Previsione del prezzo dell'oro

Utilizzato come mezzo di scambio e di commercio fin dall'antichità, l'oro è stato considerato uno dei beni più preziosi e un rifugio sicuro per la conservazione. Passano i secoli, ma il suo valore continua a crescere grazie alla sua scarsità e alla sua immunità alla distruzione. Oggi l'oro è ancora uno degli asset più consolidati e diffusi per gli investimenti, soprattutto a lungo termine. State pensando di aggiungerlo al vostro portafoglio? Leggete questa guida definitiva alla previsione del prezzo dell'oro 24k per oncia: quanto sarà domani, nel 2024, nel 2025 e in seguito.

Indice dei contenuti

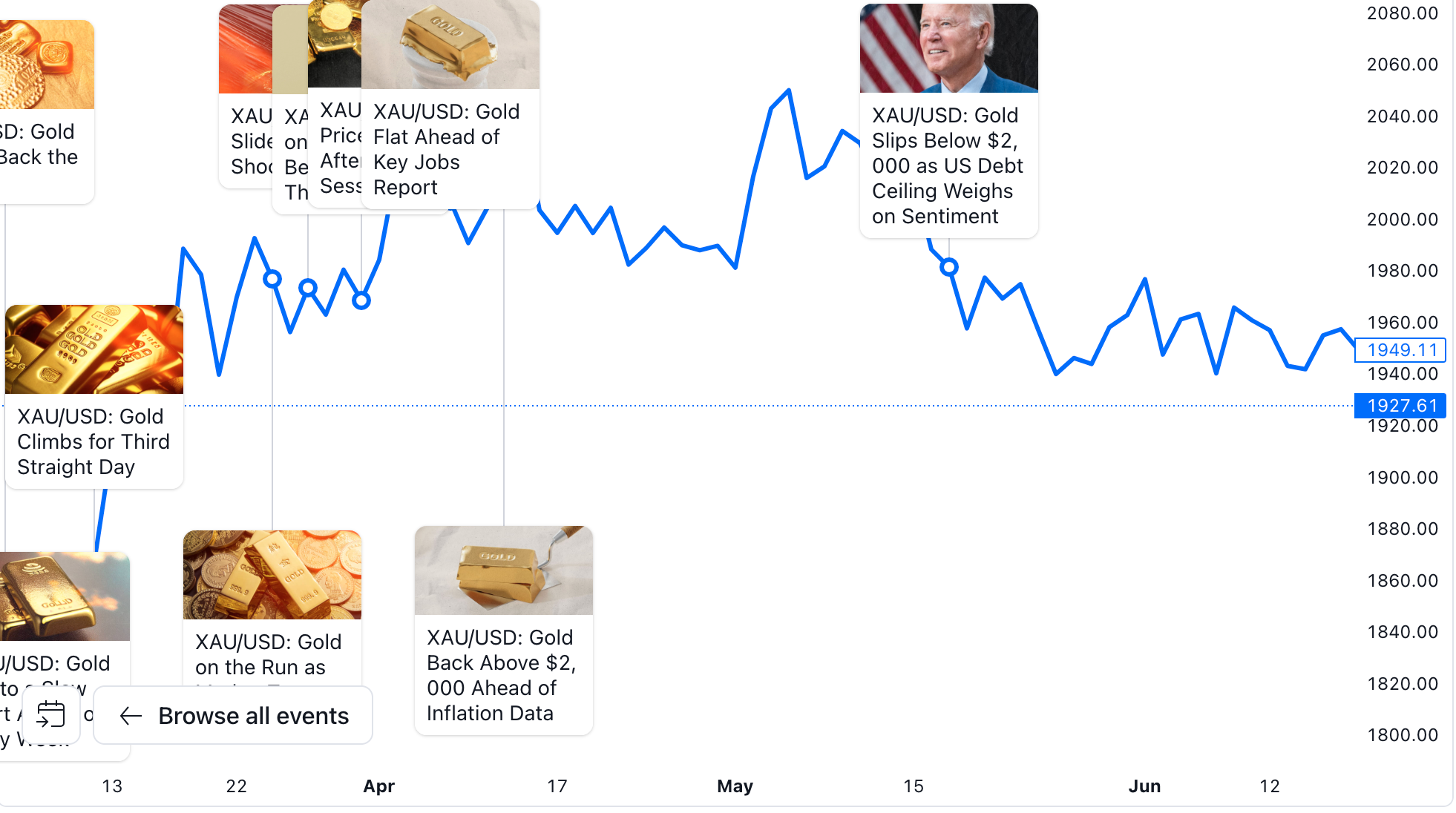

ANALISI TECNICA DELL'ORO

GRAFICO STORICO DEL PREZZO DELL'ORO

PREVISIONE DEL PREZZO DELL'ORO A BREVE TERMINE PER IL 2024

PREVISIONI SUL PREZZO DELL'ORO NEL 2025

PREVISIONI SUL PREZZO DELL'ORO NEL 2026

PREVISIONI DEL PREZZO DELL'ORO PER IL 2030

PREVISIONI SUL PREZZO DELL'ORO NEI PROSSIMI 5 ANNI

PREVISIONI SUL PREZZO DELL'ORO NEI PROSSIMI 10 ANNI

PREVISIONE DEL TASSO DI CAMBIO DELL'ORO PER I PROSSIMI 20 ANNI

COSA INFLUENZA IL PREZZO DELL'ORO?

L'ORO È UN BUON INVESTIMENTO?

FAQ

ANALISI TECNICA DELL'ORO

)

Tutto sommato, l'impennata dell'oro negli ultimi anni ha preso davvero slancio nei primi giorni di maggio, salendo del 26,3% in 7 mesi a 2.050 dollari. Questo valore non è molto distante dal massimo di chiusura, che ha stabilito livelli record all'inizio di agosto 2020 a 2.062 dollari. L'ultima volta che il Federal Open Market Committee (FOMC) della Federal Reserve ha aumentato il tasso sui fondi federali di 25 punti base, è stata seguita dall'ultima quotazione dell'oro. L'intervallo tipico è del 5,13%.

A causa dell'estrema leva finanziaria presente in questo mercato, gli speculatori di solito controllano la direzione dei prezzi dell'oro nel breve periodo. Le buste paga degli Stati Uniti sono scese dell'1,6% venerdì 5 maggio, come conseguenza del calo stagionale dei prezzi dell'oro nel mese. Un'altra significativa sorpresa positiva nei dati mensili sui posti di lavoro negli Stati Uniti per il mese di aprile è stata in gran parte responsabile di questo risultato.

