GBP Forecast for 2026 and Beyond

Understanding the British pound's role is crucial as we delve into the GBP forecast for 2026 and beyond. Esteemed for its stability and deep ties to the UK economy, GBP distinguishes itself in the global financial market. Our insights will navigate the nuanced GBP to USD forecast, spotlighting exchange rates and economic indicators. This information will serve as a vital tool for leveraging your financial strategies, ensuring you're equipped to harness the potential of this asset.

Table of Contents

KEY TAKEAWAYS

GBP PRICE TODAY

GBP FORECAST SUMMARY

GBP PRICE PREDICTION FOR THE NEXT MONTH

GBP TECHNICAL ANALYSIS

GBP HISTORICAL PRICE MOVEMENTS

WHAT SHOULD YOU KNOW ABOUT THE BRITISH POUND (GBP)?

WHAT DRIVES GBP’S VALUE?

HOW TO PREDICT THE PRICE OF GBP

GBP PRICE PREDICTION FOR 2026

GBP PRICE PREDICTION FOR 2027

GBP PRICE PREDICTION FOR 2028

GBP FORECAST FOR 2029

GBP FORECAST FOR 2030

CONCLUSION

FAQ

KEY TAKEAWAYS

- Forecasts for 2026 and beyond vary, with potential peaks reaching up to 1.3508 USD, while some models expect only modest fluctuations in later years.

- Key factors influencing GBP value include central bank policies, interest rate decisions by the Bank of England, UK economic performance, and global economic trends.

- Technical analysis indicates a bullish near-term outlook for GBP, supported by positive signals from RSI, STOCH, and MACD.

- Long-term forecasts for 2026–2030 remain mixed: some analysts project stability and gradual growth, while others anticipate potential declines.

- The pound’s trajectory will depend on the pace of disinflation in the UK, monetary policy adjustments, global risk appetite, and foreign investment flows, which together will determine whether GBP sustains its recovery or faces renewed pressure.

GBP PRICE TODAY

Just2Trade (J2T) is an international brokerage company known for its analytical reports and currency forecasts. The interactive chart below combines data from J2T and other reputable open sources to provide a balanced view of the GBP/USD dynamics. We aggregate and visualize information from various analytical perspectives to present an objective picture of market expectations. This material is for informational purposes only and does not constitute investment or trading advice.

