PKO Bank Polski (PKO BP) Stock Forecast 2026

In recent times, Bank Polski SA (PKO Bank Polski) has attracted significant attention from the global trading community, emerging as a central point of interest. As Poland's premier banking institution, its stock performance serves as an indicator of the broader financial sector's health.

In this comprehensive analysis, we'll delve deep into the PKO BP (Bank Polski SA) stock overview, dive deeper into its technical patterns, and trace its price history. Additionally, we will shed light on the PKO BP forecast, offering both short- and long-term perspectives for potential investors.

Table of Contents

PKO STOCK: BASIC INFO FORECAST SUMMARY

POWSZECHNA KASA OSZCZĘDNOŚCI BANK POLSKI SA (PSZKF) MARKET OVERVIEW

TECHNICAL ANALYSIS

PKO BP PRICE HISTORY

WHAT FACTORS INFLUENCE THE PKO BP STOCK PRICE?

HOW TO PREDICT THE PKO BP STOCK PRICE

POWSZECHNA KASA OSZCZĘDNOŚCI BANK POLSKI SA STOCK PRICE FORECAST FOR 2025

POWSZECHNA KASA OSZCZĘDNOŚCI BANK POLSKI SA STOCK PRICE FORECAST FOR 2026

POWSZECHNA KASA OSZCZĘDNOŚCI BANK POLSKI SA STOCK PRICE FORECAST FOR 2027

POWSZECHNA KASA OSZCZĘDNOŚCI BANK POLSKI SA STOCK PRICE FORECAST FOR 2028

PKO BANK POLSKI STOCK PRICE FORECAST FOR 2029

SUMMARY: IS PKO BP STOCK A GOOD INVESTMENT?

FAQ

PKO STOCK: BASIC INFO FORECAST SUMMARY

PKO Bank Polski SA, one of Poland's largest financial institutions, holds a critical position in the Polish economy and financial markets. Its stock performance provides essential insights into market dynamics, making it a key focus for investors seeking opportunities in Eastern Europe.

Recent Trends

PKO Bank Polski shares have maintained a stable, moderately upward trend amid a stabilizing economy and inflation returning toward the NBP’s target range. The stock is supported by strong interest income, solid profit margins, and rising demand for retail and mortgage services.

Investors view positively the bank’s strategy focused on digitalization, fintech expansion, and consistent dividend payouts. Despite persistent geopolitical and macroeconomic risks, PKO BP shares remain among the most stable in the Polish banking sector, reflecting market confidence and sustained financial performance.

Analysts’ Forecasts

The market and technical outlook for PKO Bank Polski SA remains moderately positive. Moving averages indicate a dominance of buyers, while most oscillators point to short-term consolidation following strong gains in mid-2026. Combined with growing net interest margins, stabilized inflation, and continued high demand for mortgage loans, the market expects a gradual increase in the stock’s value in the medium and long term.

According to PKO BP’s financial reports, the bank maintains a high return on equity (ROE) and benefits from the recovery of the domestic economy. Its stable dividend policy, ongoing digitalization of services, and expansion in the fintech segment strengthen investor confidence among both institutional and retail participants.

| Year |

Projected Price Range (PLN) |

Key Factors |

| 2026 |

76 – 80 |

Expansion in fintech services, stable dividend policy, and growing demand for mortgage loans. |

| Horizon to End of 2029 |

122 – 137 |

Sustained economic growth, digitalization of banking services, and higher return on equity. |

| Forecast for 2030 (WalletInvestor) |

142 – 146 |

Long-term bullish outlook based on algorithmic models; expected increase in PKO’s value along with the development of Poland’s financial market. |

Key Factors Influencing PKO Stock Forecasts

- Economic Context: Inflation stabilizing within the NBP’s target range (2–3%) and a predictable monetary policy support the valuation of financial institutions.

- Digital Transformation: PKO BP’s continued investments in digital service channels, fintech solutions, and AI development in retail banking fuel long-term growth.

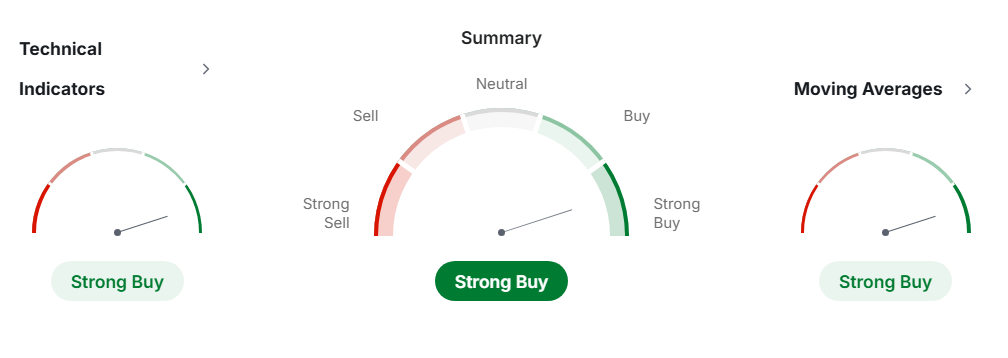

- Technical Analysis: The prevalence of “Buy” signals across moving averages, coupled with neutral oscillators, suggests a scenario of steady, systematic growth with occasional short-term corrections.