All'interno della tendenza rosa sta emergendo una potente tendenza rialzista. Se non scende al di sotto di questo livello, l'oro potrà superare i 2.200 dollari. Molto probabilmente l'asset seguirà la tendenza, arrivando a toccare il livello di 2.400 dollari, a meno che non si verifichi un calo significativamente più forte di quello blu.

Ora che il comportamento a lungo termine è stato verificato, analizziamo il comportamento a breve termine: guardate il grafico 1W. Un declino fino a 1.850 dollari non solo annullerebbe il trend rialzista di lungo periodo, ma allungherebbe anche di molto il periodo di recupero.

Anche questo frame mostra una riconoscibile svolta rialzista. All'interno del rialzo rosa precedentemente descritto, è presente una rottura del ribasso blu. Una tendenza al rialzo più ripida (viola) dovrebbe essere in grado di spingere il prezzo oltre la tendenza bianca e fino alla soglia dei 2.250 dollari, se continuerà a salire oltre la soglia dei 2.200 dollari.

È probabile che il prezzo rimanga al di sopra della banda superiore della tendenza bianca intorno a 2.250 dollari. Dopo un breve periodo di stabilizzazione, potrebbe formare una versione molto più ripida della tendenza bianca, rendendo obsoleta la precedente, e salire rapidamente sopra i 2.400 dollari. Il livello di 2.080 dollari sarà probabilmente ritestato, e forse anche molto più in basso se il prezzo inizierà a scendere sotto i 2.200 dollari.

GRAFICO STORICO DEL PREZZO DELL'ORO

)

Il prezzo dell'oro ha subito oscillazioni nel corso dell'ultimo secolo, con diverse tappe degne di nota. Ecco una breve storia dei prezzi dell'oro negli ultimi cento anni:

- Nel 1920, il prezzo dell'oro era di 20,67 dollari USA per oncia. Questo prezzo medio rimase stabile fino agli anni Trenta, quando Franklin D. Roosevelt svalutò il dollaro USA e fece salire il costo del metallo prezioso a 35 dollari.

