How To Buy Disney Stock (DIS)

Owning Disney stock allows you to invest in one of the world’s most iconic entertainment giants, known for its theme parks, beloved characters like Mickey Mouse, and innovative digital video platforms like Disney+. With recent expansions into digital video platforms and steady growth as a blue-chip stock, Disney offers both stability and potential for profit. This guide will show you how to buy Disney stocks, helping you make informed decisions as you start investing.

Table of content

Key takeaways

Understanding Disney as an Investment

How to Buy Disney Stock

Monitoring Your Investment

When to Sell Your Stock

Investing in Disney Through Funds

Disney's Profitability and Dividends

Will Disney Stock Split?

Conclusion

FAQs

Key takeaways

The article offers a detailed guide on buying Disney stock (DIS), highlighting its appeal as a long-term investment due to its iconic brand, streaming innovations, and dividend payments.

It explains methods of purchase, including brokerage accounts and direct plans, and emphasizes diversification and research. Disney's profitability, dividend resumption, and potential stock splits are discussed alongside risks like market volatility and competition.

Practical steps for monitoring investments and aligning them with financial goals are provided. The guide positions Disney assets as a strong, but cautious, choice for portfolio diversification.

Understanding Disney as an Investment

The Walt Disney Company is a powerhouse in the entertainment industry, boasting a diverse portfolio that includes theme parks, streaming services, and beloved brands like Marvel Studios and National Geographic.

Investing in Disney, a well-regarded blue-chip stock, offers long-term growth potential thanks to its strategic expansions, such as the launch of Disney+ and acquisitions of major assets like 21st Century Fox.

For investors looking to buy Disney stock, its solid track record makes it an appealing choice. Recent innovations and the company’s focus on growing its digital video platform sector contribute to its increasing stock price. Moreover, Disney shareholders benefit from periodic dividend payments, underscoring its value as part of a diversified financial plan.

However, risks such as market volatility and rising competition in the streaming market must be considered. When buying Disney stock, ensure your investment aligns with your personal finance goals and consult with financial advisors if necessary.

Whether through an online brokerage account or a direct stock purchase plan, Disney offers an exciting opportunity for those aiming to purchase shares of this entertainment giant.

How to Buy Disney Stock

Purchasing Disney stock is a straightforward process, offering two primary methods: using a brokerage account or Disney’s direct stock procurement plan. Both options have unique advantages, depending on your personal finance and investment goals.

To buy through a brokerage account, start by selecting a reliable platform and funding it with your deposit account. Search for Disney using its ticker symbol, DIS, and place a market order to purchase at the current market value, or set a limit order for your preferred price. This method provides flexibility and often lowers trading costs, especially when using online platforms.

Alternatively, Disney offers a direct stock procurement plan, which allows you to purchase Disney stock without a broker. Administered by a third party, this option requires a minimum investment and may involve additional fees. However, it is an excellent way for Disney stockholders to gradually increase their holdings.

Both methods grant access to the perks of being a Disney shareholder, including potential dividend remittance. Whether you're drawn to its iconic brands like Walt Disney Studios, Disney Channel, or Walt Disney World, or intrigued by its leadership in streaming services, investing in Disney lets you own a piece of this globally recognized entertainment leader. Consider your preferences, compare fees, and start investing today.

Choosing a Brokerage

Selecting the right brokerage is crucial when you’re ready to buy Disney stock. Start by evaluating brokers based on factors such as trading fees, platform usability, customer service, and access to resources for informed decisions. Look for a brokerage that supports investments in individual stocks, index funds, and exchange traded funds to diversify your portfolio.

For those seeking a top-tier option, J2T offers a user-friendly platform with competitive fees and excellent customer support. Its intuitive tools make it ideal for beginners and seasoned investors alike. Once registered and funded with your bank account, you can easily purchase Disney shares at the current market price.

Regardless of whether you're investing in mutual funds, legendary brands, or blue-chip companies like Disney, you can effectively manage your money by working with a trustworthy broker like J2T. With careful selection, you'll be well-positioned to invest in Disney confidently.