POWSZECHNA KASA OSZCZEDNOSCI BANK POLSKI SA (PSZKF) MARKET OVERVIEW

Analysts have observed a fluctuating trend in PKO BP stock, with some pointing to potential growth avenues. While predictions vary, there's a consensus that traders should keep a keen eye on the stock's movement and strategize accordingly.

As always, it's essential for investors to do their due diligence before making any investment plans or subscribing to any investment advice.

TECHNICAL ANALYSIS

The technical analysis for PKO Bank Polski (WSE: PKO) indicates a stable long-term upward trend, accompanied by mostly neutral signals across short-term indicators.

Moving averages and oscillators are currently showing strong purchasing signals: RSI (70.496), STOCH (66.564), STOCHRSI (55.645), CCI (135.9696), MACD (8.79), ADX (42.337), High/Lows (8.2329), Ultimate Oscillator (60.428) and Bull Bear Power (15.498), while Williams %R with the score nelow zero line shows overbought signal.

|

Value |

Action |

| RSI(14) |

70.496 |

Buy |

| STOCH(9,6) |

66.564 |

Buy |

| STOCHRSI(14) |

55.645 |

Buy |

| MACD(12,26) |

8.79 |

Buy |

| ADX(14) |

42.337 |

Buy |

| Williams %R |

-5.917 |

Overbought |

| CCI(14) |

135.9696 |

Buy |

| ATR(14) |

10.1386 |

High Volatility |

| Highs/Lows(14) |

8.2329 |

Buy |

| Ultimate Oscillator |

60.428 |

Buy |

| ROC |

51.326 |

Buy |

| Bull/Bear Power(13) |

15.498 |

Buy |

The majority of Moving Average indicators continue to issue a Buy signal, confirming the persistence of trend strength in the medium and long term. EMA (10) = PLN 74.64, SMA (10) = PLN 75.95, EMA (20) = PLN 67.79, SMA (50) = PLN 50.00, EMA (200) = PLN 41.76, and SMA (200) = PLN 38.91.

According to classic Pivot Points, key support levels are at S1 = PLN 84 and S2 = PLN 83.78, while resistance levels are at R1 = PLN 84.5, R2 = PLN 84.78, and R3 = PLN 85.

|

S3 |

S2 |

S1 |

Pivot Points |

R1 |

R2 |

R3 |

| Classic |

68.06 |

70.47 |

73.94 |

76.35 |

79.82 |

82.23 |

85.7 |

| Fibonacci |

70.47 |

72.72 |

74.1 |

76.35 |

78.6 |

79.98 |

82.23 |

| Camarilla |

75.78 |

76.32 |

76.86 |

76.35 |

77.94 |

78.48 |

79.02 |

| Woodie's |

68.58 |

70.73 |

74.46 |

76.61 |

80.34 |

82.49 |

86.22 |

| DeMark's |

– |

– |

75.14 |

76.95 |

81.02 |

– |

– |

Currently, PKO BP shares trade around PLN 84.44, confirming the sustained strength of the recent upward trend and price stability above major moving averages.

The fundamentals of PKO remain strong, supported by solid financial performance — a net margin of 34.03%, debt-to-equity ratio of 60.5%, and an attractive dividend yield of 7.73%, all of which reinforce investor confidence.

PKO BP PRICE HISTORY

| Month |

Minimum Price (PLN) |

Maximum Price (PLN) |

| 2024 |

| January 2024 | 49.80 | 51.00 |

| February 2024 | 54.42 | 56.10 |

| March 2024 | 58.30 | 59.66 |

| April 2024 | 60.42 | 61.90 |

| May 2024 | 57.34 | 58.20 |

| June 2024 | 62.38 | 63.44 |

| July 2024 | 58.58 | 59.54 |

| August 2024 | 57.14 | 58.06 |

| September 2024 | 55.98 | 58.18 |

| October 2024 | 55.20 | 56.28 |

| November 2024 | 55.24 | 56.06 |

| December 2024 | 59.36 | 60.10 |

| 2025 |

| January 2025 | 59.42 | 70.28 |

| February 2025 | 63.30 | 79.66 |

| March 2025 | 65.84 | 81.08 |

| April 2025 | 48.50 | 65.20 |

| May 2025 | 63.40 | 70.80 |

| June 2025 | 69.20 | 76.50 |

| July 2025 | 75.20 | 83.54 |

| August 2025 | 75.36 | 81.16 |

| September 2025 | 67.92 | 74.06 |

| October 2025 | 71.872 | 77.995 |

| November 2025 | 76.555 | 77.523 |

| December 2025 | 77.583 | 79.628 |

Key Observations:

- Highest price: PLN 83.54 in July 2025 — the peak of the yearly upward trend, confirming strong demand for PKO BP shares.

- Lowest price: PLN 48.50 in April 2025 — a brief correction following dynamic gains earlier in the year.

- First half of 2025: recovery after the April decline; in June, the price reached PLN 76.50 amid dominant “Buy” signals from moving averages.

- Second half of 2025: consolidation within the PLN 67–83 range, with neutral RSI and Stochastic indicators, pointing to a stable trend.

- Overall trend: sustained growth supported by solid fundamentals and investor confidence.

WHAT FACTORS INFLUENCE THE PKO BP STOCK PRICE?

- Internal factors include the bank's financial health, management decisions, and quarterly earnings reports.

- External factors include broader economic indicators, regulatory changes, the overall health of the Polish economy, global events (especially those impacting the European banking sector), and more.

HOW TO PREDICT THE PKO BP STOCK PRICE

The art of forecasting PKO shares is a blend of quantitative analysis and market intuition. Analyzing historical information and combining it with current fundamental and technical indexes can provide insights into potential trends. However, it's essential to remember that, while patterns often repeat, markets remain unpredictable. Thus, even the most robust models carry significant risks.

POWSZECHNA KASA OSZCZEDNOSCI BANK POLSKI SA STOCK PRICE FORECAST FOR 2026

The Bank Polski SA stock price forecast for 2026 suggests steady growth fueled by strong earnings, robust financial by-products, and strategic investments. Below is a detailed monthly stock forecast for PKO stock, with projected minimum and maximum prices.

| Month |

Minimum Price (PLN) |

Maximum Price (PLN) |

| 2026 |

| January 2026 | 79.711 | 81.059 |

| February 2026 | 81.215 | 82.304 |

| March 2026 | 81.741 | 82.948 |

| April 2026 | 83.027 | 83.811 |

| May 2026 | 83.780 | 84.457 |

| June 2026 | 84.568 | 85.246 |

| July 2026 | 85.329 | 86.846 |

| August 2026 | 86.692 | 87.275 |

| September 2026 | 87.311 | 88.144 |

| October 2026 | 88.224 | 90.779 |

| November 2026 | 90.916 | 91.961 |

| December 2026 | 92.076 | 94.070 |

POWSZECHNA KASA OSZCZEDNOSCI BANK POLSKI SA STOCK PRICE FORECAST FOR 2027

The Bank Polski SA stock price forecast for 2027 predicts steady growth based on historical data, strong financial by-products, and strategic investments in digital banking and corporate services. Below are the projected minimum and maximum prices for each month.

| Month |

Minimum Price (PLN) |

Maximum Price (PLN) |

| 2027 |

| January 2027 | 94.094 | 95.408 |

| February 2027 | 95.552 | 96.739 |

| March 2027 | 96.180 | 97.420 |

| April 2027 | 97.463 | 98.212 |

| May 2027 | 98.196 | 98.926 |

| June 2027 | 99.057 | 99.718 |

| July 2027 | 99.777 | 101.291 |

| August 2027 | 101.125 | 101.732 |

| September 2027 | 101.740 | 102.589 |

| October 2027 | 102.607 | 105.116 |

| November 2027 | 105.269 | 106.455 |

| December 2027 | 106.546 | 108.452 |

Risk and Opportunity Context

Risks: Economic downturns, regulatory challenges, and higher operational costs could pose risks to the PKO price.

Opportunities: PKO's investments in digital transformation and growing aid levels signal a strong future in investing and trade.