- Durante la Seconda Guerra Mondiale, il governo statunitense fissò il prezzo dell'oro a 35 dollari per alimentare il budget di guerra. Questo prezzo durò fino agli anni Settanta e si mantenne intorno allo stesso livello. Tuttavia, la crescente inflazione e l'incertezza economica hanno portato a un aumento della domanda di oro come una delle opzioni di investimento più sicure.

- Nel 1971 il presidente Nixon pose fine al gold standard, facendo ovviamente aumentare il prezzo. Nel 1980 il bene raggiunse il massimo storico di 850 dollari a causa dell'instabilità politica, dell'inflazione e di diversi eventi geopolitici, come l'invasione dell'Unione Sovietica in Afghanistan.

- Gli anni '80 e '90 sono stati caratterizzati da una relativa stabilità: il prezzo dell'oro ha oscillato per anni intorno ai 400 dollari.

Nel 2008, la crisi finanziaria globale ha dato il via alla crescita del prezzo dell'oro: ha raggiunto i 1.000 dollari grazie agli investimenti che si sono riversati su questo bene sicuro.

- Tra il 2011 e il 2015, i prezzi dell'oro hanno superato nuovi limiti. Nel 2011 il prezzo ha raggiunto un nuovo massimo storico di 1.900 dollari. Tuttavia, il suo valore è diminuito nel 2013 e nel 2015 è sceso a circa 1.050 dollari. Nel 2023, l'oro ha superato la soglia dei 1.900 dollari e tuttora vi si aggira intorno.

Negli anni precedenti il costo dell'oro è rimasto relativamente stabile, con lievi fluttuazioni dovute a eventi geopolitici e all'incertezza economica.

PREVISIONE DEL PREZZO DELL'ORO A BREVE TERMINE PER IL 2024

Nonostante l'ampia gamma di previsioni, la maggior parte di esse indica per il 2024 una fascia di prezzo paragonabile a quella del 2023. La forza del dollaro è indicata come una delle ragioni principali. Gli analisti prevedono che il dollaro manterrà la sua posizione o si rafforzerà ulteriormente nella prima metà del 2024, prima che il rallentamento della crescita provochi un picco o un calo dei tassi di interesse. Al contrario, l'indebolimento del dollaro provocherà un aumento dei prezzi dell'oro nei restanti mesi del 2024.

Va notato che la maggior parte delle previsioni per il 2024 non tiene conto di questioni scottanti come l'influenza delle azioni russe o cinesi sulla scena politica. Questi Paesi potrebbero avere un enorme impatto sul prezzo dell'oro, sia in senso positivo che negativo.

Nel 2024 si prevede che la Federal Reserve, la Banca Centrale Europea e la Banca d'Inghilterra allentino le loro politiche monetarie, il che comporterà una riduzione dei differenziali tra il tasso di cambio dell'euro, della sterlina e del dollaro rispetto all'oro, tipicamente considerato un bene privo di tassi d'interesse.

Nel 2024, i prezzi dell'oro beneficeranno dell'allentamento della politica monetaria da parte della Fed, della BCE e della BoE, in quanto i differenziali di tasso tra USD/EUR/GBP e oro diminuiranno.

Secondo gli strateghi, tuttavia, l'impatto potrebbe essere meno grave rispetto a quando i tassi d'interesse erano molto più bassi, perché si prevede che lo spread a favore di queste valute continuerà ad essere consistente.

Ecco le previsioni del prezzo dell'oro per il 2024 di WalletInvestor:

| Data |

Prezzo minimo |

Prezzo massimo |

Cambiamento |

| Aprile 2024 |

2157.758 |

2164.499 |

0.05% ▲ |

| Maggio 2024 |

2152.477 |

2158.775 |

0.01% ▲ |

| Giugno 2024 |

2147.750 |

2160.406 |

-0.56% ▼ |

| Luglio 2024 |

2144.567 |

2168.938 |

1.05% ▲ |

| Agosto 2024 |

2169.767 |

2190.243 |

0.93% ▲ |

| Settembre 2024 |

2167.061 |

2191.891 |

-1.12% ▼ |

| Ottobre 2024 |

2166.192 |

2174.808 |

0.3% ▲ |

| Novembre 2024 |

2170.609 |

2173.954 |

0.04% ▲ |

| Dicembre 2024 |

2166.391 |

2177.938 |

0.25% ▲ |

PREVISIONI SUL PREZZO DELL'ORO NEL 2025

Si prevede che i fattori importanti che hanno influenzato l'anno in corso si estenderanno sostanzialmente al 2025. La performance dell'oro come asset di rischio sarà probabilmente rafforzata da una politica più restrittiva della Fed e dal conseguente rallentamento della crescita economica.