Researching Disney and its Stock

Before you buy Disney stock, thorough research is essential to make informed investment decisions. While Disney is widely known for its beloved Disney characters and iconic properties like Magic Kingdom and Disney Cruise Line, it’s crucial to delve into its financial performance and market positioning.

Start by analyzing key metrics such as net income, past performance, and dividend history—yes, Disney pay dividends, making it an attractive blue-chip stock for long-term investors. Examine how Disney operates within the communications sector, its recent growth in media networks, and its resilience in the stock market amid competition.

Additionally, platforms like Motley Fool offer insights on trends and expert analysis. Compare Disney’s valuation to other exchange-traded funds or stocks in your portfolio. Keep an eye on the market price, and assess potential risks such as trading fees and broader market conditions.

By staying informed through news updates and financial reports, you’ll better understand the potential of Disney stock DIS and its alignment with your investment strategy. Careful research ensures you see Disney as more than just one company—but as a significant player in the global market.

Deciding How Disney Stock Fits into Your Portfolio

When deciding to buy Disney stock, it’s important to evaluate how it aligns with your overall investment strategy. Disney, a globally recognized blue-chip stock, offers stability and growth potential, making it an attractive choice for long-term investors.

However, investing in individual stocks like Disney stock DIS comes with risks, especially compared to diversified options like index funds or an exchange traded fund.

The foundation of successful portfolio management is diversification. If you currently own equities in the communications industry or other businesses with comparable market trends, Disney could either improve or upset your portfolio. Examine how Disney aligns with your blue-chip stocks or ETF holdings, and think about how market movements affect its performance.

Consider your timeframe and financial objectives as well. Do you want long-term growth through dividends and stock appreciation, or are you investing for short-term gains? With resources like the Disney Store, the history of the brothers Walt, and well-known brands, Disney's distinct position as a leader in entertainment makes it a long-term choice. However, it is important to carefully consider aspects like spotty market.

Along with your Disney stock investment, keep a well-rounded portfolio with a variety of assets to reduce risks. Whether you're motivated by the vision of Roy Disney or want to take advantage of Disney's steady expansion, making sure it fits with your plan can help you make better, more educated choices.

Determining How Much to Invest

Consider your short-term objectives and portfolio balance when determining how much to invest in Disney shares. Assessing your financial status and investing goals should come first. Analyze whether Disney assets supports short-term financial milestones, like saving for a particular expense, or if it fits with your long-term growth strategy.

Diversification is a crucial component of risk management. Ensure that your investment in Disney doesn’t significantly dominate your portfolio, which could make you subject to market volatility. To lessen exposure to the volatility of individual equities, instead, strive for a well-balanced mix of assets, such as stocks, bonds, and ETFs.

Consider employing the dollar-cost averaging method if you're worried about market timing. With this strategy, a set sum of money is invested at regular periods, independent of the stock value. You can lessen the effects of market volatility and even take advantage of reduced average expenses during downturns by distributing your investments over time.

Lastly, keep your cash flow requirements in mind. Don't overinvest in equities at the expense of liquidity because having money on hand is crucial for both anticipated and unforeseen costs. You may invest in Disney stock with confidence and keep a solid, balanced portfolio if you know what your financial priorities are and employ techniques like dollar-cost averaging consistently.

Placing a Stock Order

Placing an order to buy Disney stock is a straightforward process when using an online trading platform. Begin by logging into your brokerage account and ensuring it is funded. Search for Disney using its ticker symbol, DIS, which represents the company on the stock/commodity market.

Choose the order type that best fits your investing plan after that. Because it executes at the current market value, a market order is the quickest and easiest option to buy shares. You can establish a maximum price for your purchase using a limit order, though, if you want additional control over the cost. Only if Disney assets are available at or below this price will your purchase be fulfilled.

Some systems have stop-limit orders, which combine the capabilities of limit and stop-loss orders to assist you control risk, with more precision. This kind of order only executes within a predetermined price range and is activated when the stock hits a given price.