POWSZECHNA KASA OSZCZEDNOSCI BANK POLSKI SA STOCK PRICE FORECAST FOR 2028

The Bank Polski SA stock price forecast for 2028 indicates consistent growth, supported by strong earnings, innovative strategies, and an expanding customer base. Below is a detailed breakdown of monthly predictions for pko stock, showing minimum and maximum prices.

| Month |

Minimum Price (PLN) |

Maximum Price (PLN) |

| 2028 |

| January 2028 | 108.559 | 109.894 |

| February 2028 | 110.038 | 111.162 |

| March 2028 | 110.630 | 111.869 |

| April 2028 | 111.875 | 112.610 |

| May 2028 | 112.607 | 113.523 |

| June 2028 | 113.607 | 114.168 |

| July 2028 | 114.237 | 115.731 |

| August 2028 | 115.559 | 116.244 |

| September 2028 | 116.168 | 116.972 |

| October 2028 | 117.075 | 119.757 |

| November 2028 | 119.870 | 120.992 |

| December 2028 | 121.001 | 122.808 |

Risk and Opportunity Context

Risks: External factors like global economic instability or higher regulatory costs may impact PKO price trends.

Opportunities: Expansion in fintech services and enhanced support levels offer long-term growth potential for investors.

PKO BANK POLSKI STOCK PRICE FORECAST FOR 2029

The Bank Polski sa stock forecast for 2029 indicates consistent growth in PKO stock, supported by the bank's expanding customer base, robust earnings, and a strong presence in the Polish financial market. Reviewers predict that Bank Polski SA will continue to outperform in the financial sector, making it a reliable choice for long-term investing.

| Month |

Minimum Price (PLN) |

Maximum Price (PLN) |

| 2029 |

| January 2029 | 122.922 | 124.500 |

| February 2029 | 124.600 | 125.584 |

| March 2029 | 125.091 | 126.257 |

| April 2029 | 126.281 | 127.013 |

| May 2029 | 127.106 | 127.966 |

| June 2029 | 127.989 | 128.570 |

| July 2029 | 128.605 | 130.165 |

| August 2029 | 129.999 | 130.664 |

| September 2029 | 130.595 | 131.342 |

| October 2029 | 131.435 | 134.220 |

| November 2029 | 134.312 | 135.378 |

| December 2029 | 135.449 | 137.282 |

SUMMARY: IS PKO BP STOCK A GOOD INVESTMENT?

PKO BP, Poland's largest bank, shows consistent growth with strong earnings, innovative financial by-products, and solid support. Its leadership in Polish stock exchanges and reliable profit margins make it an attractive choice for investing. Despite potential risks, its strategic investments and robust fundamentals suggest long-term value. Always verify with detailed information before accepting investment advice.

FAQ

-

What is the Powszechna Kasa Oszczednosci Bank Polski stock price today?

As of January 2026, the share price of Powszechna Kasa Oszczędności Bank Polski SA (PKO BP) stands at approximately PLN 84.44 per share. The stock remains near its local highs, with the trend staying stable and supported by the bank’s strong financial results.

-

Will the PKO BP stock price drop?

A significant decline in the near term is not expected. Forecasts for 2026–2029 indicate a steady increase in share value — from around PLN 79 at the beginning of 2026 to over PLN 135 by December 2029. Short-term corrections may occur, but the overall market trend remains upward.

-

Will the PKO BP stock price grow?

According to forecasts, PKO BP shares are expected to continue rising, supported by growing profits, investments in digitalization, and a strong financial position. The projected price range is PLN 79–94 in 2026, PLN 94–108 in 2027, PLN 108–122 in 2028, and PLN 122–137 in 2029. The uptrend is also confirmed by technical indicators — most moving averages continue to show a “Buy” signal across all major intervals.

-

Will the PKO BP stock price crash?

A crash in PKO BP’s stock price is highly unlikely. The bank maintains strong fundamentals, high equity levels, and stable profitability. Potential risks — such as a global economic slowdown or geopolitical tensions — may cause temporary volatility, but there is no indication of a lasting decline in the stock’s value.

-

Will the Powszechna Kasa Oszczednosci Bank Polski stock price hit 15 USD in a year?

At the current price of about PLN 84.44 and an exchange rate of 1 PLN ≈ 0.28 USD, the share is valued at roughly USD 23.64. This means the 15 USD level was already surpassed earlier. Further growth to around USD 24–25 is expected in the coming months.

-

Will the Powszechna Kasa Oszczednosci Bank Polski stock price hit 20 USD in a year?

The current value is already close to USD 23.64, suggesting that the 20 USD marking that this lin is already crossed. Projections for 2026 show a range of PLN 80–90 (USD 24-25), confirming the continuation of the upward trend.

-

Will the Powszechna Kasa Oszczednosci Bank Polski stock price hit 50 USD in a year?

Even at a favorable exchange rate of 1 PLN ≈ 0.28 USD, a price of USD 50 would correspond to around PLN 185. According to forecasts, the maximum share price by the end of 2029 will be around PLN 137 (≈ USD 37), making it highly unlikely for the stock to reach USD 50 within a year.