Ecco alcune previsioni di diverse fonti:

-

Secondo Wallet Investor, nel 2025 il prezzo di apertura dell'oro dovrebbe raggiungere i 2.179 dollari. Entro la fine del 2025, il prezzo di chiusura salirà a 2.229 dollari dal precedente prezzo di chiusura di 2.210 dollari del giugno 2025.

- L'Agenzia per le previsioni economiche sostiene che il costo dell'oro dovrebbe oscillare tra i 2.200 e i 2.500 dollari nel 2025. Il prezzo stimato per i prossimi cinque anni è di 2.600 dollari.

- Le previsioni sui prezzi delle monete per il 2025 dicono che il prezzo finirà l'anno al livello di 2.400 dollari. In seguito, i tassi continueranno a salire in modo significativo.

| Data |

Prezzo minimo |

Prezzo massimo |

Cambiamento |

| Agosto 2025 |

2232.587 |

2252.943 |

0.90% ▲ |

| Settembre 2025 |

2230.241 |

2255.152 |

-1.08% ▼ |

| Ottobre 2025 |

2229.481 |

2238.001 |

0.25% ▲ |

| Novembre 2025 |

2233.826 |

2237.307 |

0.06% ▲ |

| Dicembre 2025 |

2229.704 |

2241.447 |

0.23% ▲ |

PREVISIONI SUL PREZZO DELL'ORO NEL 2026

Il 2026 dovrebbe essere un anno tranquillo per l'oro, con una crescita stabile ma minore. Ecco la proiezione dei prezzi di WalletInvestor:

| Data |

Prezzo minimo |

Prezzo massimo |

Cambiamento |

| Gennaio 2026 |

2242.551 |

2269.538 |

1.19% ▲ |

| Febbraio 2026 |

2270.792 |

2287.779 |

0.74% ▲ |

| Marzo 2026 |

2283.712 |

2290.729 |

-0.26% ▼ |

| Aprile 2026 |

2284.514 |

2290.763 |

0.06% ▲ |

| Maggio 2026 |

2279.136 |

2285.092 |

-0.03% ▼ |

| Giugno 2026 |

2273.365 |

2286.675 |

-0.55% ▼ |

| Luglio 2026 |

2271.021 |

2294.430 |

0.92% ▲ |

| Agosto 2026 |

2298.010 |

2317.278 |

0.83% ▲ |

| Settembre 2026 |

2294.225 |

2318.244 |

-1.01% ▼ |

| Ottobre 2026 |

2292.970 |

2301.070 |

0.28% ▲ |

| Novembre 2026 |

2297.108 |

2300.560 |

0.04% ▲ |

| Dicembre 2026 |

2293.079 |

2304.081 |

0.21% ▲ |

PREVISIONI DEL PREZZO DELL'ORO PER IL 2030

Nel complesso, le previsioni sul prezzo dell'oro per il 2030 sono positive. A causa della perdurante instabilità economica causata dall'incombente crollo dei sistemi bancari europei e americani, gli investitori iniziano a perdere fiducia nelle istituzioni finanziarie tradizionali. Non sorprende quindi che l'oro sia di nuovo considerato un investimento a prova di bomba. Gli investitori considerano l'oro come una riserva di valore affidabile durante le crisi economiche.

Anche le azioni delle banche centrali hanno contribuito allo status di investimento numero uno dell'oro. Per compensare gli effetti economici dell'epidemia di COVID-19, le banche di tutto il mondo hanno creato valuta in grandi quantità. Di conseguenza, il settore finanziario ha registrato un forte aumento della liquidità, che ha innescato un incremento dei tassi di inflazione a livello globale.