Once your order type has been chosen, indicate how many Disney assets you wish to buy and complete the transaction. The majority of online trading systems offer real-time order tracking capabilities, which make it simple to keep tabs on your orders' progress.

After your transaction is finished, monitor your investment and periodically check your portfolio. A seamless purchasing experience is ensured by being aware of order kinds and effectively utilizing Disney's ticker symbol, which enables you to confidently move closer to your financial objectives.

Monitoring Your Investment

You start your journey as a co-owner of Disney as soon as you buy stock in the corporation. To make sure your investment is in line with your financial objectives and to make well-informed decisions based on the stock's performance, active monitoring is essential.

Start by following announcements on Disney's investor relations website and DIS News to remain up to date on the most recent developments. These resources offer insightful information about the business's activities, future initiatives, and financial standing.

To find patterns and market possibilities, use tools such as the DIS Chart or Motley fool, which provides a visual depiction of the stock's performance over time, and take technical analysis into account.

You may monitor Disney's development and make strategic decisions by routinely examining financial data and performance updates. Additionally, active monitoring allows you to make necessary adjustments to your investing plan, keeping it in line with your larger portfolio objectives.

As a Disney shareholder, keep in mind that you are more than simply a stockholder; you are a co-owner of one of the most recognizable businesses in the world. Use every resource at your disposal to keep informed and involved while treating your investment with caution and diligence.

When to Sell Your Stock

The market performance of the company and your investing objectives must be carefully taken into account when determining when to sell Disney assets. It might be appropriate to think about selling if your intended returns have been realized or if you require the money for a particular use. Always make sure your choice is in line with your overall financial forecast, though.

Pay attention to quarterly earnings reports and DIS Consensus Estimates, since both offer valuable information about Disney's financial situation and prospects. You may need to reassess your role if there are unexpected changes in performance or a major shift in the company's perspective.

Additionally, keep an eye on news and general market conditions that could affect Disney's stock price. You can make confident, data-driven decisions about whether to sell and keep your financial goals on track by remaining informed and routinely assessing your investing goals.

Investing in Disney Through Funds

Purchasing individual Disney assets isn't necessarily necessary to invest in the company. An alternate method of gaining exposure to Disney assets while enjoying the benefits of diversification is through index funds and mutual funds, or ETFs. By combining investments from several businesses, these funds offer a well-rounded strategy that can lessen the risks connected with individual stock ownership.

ETFs are especially attractive to investors who want exposure to a particular sector. For instance, Disney is frequently included in the holdings of funds that concentrate on the communications or entertainment industries.

Disney stock is heavily weighted in the Communication Services Select Sector SPDR Fund (XLC), for instance. To make sure your investment stays cost-effective, compare the expense ratios of these funds; over time, lower expenditure ratios usually result in higher net returns.

Conversely, mutual funds, like the S&P 500, which includes Disney, are meant to mimic the performance of market benchmarks. By providing wide exposure, these funds lessen the volatility associated with a particular business while still enabling you to profit from Disney's expansion.

Consider the funds' holdings, Disney assets weighting, and compatibility with your financial objectives when choosing one. For instance, a diversified mutual fund (ETF) or index fund may be the best option if you want exposure to Disney while reducing volatility.

Disney's Profitability and Dividends

Even if the pandemic's aftereffects on net earnings and significant streaming investments have hampered recent earnings growth, Disney is still profitable. Focusing on platforms like Disney+ has increased its viewership and long-term income potential, but these initiatives have temporarily strained profitability.

To address this, Disney has launched a reorganization plan that includes cost-cutting measures meant to increase productivity and simplify operations.

The return of dividends following a three-year hiatus is one of the biggest changes to Disney's financial plan. The corporation protected capital during a difficult economic time because of this stop.

Disney has now reiterated its dedication to providing value to shareholders by restoring dividends as a semiannual payout. Analysts predict that future dividend history may feature more significant rises as Disney's efforts in streaming and other growth areas start to pay off, even though the current dividend rate represents a cautious restart.