GBP FORECAST SUMMARY

| Year |

Mid-Year Price |

End-Year Price |

| 2026 | $1.2618 | $1.3821 |

| 2027 | $1.3915 | $1.3677 |

| 2028 | $1.2242 | $1.2212 |

| 2029 | $1.2844 | $1.2895 |

| 2030 | $1.2797 | $1.3053 |

GBP Price Prediction for the next month

Daily Forecast Table

| Date |

Min |

Max |

Rate |

% Change |

| 01/01 |

0.7319 |

0.7467 |

0.7393 |

-0.14% |

| 02/01 |

0.7319 |

0.7467 |

0.7393 |

-0.15% |

| 03/01 |

0.7318 |

0.7466 |

0.7392 |

-0.16% |

| 04/01 |

0.7317 |

0.7465 |

0.7391 |

-0.17% |

| 05/01 |

0.7317 |

0.7464 |

0.7391 |

-0.18% |

| 06/01 |

0.7316 |

0.7464 |

0.7390 |

-0.19% |

| 07/01 |

0.7315 |

0.7463 |

0.7389 |

-0.20% |

| 08/01 |

0.7315 |

0.7462 |

0.7388 |

-0.21% |

| 09/01 |

0.7314 |

0.7462 |

0.7388 |

-0.22% |

| 10/01 |

0.7313 |

0.7461 |

0.7387 |

-0.23% |

| 11/01 |

0.7313 |

0.7460 |

0.7386 |

-0.24% |

| 12/01 |

0.7312 |

0.7460 |

0.7386 |

-0.25% |

| 13/01 |

0.7311 |

0.7459 |

0.7385 |

-0.26% |

| 14/01 |