La tabella seguente mostra quali potrebbero essere i prezzi dell'oro negli anni successivi:

| Anno |

Valore di metà anno |

Valore di fine anno |

| 2025 |

$2,589 |

$2,769 |

| 2026 |

$2,801 |

$2,809 |

| 2027 |

$2,894 |

$3,130 |

| 2028 |

$3,345 |

$3,560 |

| 2029 |

$3,703 |

$3,865 |

| 2030 |

$4,133 |

$4,192 |

PREVISIONI SUL PREZZO DELL'ORO NEI PROSSIMI 5 ANNI

I tassi di inflazione, le politiche delle banche centrali e le tensioni geopolitiche sono gli aspetti chiave che definiscono le previsioni sul prezzo futuro dell'oro fatte da economisti e istituzioni finanziarie.

I mercati azionari sono stati colpiti da un'elevata volatilità dall'inizio del 2022. Un anno fa il prezzo dell'oro era in costante aumento e la tendenza al rialzo non si è attenuata. Il problema principale che influenzerà XAU/USD in futuro è l'inflazione. Gli americani stanno assistendo al più grande problema di inflazione degli ultimi quarant'anni. Poiché l'oro è sempre stato il più efficace strumento anti-inflazione, i prezzi potrebbero salire ulteriormente e superare i 2.000 dollari.

Il prezzo dell'oro dovrebbe aumentare nei prossimi anni, ma potrebbe tornare a superare i 2.000 dollari l'oncia. A ciò potrebbero contribuire i seguenti eventi:

-

Generosi stimoli fiscali e monetari daranno il via a crescenti aspettative inflazionistiche e al deprezzamento del dollaro.

- L'industria dei metalli preziosi può contare su un afflusso di finanziamenti da parte degli investitori e su un lento ma costante miglioramento della domanda dei consumatori in Cina e in India.

- Poiché smetterebbero di produrre reddito, i titoli di Stato (debito pubblico) non servirebbero come asset difensivi contro l'inflazione e i tassi di interesse negativi.

- L'oro sarà ampiamente utilizzato come copertura in circostanze geopolitiche tese. In questo caso, il costo opportunità del possesso di oro diminuirebbe.

Ecco una previsione del prezzo dell'oro a 5 anni:

| Anno |

Valore di metà anno |

Valore di fine anno |

| 2024 |

$2,289 |

$2,312 |

| 2025 |

$2,526 |

$2,701 |

| 2026 |

$2,732 |

$2,740 |

| 2027 |

$2,823 |

$3,053 |

| 2028 |

$3,263 |

$3,472 |

PREVISIONI SUL PREZZO DELL'ORO NEI PROSSIMI 10 ANNI

Il grafico di previsione del prezzo dell'oro per i prossimi dieci anni appare positivo, in quanto le previsioni generali sull'oro sono ancora valide: il suo valore non potrà che aumentare, soprattutto se si considera che una crisi finanziaria è all'orizzonte, e possiamo osservare cosa è successo nei dieci anni successivi al 2008.

La crisi globale del 2008, secondo Dohmen Capital Research, è un esempio recente e calzante. Con la restrizione del credito, la crisi si è intensificata, è iniziata la corsa all'incasso di tutti gli asset e l'oro è crollato del 31%. Per i tori che non sapevano che una crisi finanziaria fa crollare il valore di tutti gli asset, è stato terribile. Ma in fondo, ha anche prodotto una fantastica opportunità di acquisto.

Tenendo conto di tutti questi punti, l'oro rimane un investimento degno di nota perché il suo valore è destinato a raddoppiare in una prospettiva di 10 anni, ma, naturalmente, dipenderà da una serie di fattori politici ed economici.

La tabella seguente mostra una previsione del prezzo dell'oro a 10 anni con prezzi minimi e massimi:

| Anno |

Valore di metà anno |

Valore di fine anno |

| 2024 | $2,289 | $2,312 |

| 2025 | $2,526 | $2,701 |

| 2026 | $2,732 | $2,740 |

| 2027 | $2,823 | $3,053 |

| 2028 | $3,263 | $3,472 |

| 2029 | $3,611 | $3,769 |

| 2030 | $4,030 | $4,087 |

| 2031 | $4,124 | $4,249 |

| 2032 | $4,465 | $4,688 |

| 2033 | $4,910 | $5,103 |

| 2034 | $5,322 | $5,540 |

| 2035 | $5,757 | $5,973 |

PREVISIONE DEL TASSO DI CAMBIO DELL'ORO PER I PROSSIMI 20 ANNI

Prevedere il prezzo dell'oro nel 2040 è altamente speculativo e incerto. Una miriade di fattori influisce sul prezzo dell'oro in ogni periodo e la loro interazione rende inaffidabili le previsioni a lungo termine.