From theme parks to popular franchises, Disney's varied portfolio ensures different revenue streams and contributes to its success. Investors should continue to be mindful of the dangers, though, given the company's ambitious plans and the competitive market.

Will Disney Stock Split?

Disney has a history of stock splits, typically occurring when its share price surpasses certain thresholds. Notable splits include:

- July 10, 1998: 3-for-1 split

- May 18, 1992: 4-for-1 split

- March 6, 1986: 4-for-1 split

- January 16, 1973: 2-for-1 split

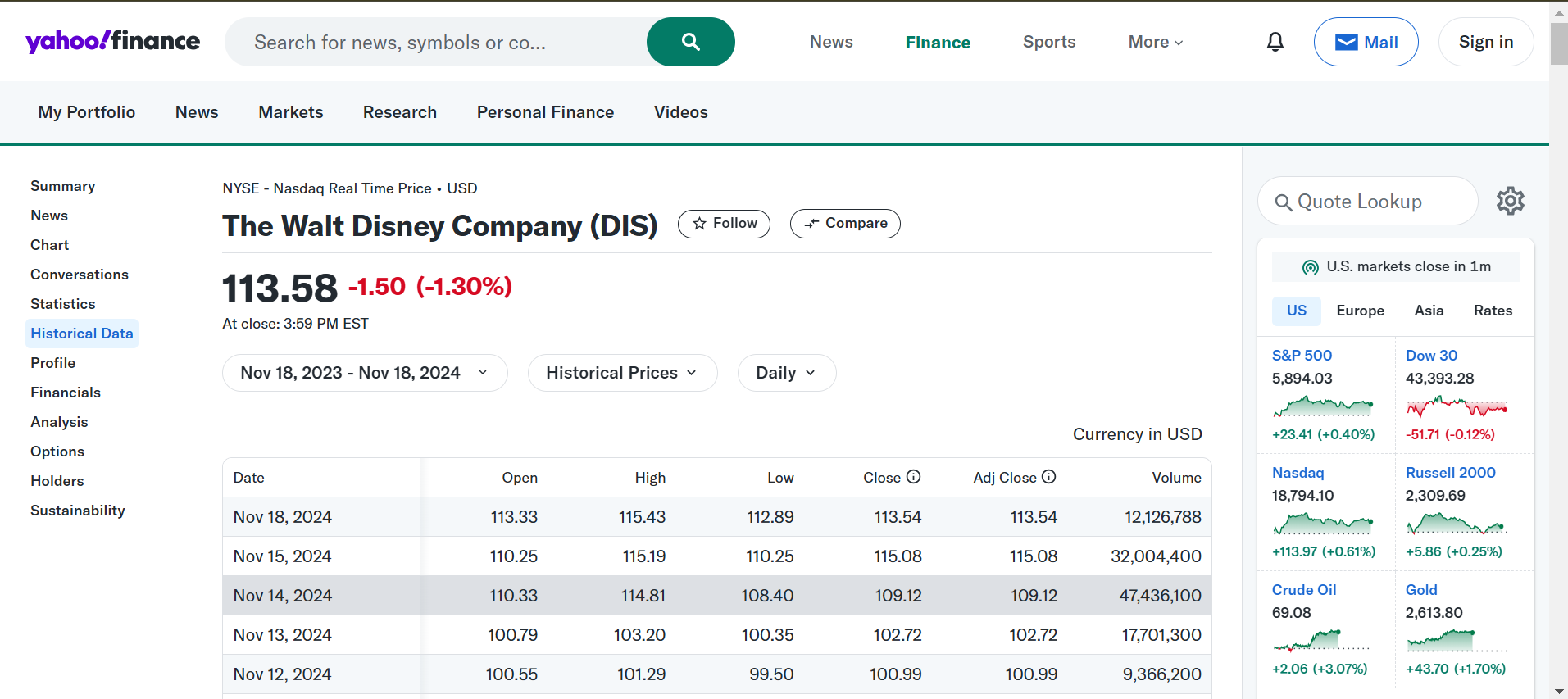

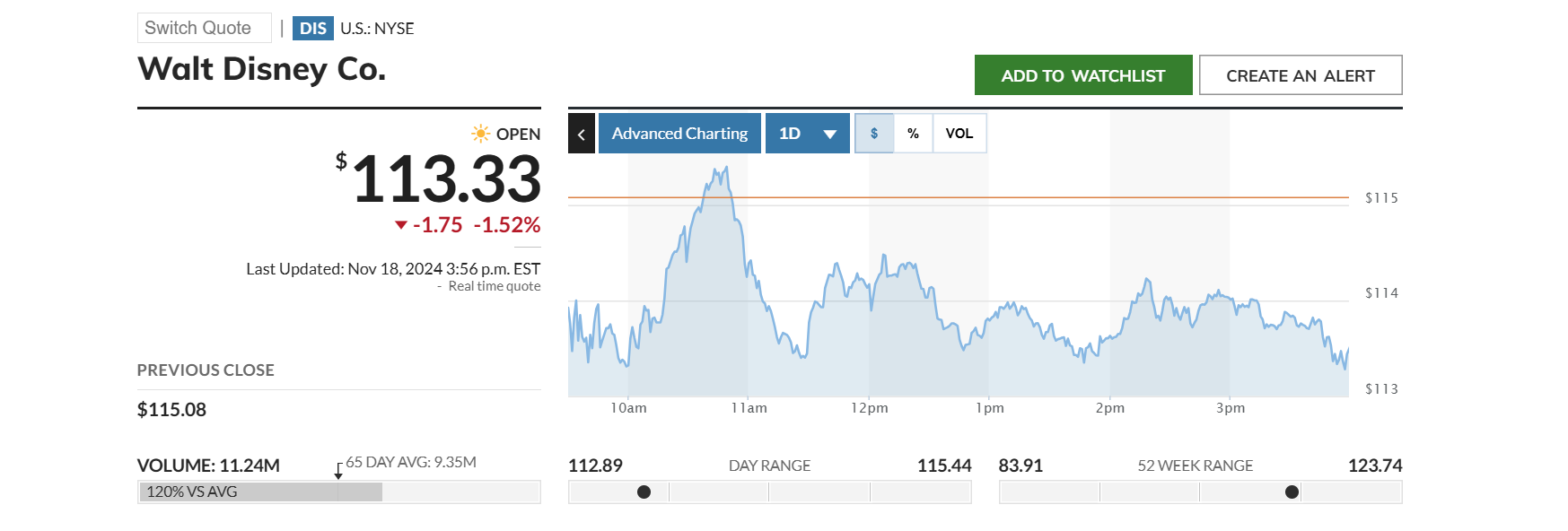

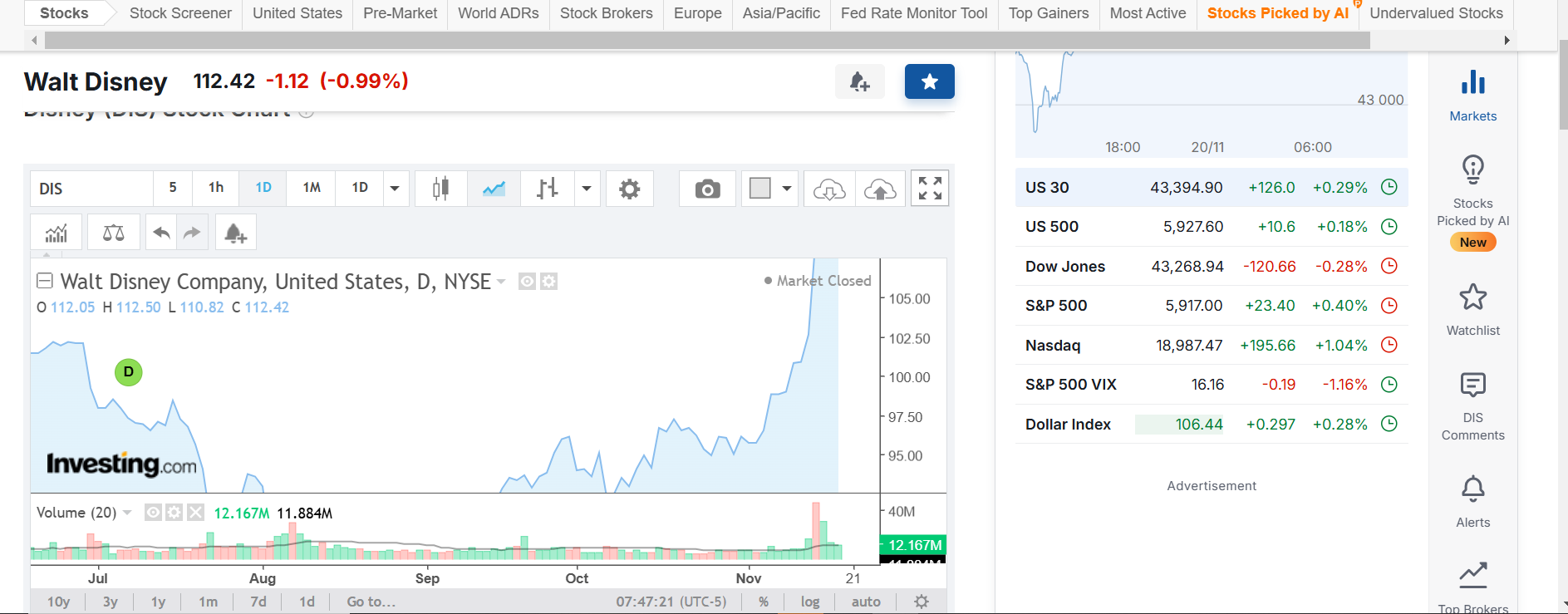

To improve liquidity and increase investor access to shares, these steps were frequently taken when Disney's stock value surpassed $100 a share. Disney's stock closed at $115.08 on November 15, 2024. Even though this price is more than $100, Disney has not recently announced that a stock split is imminent.