0.7311 |

0.7458 |

0.7384 |

-0.27% |

| 15/01 |

0.7310 |

0.7457 |

0.7384 |

-0.27% |

| 16/01 |

0.7309 |

0.7457 |

0.7383 |

-0.28% |

| 17/01 |

0.7308 |

0.7456 |

0.7382 |

-0.29% |

| 18/01 |

0.7308 |

0.7455 |

0.7382 |

-0.30% |

| 19/01 |

0.7307 |

0.7455 |

0.7381 |

-0.31% |

| 20/01 |

0.7306 |

0.7454 |

0.7380 |

-0.32% |

| 21/01 |

0.7306 |

0.7453 |

0.7380 |

-0.33% |

| 22/01 |

0.7305 |

0.7453 |

0.7379 |

-0.34% |

| 23/01 |

0.7304 |

0.7452 |

0.7378 |

-0.35% |

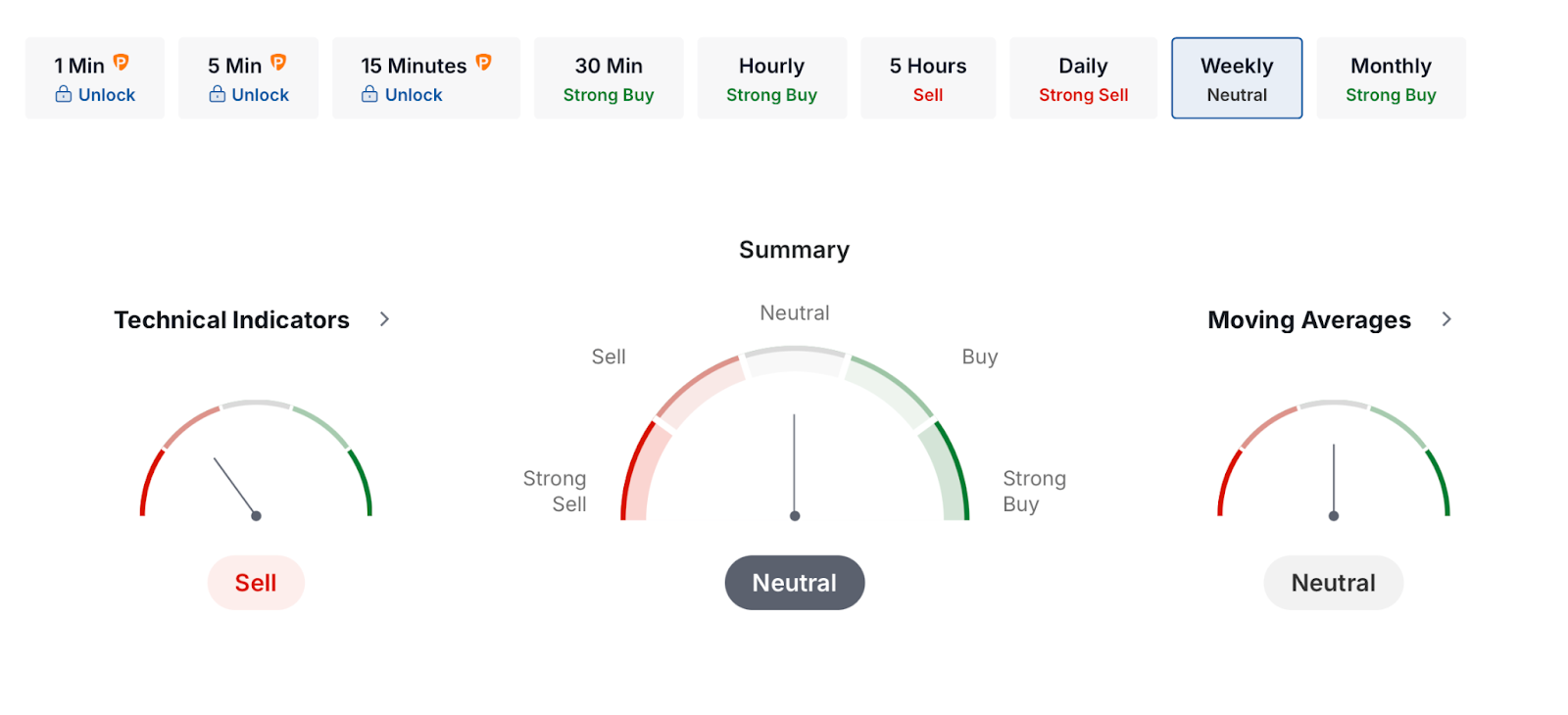

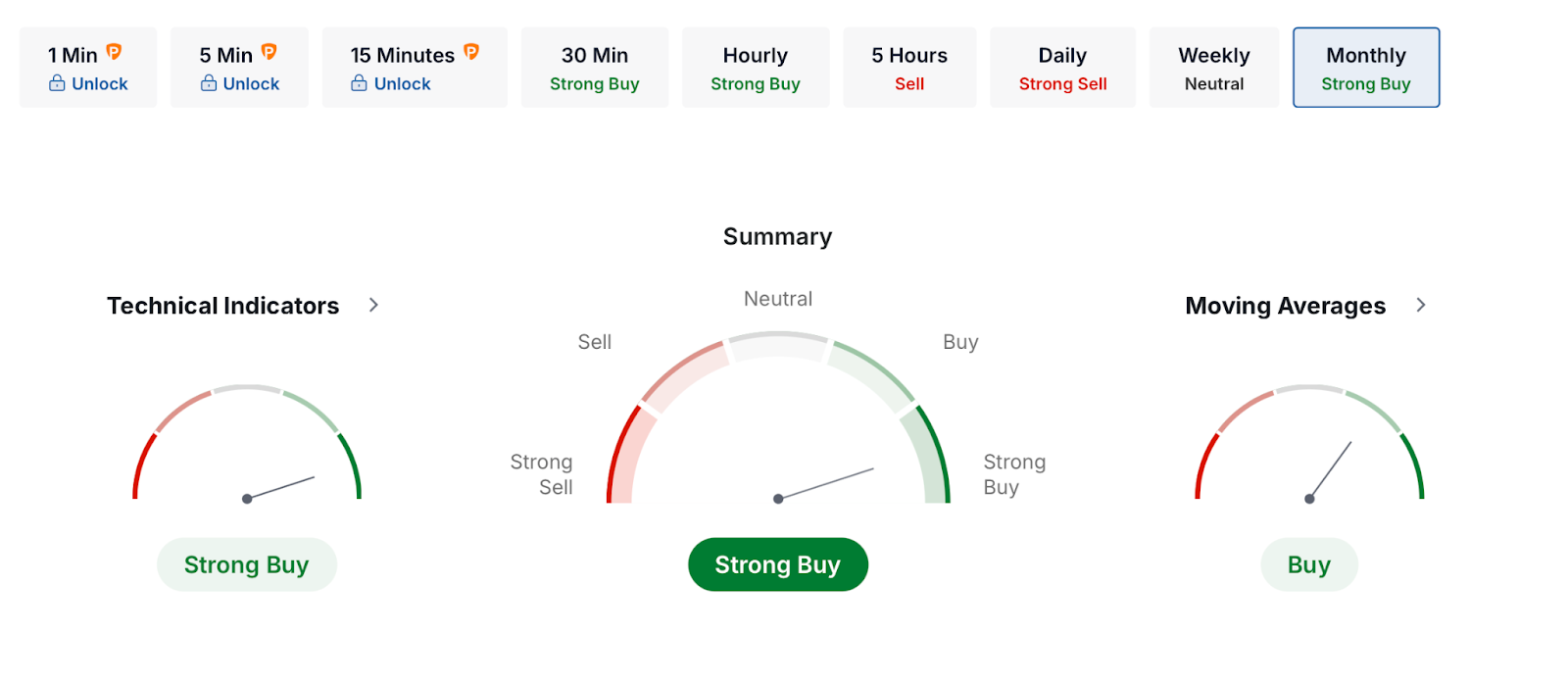

GBP TECHNICAL ANALYSIS

Technical analysis is an important tool that helps traders understand the potential moves of the forex market.

Over the past six months, GBP/USD has shown moderate upward momentum with periods of consolidation.

Long-term technical indicators — particularly on the monthly chart — continue to suggest a bullish outlook.

Moving Averages on higher timeframes support a Buy sentiment for the pair.

