PKN Orlen (PKN) stock forecast for 2025 - 2030

PKN Orlen is one of the biggest energy firms in Poland and Central Europe. Its areas of expertise include polymers, chemical goods, fuel oil, diesel fuel, and gasoline manufacturing (production and refining). Along with running a network of filling stations throughout Poland and beyond, it also retails petrol under its own brand. In this article, you can see PKN Orlen shares forecasts for 2025 and beyond. You will also get insights into its historical performance, as well as ways to predict the ORLEN SA price.

Table of Contents

About PKN Orlen stock price forecast

PKN Orlen technical analysis

PKN Orlen Stock Price History

PKN Orlen Stock Price Forecast for 2025

PKN Orlen Stock Price Forecast for 2026

PKN Orlen Stock Price Forecast for 2027

PKN Orlen Stock Price Forecast for 2028

PKN Orlen Stock Price Forecast for 2029

PKN Orlen Stock Price Forecast for 2030

What Affects the PKN Orlen Stock Price?

How to predict the PKN Orlen Stock Price

Conclusion

FAQs

About PKN Orlen stock price forecast

Before we delve into the PKN forecast, here's an updated overview of the equity and analysts' stance as of April 2025:

- Current Price: Orlen (WSE:PKN) is trading at 69.32 PLN.

- Analyst Forecasts: Analysts project the stock may reach approximately 85 PLN in 1 1-year period.

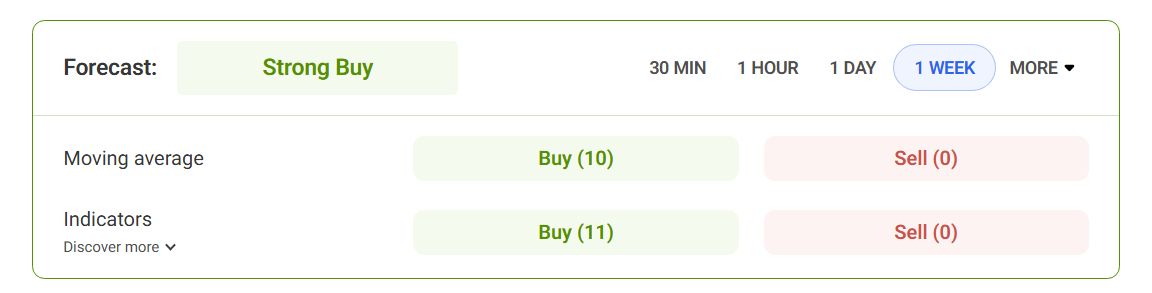

- Technical Indicators: On the 1-hour chart, trading indicators suggest a Sell signal; on the daily (1D) timeframe, the signal is Neutral, while the weekly (W1) timeframe indicates a Buy.

- Market Outlook: Throughout 2025, ORLEN SA is expected to experience a downward trend, with prices potentially decreasing to around 56.88 PLN.

PKN Orlen technical analysis

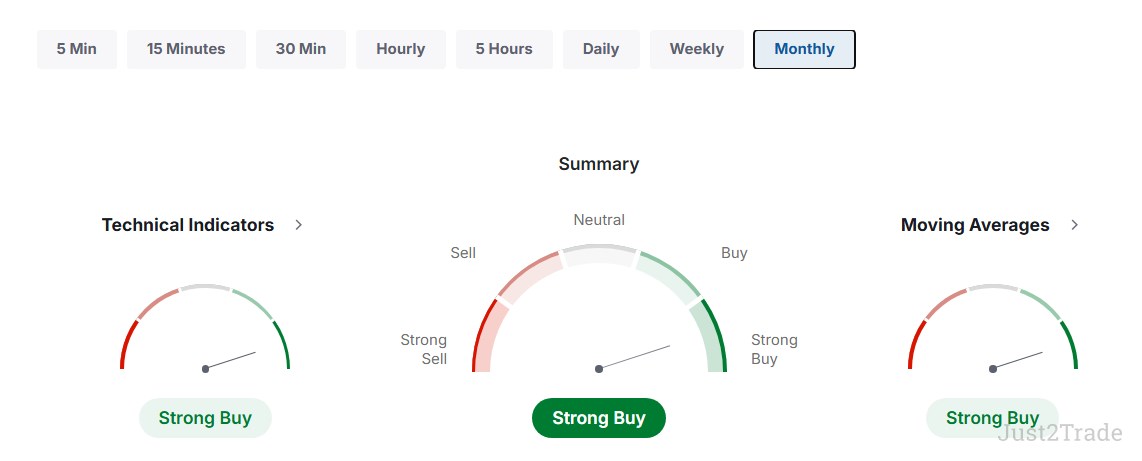

As of April 2025, technical analysis for PKN Orlen indicates a strong bullish trend. The 14-day Relative Strength Index (RSI) stands at 68.57, suggesting buying momentum. All key moving averages (5, 10, 20, 50, 100, and 200-day) are signaling a 'Buy'.