A stock split maintains the company's market capitalization while increasing the number of outstanding shares and proportionately lowering the share price. This entails owning additional shares at a reduced price per share for investors without affecting the overall value of their investment.

In conclusion, Disney has a history of dividing its stock at high prices, but there is currently no sign that this will happen anytime soon. For any changes on this issue, investors should keep an eye on Disney's public statements.

Conclusion

Disney is an appealing option for long-term investment due to its unmatched brand strength, which is demonstrated by its recognizable Magic Kingdom and internationally renowned properties. Despite market obstacles, the company is well-positioned for development thanks to its persistent focus on streaming possibilities through platforms like Disney+.

But since investing is always risky, it's crucial to assess your unique financial circumstances before committing. Taking use of Disney's promise while managing uncertainty can be achieved by starting small and keeping an eye on the big picture. Disney may be a profitable addition to your investing portfolio if you prepare ahead.

FAQs

Can I buy Disney stock directly?

The Walt Disney Company Investment Plan enables investors to acquire Disney assets directly, eliminating the need for a broker.

How much does it cost to buy a Disney stock?

As of November 12, 2024, Disney's stock price closed at $100.99 per share.

Is Disney stock worth buying?

Disney assets is now rated by analysts as a "Moderate Buy" with an average price objective of $123.83, suggesting that the company may see an increase in value from its current price.

What is the minimum stock purchase for Disney?

To buy Disney shares directly through The Walt Disney Company Commitment Plan, new investors need to either commit to regular monthly installments of $50 or make an initial commitment of at least $250.

Why is Disney stock so cheap?

The COVID-19 pandemic's aftereffects on Disney's theme parks, significant investments in digital video platforms, and heightened rivalry in the entertainment sector are some of the reasons why the company's stock price has dropped.