When having a closer look at some specific technical analysis tools, the picture is also bullish.

| Indicator |

Value |

Action |

| RSI (14) |

58.726 |

Buy |

| STOCH (9,6) |

59.426 |

Buy |

| STOCHRSI (14) |

100 |

Overbought |

| MACD (12,26) |

0.004 |

Buy |

| ADX (14) |

24.11 |

Neutral |

| Williams %R |

-4.915 |

Overbought |

| CCI (14) |

100.0685 |

Buy |

| ATR (14) |

0.0183 |

Less Volatility |

| Highs/Lows (14) |

0.0117 |

Buy |

| Ultimate Oscillator |

61.311 |

Buy |

| ROC |

0.312 |

Buy |

| Bull/Bear Power (13) |

0.0229 |

Buy |

GBP HISTORICAL PRICE

MOVEMENTS

The GBP's journey through recent years is a story marked by resilience and unexpected turns:

- 2018: Brexit negotiations set the stage, causing ripples in the GBP/USD rate.

- 2019: Brexit's uncertainty kept the pound on a roller coaster ride.

- 2020: The COVID-19 pandemic threw the GBP into unprecedented volatility.

- 2021: A glimmer of hope as signs of economic recovery and vaccine rollouts began to bolster the pound's strength.

- 2022: New challenges emerged with geopolitical tensions and inflation worries, steering the pound's course.

- 2024: A period of gradual recovery amid stabilizing inflation and a more cautious Bank of England policy.

Here's a table with the average GBP/USD historical price year by year:

| Year |

Average GBP to USD Forecast |

| 2018 | $1.334 |

| 2019 | $1.276 |

| 2020 | $1.284 |

| 2021 | $1.378 |

| 2022 | $1.357 |

| 2023 | $1.246 |

| 2024 | $1.314 |

| 2025 | $1.3407 |

The year 2024 proved to be a difficult period for the pound sterling, with GBP/USD declining 1.68% over the year. The currency pair faced significant pressure throughout the year, reflecting broader economic challenges and monetary policy divergences between the Bank of England and the Federal Reserve.

2024 Key Statistics:

- Average Rate: 1.2781 USD

- Highest Rate: 1.3413 USD (September 24)

- Lowest Rate: 1.2350 USD (April 22)

- Annual Performance: -1.68%

| Month |

Average Rate |

Notable Events |

Monthly Trend |

| January 2024 |

~1.275 |

New Year positioning |

Stable start |

| February 2024 |

~1.265 |

BoE policy expectations |

Slight decline |

| March 2024 |

~1.255 |

Economic data releases |

Continued pressure |

| April 2024 |

~1.245 |

Yearly low recorded |

Significant weakness |

| May 2024 |

~1.260 |

Partial recovery |

Modest rebound |

| June 2024 |

~1.275 |

Mid-year consolidation |

Stabilization |

| July 2024 |

~1.285 |

Summer trading |

Gradual improvement |

| August 2024 |

~1.295 |

Pre-autumn positioning |

Continued recovery |

| September 2024 |

~1.315 |

Yearly high reached |

Strong rally |

| October 2024 |

~1.300 |

Profit-taking |

Modest pullback |

| November 2024 |

~1.290 |

Autumn volatility |

Range-bound |

| December 2024 |

~1.280 |

Year-end positioning |

Mixed close |

The GBP analysis for 2025 was more challenging. It hinges on global economic trends and UK fiscal policies. Stability in the UK economy could lift the GBP, possibly surpassing current levels. However, global uncertainties may impact this outlook, making it essential to monitor key economic indicators for more precise predictions.