The Moving Average Convergence Divergence (MACD) is positive at 0.6, reinforcing the upward trend. Additional indicators, including the Commodity Channel Index (CCI) and Rate of Change (ROC), also support a bullish outlook. Overall, the technical indicators collectively suggest a 'Strong Buy' for Orlen.

PKN Orlen Stock Price History

2024 showed significant volatility for PKN Orlen, with monthly price swings as large as 15% to 17%, notably higher than the previous year. Despite reaching highs of nearly 74 PLN, the stock ultimately declined by about 15.5 PLN, closing the year around 47.20 PLN.

| Date |

Price |

Open |

High |

Low |

Volume |

| Dec 01, 2024 | 47.20 | 51.00 | 53.59 | 45.40 | 62.73M |

| Nov 01, 2024 | 51.02 | 52.41 | 54.37 | 49.99 | 42.86M |

| Oct 01, 2024 | 52.09 | 56.16 | 58.90 | 51.45 | 45.45M |

| Sep 01, 2024 | 55.87 | 64.14 | 66.16 | 55.36 | 48.66M |

| Aug 01, 2024 | 64.34 | 64.74 | 65.19 | 59.90 | 31.76M |

| Jul 01, 2024 | 64.67 | 67.50 | 69.17 | 62.80 | 33.84M |

| Jun 01, 2024 | 67.69 | 64.26 | 68.30 | 61.70 | 40.93M |

| May 01, 2024 | 63.57 | 66.44 | 73.59 | 62.81 | 43.93M |

| Apr 01, 2024 | 66.44 | 65.30 | 70.90 | 65.29 | 45.87M |

| Mar 01, 2024 | 65.08 | 62.56 | 65.65 | 60.80 | 39.00M |

| Feb 01, 2024 | 61.98 | 62.45 | 68.87 | 61.91 | 53.54M |

| Jan 01, 2024 | 62.66 | 65.92 | 66.78 | 58.30 | 37.96M |

The recent PKN price history shows an upward movement from 62 PLN to 69 PLN. PKN is expected to continue growing.

| Date |

Price |

Open |

High |

Low |

Volume |

| Apr 29, 2025 | 69.09 | 69.32 | 69.44 | 69.02 | 392.92K |

| Apr 28, 2025 | 69.32 | 68.80 | 69.48 | 68.79 | 2.61M |

| Apr 25, 2025 | 68.80 | 68.30 | 69.23 | 68.25 | 3.11M |

| Apr 24, 2025 | 68.30 | 66.86 | 68.30 | 66.46 | 3.65M |

| Apr 23, 2025 | 67.09 | 66.89 | 67.24 | 66.28 | 3.37M |

| Apr 22, 2025 | 65.98 | 63.90 | 65.98 | 63.90 | 4.76M |

| Apr 17, 2025 | 63.70 | 63.80 | 64.48 | 63.58 | 1.64M |

| Apr 16, 2025 | 63.86 | 62.82 | 63.96 | 62.34 | 2.35M |

| Apr 15, 2025 | 63.05 | 65.00 | 65.28 | 62.67 | 3.77M |

| Apr 14, 2025 | 65.00 | 65.10 | 65.50 | 64.62 | 2.42M |

| Apr 11, 2025 | 64.44 | 64.30 | 65.20 | 64.00 | 2.29M |

| Apr 10, 2025 | 64.30 | 67.00 | 67.20 | 63.18 | 3.88M |

| Apr 09, 2025 | 62.04 | 62.03 | 63.33 | 61.33 | 3.47M |

PKN Orlen Stock Price Forecast for 2025

Throughout 2025, the ORLEN SA price will fluctuate with slight upward and downward movements.