Le previsioni per i prossimi 20 anni dipenderanno dalle condizioni economiche globali: inflazione, tassi di interesse, fluttuazioni valutarie e decine di altri fattori. Quando il mondo sarà preoccupato per l'inflazione o l'instabilità economica, gli investitori potranno rifugiarsi nell'oro, che salirà di prezzo.

Le tensioni geopolitiche, le controversie commerciali, l'instabilità politica e i principali eventi globali possono influenzare il sentimento degli investitori e aumentare la domanda di oro come bene rifugio. Le banche centrali detengono ingenti riserve d'oro e le loro attività di acquisto o vendita possono influenzare il mercato. Cambiamenti nelle loro politiche, come un aumento degli acquisti di oro, possono far salire i prezzi.

L'offerta e la domanda di oro sono fattori determinanti per il suo prezzo. Fattori come i livelli di produzione dell'oro, i progressi tecnologici nell'estrazione, la domanda di gioielli e gli usi industriali possono influenzare l'equilibrio tra domanda e offerta.

Anche il sentimento degli investitori, le speculazioni di mercato e le attività di trading sui futures dell'oro e su altri strumenti finanziari possono avere un impatto a breve termine sulle quotazioni dell'oro. Questi fattori possono essere influenzati da varie peculiarità psicologiche e comportamentali difficili da analizzare.

COSA INFLUENZA IL PREZZO DELL'ORO?

Poiché l'oro è uno dei beni più antichi, il suo valore dipende da un gran numero di fattori, di cui parleremo qui di seguito.

Inflazione

L'inflazione è uno dei principali fattori che influenzano il prezzo dell'oro - hanno una correlazione negativa. Quando l'inflazione aumenta, la valuta nazionale inizia a perdere valore, spingendo gli investitori a cercare beni a prova di crisi come l'oro. L'aumento della domanda di oro ne fa salire il prezzo.

Al contrario, quando l'inflazione è bassa, il valore della moneta è stabile, il che riduce l'attrattiva dell'oro come investimento e ne fa scendere il prezzo.

Fluttuazioni valutarie

Le fluttuazioni valutarie possono avere un impatto significativo sul prezzo dell'oro. Quando una valuta si indebolisce, spesso il prezzo dell'oro sale, perché il metallo prezioso è considerato un bene rifugio e gli investitori tendono a ricorrervi nei periodi di incertezza economica.

Inoltre, un dollaro più debole rende l'oro relativamente più economico per gli acquirenti stranieri, aumentandone la domanda. Quando una valuta si rafforza, il prezzo dell'oro può diminuire perché diventa relativamente più costoso per gli acquirenti stranieri.

Tempi geopoliticamente incerti

Nei periodi di instabilità geopolitica, l'oro viene spesso preferito ad altri beni d'investimento. Quando ci sono tensioni o conflitti tra le nazioni, gli investitori cercano la stabilità e la sicurezza dell'oro, facendo salire la sua domanda e il suo prezzo. Eventi geopolitici come disordini politici, dispute commerciali o guerre possono creare un'elevata incertezza nei mercati finanziari, inducendo piccoli e grandi investitori a puntare sull'oro come copertura contro i potenziali rischi economici. Ciò significa che i prezzi dell'oro tendono a salire nei periodi di turbolenza geopolitica.

Tassi di interesse

Quando i tassi di interesse sono bassi, diminuisce l'opportunità di detenere attività non redditizie come l'oro. Ciò rende l'oro un investimento più prezioso e sicuro, con conseguente aumento della domanda e dei prezzi. Con l'aumento dei tassi d'interesse, gli investitori potrebbero spostarsi verso attività con rendimento, riducendo la domanda e potenzialmente abbassando i prezzi dell'oro.