According to Longforecast, the GBP to USD for 2025 showed a notable uptrend. The pound rose to 1.493 by October, with fluctuations throughout the year. Early months like February see a rate of 1.2683, and while the USD exchange rate may dip slightly towards the end of the year, closing at 1.465 in December.

| Month |

Low – High |

Total (%) |

| January |

1.2168 – 1.2518 |

2.9% |

| February |

1.2292 – 1.2683 |

3.2% |

| March |

1.2573 – 1.3008 |

3.5% |

| April |

1.2736 – 1.3435 |

5.5% |

| May |

1.3174 – 1.3568 |

3.0% |

| June |

1.342 – 1.3733 |

2.3% |

| July |

1.3206 – 1.3743 |

4.1% |

| August |

1.3276 – 1.3579 |

2.3% |

| September |

1.407 – 1.449 |

6.7% |

| October |

1.428 – 1.493 |

9.9% |

| November |

1.443 – 1.487 |

9.5% |

| December |

1.400 – 1.465 |

6.2% |

Coincodex offered a slightly different view on the pound for 2025. According to their analysis, the GBP to USD rate fluctuated between a low of $1.289 and a high of $1.494 throughout the year. This reflects the volatility in the financial markets, with potential swings offering both risks and opportunities for traders.

WalletInvestor was more reserved about their GBP to USD analysis. They expected this currency pair to fluctuate during 2025 without any significant highs and lows, keeping the range of 1.289 - 1.330.

WHAT SHOULD YOU KNOW ABOUT THE BRITISH POUND (GBP)?

The British pound (GBP), or pound sterling, is a cornerstone of the forex market. When paired with the dollar, this currency reflects a dynamic interplay influenced by global events, economic indicators, and central bank policies, notably those of the Federal Reserve. Understanding GBP requires a close eye on some factors:

- Tracking US dollar predictions is important, as shifts in USD valuations directly impact dollar to pound forecasts.

- Interest rates, set by central banks, are pivotal in this dance, steering investment flows and currency strength.

- Investment banks, with their in-depth analyses and forecasts, often shed light on potential GBP movements.

WHAT DRIVES GBP’S VALUE?

There are multiple factors that make the GBP price go up or down. Here are the most important ones:

- Central Bank policies, for example, interest rate decisions by the Bank of England. UK economic performance displayed by such indicators as GDP, employment rates, and inflation rates. Global economy dynamics.

- Exchange rate fluctuations in other major currencies, including the Japanese yen, Euro, and US dollar. Geopolitical events (e.g., Brexit and other political developments worldwide).

HOW TO PREDICT THE PRICE OF GBP

Forecasting the GBP's movements against the USD is challenging, given the volatility of market swings and the ever-changing political and economic landscape. While diving into trend analysis and keeping an eye on the central bank's moves offers some clarity, the unpredictable twists and turns make these forecasts more of a roadmap than a guaranteed plan. Staying informed and adaptable is key to navigating pound/dollar predictions.

GBP PRICE PREDICTION FOR 2026

By 2026, the British pound may see varied trends against the dollar. WalletInvestor has a bearish outlook for this forex pair, with a price ranging from 1.330 to 1.364. A month-by-month GBP forecast is in the table below.

| Period |

Minimum Rate |

Maximum Rate |

| January 2026 | 1.330 | 1.338 |

| February 2026 | 1.338 | 1.342 |

| March 2026 | 1.335 | 1.339 |

| April 2026 | 1.340 | 1.357 |

| May 2026 | 1.351 | 1.357 |

| June 2026 | 1.357 | 1.364 |

| July 2026 | 1.358 | 1.369 |

| August 2026 | 1.356 | 1.368 |

| September 2026 | 1.354 | 1.361 |

| October 2026 | 1.348 | 1.354 |

| November 2026 | 1.346 | 1.350 |

| December 2026 | 1.344 | 1.353 |

Longforecast expects a positive GBP to USD forecast in 2026.

| Month |

Low – High |

Total (%) |

| January 2026 | 1.299 – 1.348 | -1.2% |

| February 2026 | 1.269 – 1.328 | -4.2% |

| March 2026 | 1.288 – 1.334 | -2.2% |

| April 2026 | 1.307 – 1.347 | -1.3% |

| May 2026 | 1.327 – 1.388 | +1.7% |

| June 2026 | 1.367 – 1.425 | +4.5% |

| July 2026 | 1.404 – 1.446 | +6.0% |

| August 2026 | 1.390 – 1.432 | +5.0% |

| September 2026 | 1.365 – 1.411 | +3.1% |

| October 2026 | 1.347 – 1.389 | +1.8% |

| November 2026 | 1.307 – 1.368 | -1.3% |

| December 2026 | 1.327 – 1.372 | +0.6% |

Coincodex predictions for the GBP exchange rate are quite reserved yet positive. The year-low price is expected to be $1.348184, while the year-high is going to reach $1.468602.