| Date |

Min Price |

Max Price |

Change |

| June 2025 | 67.884 | 68.978 | -1.38 % ▼ |

| July 2025 | 67.200 | 68.001 | -1.19 % ▼ |

| August 2025 | 65.745 | 67.037 | -1.97 % ▼ |

| September 2025 | 65.222 | 65.834 | -0.24 % ▼ |

| October 2025 | 65.435 | 66.235 | 0.92 % ▲ |

| November 2025 | 66.388 | 67.235 | 0.66 % ▲ |

| December 2025 | 65.903 | 66.791 | -0.13 % ▼ |

PKN Orlen Stock Price Forecast for 2026

According to WalletInvestor’s AI-based Orlen forecasts, the stock price will go down and close the year at around 63 PLN.

| Date |

Min Price |

Max Price |

Change |

| January 2026 | 65.124 | 67.128 | -2.26 % ▼ |

| February 2026 | 64.430 | 65.408 | 0.75 % ▲ |

| March 2026 | 64.893 | 66.378 | 1.55 % ▲ |

| April 2026 | 66.525 | 67.921 | 0.64 % ▲ |

| May 2026 | 66.254 | 66.785 | -0.49 % ▼ |

| June 2026 | 65.655 | 66.693 | -1.16 % ▼ |

| July 2026 | 64.847 | 65.722 | -1.35 % ▼ |

| August 2026 | 63.459 | 64.740 | -1.90 % ▼ |

| September 2026 | 62.952 | 63.588 | -0.53 % ▼ |

| October 2026 | 63.127 | 63.892 | 0.98 % ▲ |

| November 2026 | 64.030 | 64.944 | 0.71 % ▲ |

| December 2026 | 63.625 | 64.585 | -0.56 % ▼ |

PKN Orlen Stock Price Forecast for 2027

During 2027, a minor price deflation can occur. An AI forecast claims that the PKN price will fall from 64 PLN to 61 PLN.

| Date |

Min Price |

Max Price |

Change |

| January 2027 | 63.011 | 64.868 | -1.9 % ▼ |

| February 2027 | 62.157 | 63.071 | 0.5 % ▲ |

| March 2027 | 62.615 | 64.051 | 1.53 % ▲ |

| April 2027 | 64.122 | 65.619 | 0.75 % ▲ |

| May 2027 | 63.978 | 64.498 | -0.27 % ▼ |

| June 2027 | 63.432 | 64.404 | -1.44 % ▼ |

| July 2027 | 62.651 | 63.367 | -1.14 % ▼ |

| August 2027 | 61.209 | 62.555 | -1.85 % ▼ |

| September 2027 | 60.682 | 61.306 | -0.69 % ▼ |

| October 2027 | 60.818 | 61.555 | 1.07 % ▲ |

| November 2027 | 61.675 | 62.651 | 1.13 % ▲ |

| December 2027 | 61.357 | 62.312 | -0.76 % ▼ |

PKN Orlen Stock Price Forecast for 2028

In 2028, the ORLEN SA price may fall from 60.5 PLN to 59 PLN. However, this technical analysis is very long term, so it is far from accurate. In such a distant future, there may be many factors shaping its cost.

| Date |

Min Price |

Max Price |

Change |

| January 2028 | 60.535 | 62.589 | -2.55 % ▼ |

| February 2028 | 59.849 | 60.944 | 0.62 % ▲ |

| March 2028 | 60.309 | 61.712 | 1.26 % ▲ |

| April 2028 | 62.207 | 63.325 | 0.36 % ▲ |

| May 2028 | 61.709 | 62.303 | -0.18 % ▼ |

| June 2028 | 61.006 | 62.136 | -1.69 % ▼ |

| July 2028 | 60.287 | 61.074 | -1.09 % ▼ |

| August 2028 | 58.949 | 60.369 | -2.41 % ▼ |

| September 2028 | 58.391 | 58.901 | -0.55 % ▼ |

| October 2028 | 58.613 | 59.535 | 1.55 % ▲ |

| November 2028 | 59.535 | 60.392 | 0.63 % ▲ |

| December 2028 | 59.098 | 59.813 | -0.57 % ▼ |

PKN Orlen Stock Price Forecast for 2029

The Orlen stock forecast for 2029 anticipates moderate volatility, marked by consistent fluctuations within a narrow price range.

