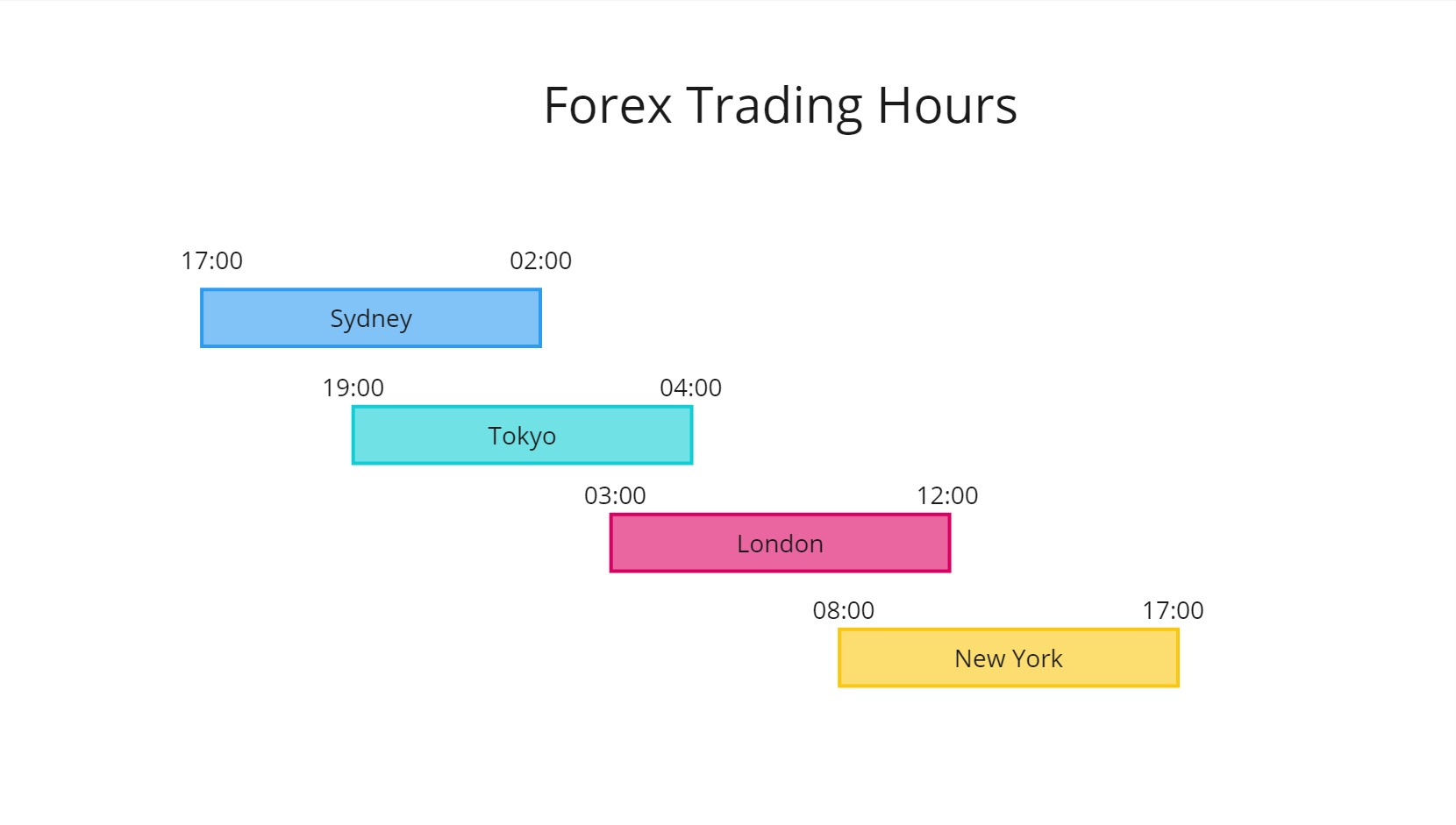

- There are four main forex sessions: Sydney, Tokyo, London and New York.

- The overlap between the London and New York sessions is often considered the best timing for trading opportunities.

- Adjusting your trading strategy to forex trading hours is crucial for your success.

What Are Forex Market Hours?

The first thing to remember is that foreign exchange (forex), unlike, for example, the stock market, operates 24 hours five days a week. How does it work like this? Forex is divided into four major trading sessions: Sydney, Tokyo, London, and New York. It opens on Sunday at 5 p.m. EST with the Sydney session and closes on Friday at 5 p.m. EST after the New York session. Each session overlaps the next one, which guarantees a continuous trading experience. So, if we want to define forex trading hours, this is a specific period when traders can conduct various activities on this market.

Understanding the Impact of Forex Market Hours on Your Trading Strategy

| Market Region |

Trading Session |

Forex Market Opens (EST) |

Forex Market Closes (EST) |

| Asian |

Sydney session |

5:00 PM |

2:00 AM |

| Asian |

Tokyo session |

7:00 PM |

4:00 AM |

| European |

London session |

3:00 AM |

12:00 PM |

| North American |

New York |

8:00 AM |

5:00 PM |

| Market Region |

Trading Session |

Forex Market Opens (GMT) |

Forex Market Closes (GMT) |

| Asian |

Sydney session |

10:00 PM |

7:00 AM |

| Asian |

Tokyo session |

12:00 AM |

9:00 AM |

| European |

London session |

8:00 AM |

5:00 PM |

| North American |

New York |

1:00 PM |

10:00 PM |

Aligning your strategy with forex trading hours isn't just about convenience; it’s about maximizing profit potential in trading. One of the most popular questions is “What is the best time to trade forex?”