GBP PRICE PREDICTION FOR 2027

For 2027, GBP forecast remains varied, reflecting uncertainty about its future trajectory. WalletInvestor predicts a generally stable yet slightly positive trend, with GBP/USD starting around 1.257 in January and gradually increasing to approximately 1.561 by December 2027.

CoinCodex, however, expects more volatility for the pound sterling to dollar forecast, with the yearly low hitting $1.052 and the high reaching $1.288.

LongForecast anticipates fluctuations throughout the year, with GBP to USD forecast reaching as high as 1.470 in October but tapering off to 1.442 by December, showing a gradual decline from the year's peak.

| Month |

High – Low |

Total (%) |

| January 2027 | 1.352 – 1.402 | +2.8% |

| February 2027 | 1.381 – 1.424 | +4.4% |

| March 2027 | 1.373 – 1.415 | +3.7% |

| April 2027 | 1.394 – 1.443 | +5.8% |

| May 2027 | 1.385 – 1.427 | +4.6% |

| June 2027 | 1.386 – 1.428 | +4.7% |

| July 2027 | 1.379 – 1.421 | +4.2% |

| August 2027 | 1.374 – 1.416 | +3.8% |

| September 2027 | 1.385 – 1.427 | +4.6% |

| October 2027 | 1.406 – 1.470 | +7.7% |

| November 2027 | 1.420 – 1.464 | +7.3% |

| December 2027 | 1.378 – 1.442 | +4.1% |

GBP PRICE PREDICTION FOR 2028

The GBP to USD forecast for 2028 shows a mixed bag of fluctuations. According ro Walletinvestor, early gains in January and April, with the pound forecast rising by 0.37% and 1%, are followed by several dips throughout the year. As this is a long-term forecast, investors should be cautious of the potential risks involved.

| Period |

Minimum Rate |

Maximum Rate |

| January 2028 | 1.356 | 1.364 |

| February 2028 | 1.363 | 1.368 |

| March 2028 | 1.361 | 1.366 |

| April 2028 | 1.366 | 1.383 |

| May 2028 | 1.377 | 1.383 |

| June 2028 | 1.384 | 1.390 |

| July 2028 | 1.384 | 1.394 |

| August 2028 | 1.382 | 1.395 |

| September 2028 | 1.380 | 1.387 |

| October 2028 | 1.374 | 1.379 |

| November 2028 | 1.371 | 1.377 |

| December 2028 | 1.369 | 1.379 |

CoinCodex predicts a range from a minimum of $1.055414 to a maximum of $1.191591. Long Forecast, however, expects the GBP forecast price to hover in the range of 1.241 - 1.408 in 2028.

GBP FORECAST FOR 2029

| Period |

Minimum Rate |

Maximum Rate |

| January 2029 | 1.369 | 1.378 |

| February 2029 | 1.377 | 1.381 |

| March 2029 | 1.374 | 1.378 |

| April 2029 | 1.379 | 1.396 |

| May 2029 | 1.390 | 1.396 |

| June 2029 | 1.396 | 1.403 |

| July 2029 | 1.396 | 1.407 |

| August 2029 | 1.395 | 1.408 |

| September 2029 | 1.393 | 1.399 |

| October 2029 | 1.387 | 1.392 |

| November 2029 | 1.385 | 1.390 |

| December 2029 | 1.382 | 1.392 |

LongForecast provides the most detailed monthly data for early 2029, starting with the pound at 1.365 in January and projecting a high of 1.408 before declining to 1.387 by month-end. February shows continued pressure with lows reaching 1.338, while March-June periods indicate range-bound trading between 1.294-1.371.

LiteFinance analysts predict a downtrend for the GBPUSD pair in 2029, expecting the pair to fall from $1.200 to $1.191 by April as the US dollar strengthens against the British pound. This suggests significant risk for sterling as economic headwinds persist.

WalletInvestor and CoinCodex offer conflicting views - with WalletInvestor expecting narrow sideways trading and low volatility, while CoinCodex suggests potential recovery in the second half of 2029, with the pair possibly reaching 1.336942.