| Date |

Min Price |

Max Price |

Change |

| January 2029 | 58.309 | 60.298 | -2.41 % ▼ |

| February 2029 | 57.561 | 58.654 | 0.93 % ▲ |

| March 2029 | 58.024 | 59.239 | 1.12 % ▲ |

| April 2029 | 59.738 | 61.081 | 0.50 % ▲ |

| May 2029 | 59.439 | 60.116 | -0.62 % ▼ |

| June 2029 | 58.776 | 59.864 | -1.51 % ▼ |

| July 2029 | 58.093 | 58.825 | -0.90 % ▼ |

| August 2029 | 56.584 | 58.099 | -2.68 % ▼ |

| September 2029 | 56.105 | 56.661 | -0.59 % ▼ |

| October 2029 | 56.304 | 57.232 | 1.62 % ▲ |

| November 2029 | 57.177 | 58.124 | 0.69 % ▲ |

| December 2029 | 56.812 | 57.554 | -0.19 % ▼ |

PKN Orlen Stock Price Forecast for 2030

The forecast for PKN Orlen stock in early 2030 suggests initial volatility, with a decline of 2.86% in January, reflecting continued caution among investors.

| Date |

Minimum Price |

Maximum Price |

Change |

| January 2030 | 55.975 | 57.997 | -2.86 % ▼ |

| February 2030 | 55.294 | 56.356 | 0.93 % ▲ |

| March 2030 | 55.756 | 56.771 | 1.00 % ▲ |

| April 2030 | 57.265 | 58.818 | 1.41 % ▲ |

What Affects the PKN Orlen Stock Price?

Since Orlen is a major oil and gas company based in Poland, the cost of this stock depends on the local economy and industry to a large extent. However, these are not the only aspects that matter. Basically, there are two main categories of factors: internal and external.

Internal factors:

- The company’s financial performance, including its profitability, revenue growth, and operational efficiency. If PKN Orlen generates strong profits and maintains a stable revenue growth, investors will be more likely to invest in the stock, which will naturally lead to a price boost.

- Strategic decisions, such as acquisitions, mergers, and investments in new projects. Successful decisions contribute to the company's growth: investors become more confident in the stock, and their purchases drive the growth in the price.

External factors:

- Global oil and gas market. Changes in oil prices, as well as supply and demand, can have a significant impact on the company's financial performance and, consequently, its stock price. For example, if oil prices rise, it can lead to higher profits for PKN Orlen.

- Economic conditions, both in Poland and globally. Growth, inflation, interest rates, and other macroeconomic factors influence investor sentiment and company performance.

- The political and regulatory environment, both in Poland and internationally. For example, changes in taxation, environmental regulations, or trade rules can impact the company's operations and financial performance.

How to predict the PKN Orlen Stock Price

First of all, to make reliable PKN orlen shares forecasts, traders should perform a fundamental analysis:

- Analyze Orlen's financial statements, including balance sheets, income statements, and cash flow statements, in order to assess the company’s financial health, earnings growth, and profitability.

- Study the oil and energy industry trends, PKN Orlen's market share, competition, regulatory environment, and potential growth drivers or risks.

- Monitor macroeconomic indicators such as oil prices, interest rates, GDP growth, and inflation rates.

Then comes the technical analysis of the stock:

- Technical analysis tools can help investors identify patterns such as moving averages, support and resistance levels, trendlines, and chart patterns (head and shoulders, hammers, flags, and triangles).

- Technical indicators like Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, and stochastic oscillators serve to identify potential buy or strong sell signals.

- It’s also important to analyze trading volume patterns to confirm price movements and assess the strength of a trend.

Conclusion

If you are looking for conservative assets to trade, PKN Orlen can be a decent choice, because it is not prone to significant volatility within a day. Plus, no major price shifts are expected in 2025. However, if you want to invest in prospective stocks, this is not the best time to buy PKN, because predictions are rather negative.

FAQs

Will the PKN stock price drop / fall?

AI-generated technical analysis suggests that PKN will keep losing its value, both in 2025, and in the longer term. We may witness a PKN price of 65 by the end of this year.

Will the PKN stock price crash?

There are no signs of PKN Orlen bankruptcy – the company is functioning normally, and investors keep buying their equity. Hence, the chance of a PKN stock price crash is almost non-existent.

Will the Polski Koncern Naftowy ORLEN stock price hit the 100 PLN price in a year?

This is not likely, because the majority of PKN predictions are pessimistic: the stock price is expected to keep lowering by 1-2% every year. Besides, a huge volume of money input would be needed for such a large price boost.

Will the Polski Koncern Naftowy ORLEN stock price hit the 200 PLN price in a year?

This is not likely, because the majority of PKN price predictions are pessimistic: the stock price is expected to keep lowering by 1-2% every year. Moreover, the price of 200 PLN is even more unrealistic in the perspective of one year.

How many shares does PKN Orlen have?

As of April 2025 (the time of writing this article), PKN Orlen has approximately 1.16 billion stocks outstanding.