It is usually believed that the optimal time to engage in a forex trade is during the overlap. These periods come with high liquidity and volatility, perfect for catching big moves. This is the time when the most important market responses take place, influenced by key economic news and data releases from major financial centers. However, don’t forget that higher volatility implies higher risks. So, when it comes to trading strategy, these forex trading hours will be more suitable for traders with high-risk tolerance and robust experience.

During calmer periods like after the New York session and before the Sydney session, the market could see reduced volatility. This means trading hours fit more traders with less risk tolerance or a less active trading approach.

Understanding the Relationship Between Currency Pairs, Trading Volume, and Time Zones

When you trade forex, you have to understand how trading volume, time zones, and market hours affect the price of currency pairs.

It’s necessary to underline that forex operates 24 hours a day making it possible to conduct continuous trading all over the globe. Each currency pair has peak trading times influenced by international transactions and banking hours. For instance, if a European company imports goods from the US, they need to buy USD, increasing demand for the dollar and potentially raising the EUR/USD price. Moreover, when banks are open, more transactions occur, increasing trading volume, and, as a result, influencing the pair value.

Many traders believe the best time to trade forex is when the major sessions overlap, like London and New York. This overlap sees the highest trading volume and volatility, making it ideal for trading.

Why You Should Trade During Certain Forex Trading Hours

Although the forex runs 24 hours a day without any centralized exchange, trading can be difficult during non-peak hours because of the limited number of counterparties. Imagine, you want to buy a EUR/AUD pair when these regions are inactive. There is a high possibility that you will encounter difficulties with trade execution.

While some brokers offer weekend trading, currency values remain stable over Saturdays and Sundays. For active short-term traders weekends and non-peak hours are usually not so appealing as there are no significant trends and market moves, and as a result not many opportunities for increased gains.

Important!

Forex active trading hours offer more liquidity, volatility, and trading opportunities for profit. These periods usually happen during overlaps between major trading sessions.

Why Some of the Forex Trading Hours are More Active Than Others

It’s all about the overlap of major financial markets. When the forex market open times for regions like London and New York coincide, trading volume significantly increases. This is also when commercial companies and hedge funds execute substantial trades, driving significant market moves. During these periods, economic reports continue to impact respective currencies, leading to increased volatility and creating potential trading opportunities.

)

The Choice of Your Forex Market Hours Depends on Your Strategy

If you are a forex trader who seeks high volatility and rapid market moves, trading during overlaps of main trading sessions, such as the London and New York markets, is the best option for you. These periods see the highest trading volume and are suitable for day traders and scalpers aiming for quick profits.

Conversely, if you are a trader with long-term strategies prioritizing stability over quick changes, you will find non-peak periods more suitable. In these periods when the foreign exchange markets are not active in important financial hubs, trends become more stable, creating chances for swing traders to profit from gradual market shifts.

Forex Market Hours Based Strategy # 1: Trading Price Gaps During Market Open on Monday

Trading price gaps imply the logic that over the weekend, the FX market is closed. However, economic and political events still occur, often leading to significant price gaps when the market reopens. So, some savvy traders use this opportunity to capitalize on these gaps by identifying currency pairs affected by weekend news and executing positions on Monday when the FX market opens.

Forex Market Hours Based Strategy # 2: Breakout Trading at London Opening Hours

The London session is known for its high liquidity and significant market moves. Therefore, it looks ideal for breakout opportunities. When the market opens, currency price often consolidates due to the surge of orders from commercial businesses and hedge funds. Traders, at this moment, concentrate on recognizing important support and resistance levels already established in the Asian session. Breakouts happen when these levels are tested during the opening of the London market. This forex strategy will fit traders who can make prompt and resolute decisions, seeking to take advantage of the initial energy and unpredictability of the London session.

Forex Market Hours Based Strategy # 3: Intraday Trading During Second Half of London Session

The second half of the London session overlaps with the New York session. As we have already mentioned, it means increased market activity and liquidity, and, as a result, more potential trading chances. Forex traders monitor economic data releases from the US and Europe and leverage the increased volatility to execute short-term trades.

Bottom Line

Unlike the stock market, the foreign exchange market is open 24 hours a day, providing continuous trading opportunities. The best times to jump in are when the London and New York sessions overlap. This is when the market is buzzing with activity, giving you more chances to profit thanks to higher liquidity and big market moves. Just keep in mind that greater potential rewards also mean higher chances for volatility. So, while these times can be potentially more profitable, they can also be more unpredictable.

FAQs

What Is The Best Time Of The Day To Trade Forex?

Most traders say that the best time to trade forex is during the overlap of the London and New York sessions. This period sees the highest liquidity and significant market moves, offering more trading opportunities.

What Time Does the Forex Market Close in the U.S.?

The forex closes in the U.S. at 5 PM EST on Friday. It stays shut during the weekend but opens again at 5 PM EST on Sunday.

What Are Forex Trading Sessions?

Forex trading sessions are specific times when major financial markets are open. The key sessions are the Sydney, Tokyo, London, and New York sessions.

What Is UTC Time?

UTC, known as Coordinated Universal Time, serves as the main standard for timekeeping worldwide.

When Is The Forex Market Open?

The forex market is open 24 hours a day, five days a week. Trading starts on Monday in the Sydney session and ends on Friday with the New York session.