Technical analysts note that the exchange rate will likely face key resistance levels around 1.37, with support expected in the region defined by 1.26-1.28. Investors should monitor weekly closes and stay nimble in their approach, as rate cuts from the central bank could influence short term movements.

GBP FORECAST FOR 2030

Summary of available 2030 data

| Source |

2030 Prediction |

Methodology |

| TradersUnion |

$1.1492 (December) |

Technical analysis |

| CoinCodex |

$1.2551 (high), $1.1829 (average) |

Algorithmic models |

| CoinCodex Alternative |

$1.2702 (5-year outlook) |

Extended projection |

| Gov.Capital |

~$1.57 (inverse calculation) |

Deep learning algorithm |

The GBP USD forecast for 2030 represents the most challenging period for pound sterling predictions, as the exchange rate projections extend far beyond typical technical analysis horizons. Current markets face significant risk when attempting to forecast the British pound performance against the US dollar over such extended timeframes.

TradersUnion analysts expect a substantial decline in GBP/USD quotes during 2030, with the pound likely to weaken and fall to $1.1492 against the dollar by December. This bearish outlook suggests persistent pressure on sterling throughout the year, potentially marking a yearly low that could challenge any larger recovery narrative.

CoinCodex expects the currency pair to surge to $1.15 with an average price of $1.07. This forecast indicates battle lines drawn between opposing analysts expectations, creating uncertainty for traders and investors seeking clear directional guidance.

| Month |

Min. Price |

Max. Price |

| Jan 2030 | $ 1.07 | $ 1.13 |

| Feb 2030 | $ 1.09 | $ 1.14 |

| Mar 2030 | $ 1.11 | $ 1.14 |

| Apr 2030 | $ 1.10 | $ 1.13 |

| May 2030 | $ 1.08 | $ 1.13 |

| Jun 2030 | $ 1.07 | $ 1.09 |

| Jul 2030 | $ 1.04 | $ 1.08 |

| Aug 2030 | $ 1.03 | $ 1.05 |

| Sep 2030 | $ 1.03 | $ 1.07 |

| Oct 2030 | $ 1.04 | $ 1.11 |

| Nov 2030 | $ 1.09 | $ 1.11 |

| Dec 2030 | $ 1.10 | $ 1.15 |

CONCLUSION

The British pound is a big deal in currency trading. What happens to it depends on a lot of things. These include changes in the global economy and UK budget plans. The USD to GBP forecast over the next few years is mixed. Some experts think it will gain value. Others are more careful in their forecasts.

If you're thinking about adding pounds to your investments, do your homework first. Look at charts and set clear rules on risk. That way you're not just following dollar to pound predictions without thinking. You'll make better choices since the world economy can be unpredictable.

FAQ

Will GBP go up or down?

Forecasts for 2026 remain mixed but generally stable. Forecusts projects highs near 1.369 USD. The pound’s path will largely depend on Bank of England monetary policy, UK inflation dynamics, and global economic conditions.

Will the Pound Get Stronger in 2026?

Several forecasts suggest that GBP could experience moderate appreciation in 2026, supported by improving economic fundamentals. Technical indicators such as RSI, STOCH, and MACD currently signal a bullish short-term outlook, though short-term volatility and potential pullbacks remain likely.

What's Today's Pound to Dollar Rate?

Rates fluctuate continuously. For 2025, projections indicate movements between the upper 1.35s with potential peaks approaching 1.36 USD. For real-time accuracy, always refer to live market data from verified financial sources.

Should I buy GBP now?

The medium-term outlook is cautiously positive, making GBP potentially appealing for investors with a balanced risk approach. However, due to market volatility and shifting global sentiment, maintaining a diversified portfolio and clear risk management strategy remains essential.

Will GBP recover in the future?

Most forecasts anticipate a gradual recovery through 2026, supported by cooling inflation, a steadier Bank of England policy stance, and improving investor sentiment. Beyond 2026, predictions diverge — some models point to stable growth, while others suggest limited downside risk amid global uncertainties.

When was the GBP the strongest?

The pound’s all-time high was reached on March 6, 1972, at $2.649 against the US dollar.