Vincoli di fornitura

Un'offerta limitata, dovuta a condizioni come la diminuzione della produzione mineraria o a interruzioni nella catena di approvvigionamento, può innescare un aumento della domanda e quindi dei prezzi. Quando l'offerta di oro è limitata, il suo valore aumenta grazie alla scarsità. Gli investitori possono prevedere future carenze e aumentare la loro domanda, provocando un aumento dei prezzi. Viceversa, se il volume dell'oro aumenta, può portare a un eccesso di offerta e a un potenziale calo dei prezzi, poiché il mercato dell'oro diventa più saturo.

L'ORO È UN BUON INVESTIMENTO?

Nel breve termine, l'oro può essere considerato un'opzione di investimento favorevole per gli investitori individuali che cercano di coprirsi dai rischi di mercato e di preservare il capitale. È considerato un bene sicuro e prezioso nei periodi di incertezza economica o di volatilità dei mercati.

Nel medio termine, il costo dell'oro può essere influenzato da fattori quali l'alta inflazione, le politiche delle banche centrali e le condizioni generali del mercato. Le azioni delle banche, come l'aumento o la riduzione dei tassi d'interesse e lo stimolo monetario, influenzano tutti gli asset scambiati. L'oro può costituire una parte del portafoglio per la conservazione e la diversificazione del patrimonio a medio termine.

Nel lungo periodo, la performance dell'oro dipenderà sicuramente dall'andamento dell'economia globale, dalle fluttuazioni valutarie e dalle dinamiche di domanda e offerta. Il principale vantaggio dell'oro è il suo valore immutabile nel corso dei secoli e continuerà sicuramente a essere considerato un bene rifugio.

Nel complesso, le previsioni per il 2027 e gli anni successivi sono positive. Con la crescita delle economie e l'aumento della popolazione, la domanda di oro, in particolare nei mercati globali emergenti, potrebbe aumentare. Inoltre, l'offerta di oro è limitata e l'estrazione di nuove riserve sta diventando sempre più impegnativa, il che potrebbe portare a una prospettiva positiva a lungo termine per i prezzi dell'oro. Il metallo prezioso può essere considerato un investimento sicuro che consente ai detentori di coprirsi dalla svalutazione delle valute e di ottenere una diversificazione ottimale del proprio portafoglio.

FAQ

Quanto dovrebbe costare l'oro nel 2030?

Entro il 2030, il prezzo dell'oro dovrebbe aumentare di oltre il 40%, passando da 3.186 a 4.515 dollari. L'oro inizierà l'anno 2030 a 3.186 dollari, salirà a 3.377 dollari nella prima metà dell'anno e terminerà l'anno a 3.418 dollari. Si tratta di un +76% circa rispetto a oggi, per l'esattezza. Tuttavia, alcune previsioni non sono così ottimistiche, suggerendo che un ulteriore aumento del prezzo dell'oro non supererà la soglia dei 3.000 dollari entro questo periodo.

Qual è la previsione del prezzo dell'oro per il 2040?

Non ci sono molte previsioni su cui fare affidamento, ma il divario tra le previsioni è molto grande: da 2.989,02 a 53.525,53 dollari. Poiché si tratta di un futuro di oltre 15 anni, il costo dipenderà ancora da molti fattori, come la situazione geopolitica, la forza dell'USD e le criptovalute.

Qual è la previsione del prezzo dell'oro per il 2050?

Entro il 2050, potremmo assistere a quotazioni di XAU/USD pari o superiori a 10.000 dollari, soprattutto se l'economia statunitense dovesse subire un crollo massiccio. Tuttavia, si tratta di uno scenario molto ottimistico per l'asset, poiché ci sono molte altre condizioni globali che influiscono sul suo costo in un periodo così lungo.

Qual è la previsione del prezzo dell'oro per il 2025?

Secondo le previsioni per il 2025 di XAU/USD, il costo dell'asset dovrebbe rimanere nell'intervallo tra 2.170 e 2.250 dollari. Le previsioni più ottimistiche sostengono che il tasso salirà a 3.500 dollari. Tuttavia, tutto dipende dall'andamento dei mercati finanziari.

L'oro perderà mai il suo valore?

Sì, anche l'oro non è immutabile ai cambiamenti economici. In futuro potrebbe perdere valore a causa dei cambiamenti nell'economia globale, delle posizioni in USD, dei cambiamenti nelle dinamiche di domanda e offerta e dei progressi tecnologici. Tuttavia, l'oro è un bene prezioso da secoli ed è considerato una scelta più sicura rispetto a molti altri beni.