CAD/USD Forecast

Alongside American and Australian dollars, the Canadian dollar is one of the top choices for trading on forex or investing. USD/CAD is among major traders’ instruments, so it’s no wonder the pair is prone to volatility. Are you planning to capitalize on it through investments or by means of short-term deals? Then it’s critical to keep tabs on its exchange rates. This article provides CAD/US dollar forecasts for short, mid, and long terms. Plus, you will find out which factors shape the cost of CAD.

Table of Contents

Peculiarities of the CAD/USD Currency Pair

USD/CAD Tech Analysis for Q1 2026

USD/CAD Tech Analysis

USD/CAD Price History and Performance

Factors Shaping the CAD Price

CAD to USD Forecast Summary

CAD to USD Technical Analysis

Long-term USD/CAD price forecast for 2026–2030

USD/CAD price forecast for 2026

USD/CAD price prediction for 2027

USD/CAD price forecast for 2028

USD/CAD price forecast for 2029

USD/CAD price forecast for 2030

Conclusion: Is CAD a Good Investment?

FAQ

Peculiarities of the CAD/USD Currency Pair

The US dollar to Canadian dollar ratio is displayed as CAD/USD. This quotation means how many Canadian dollars it takes to buy one US dollar. When the exchange ratio gets higher, it indicates a strengthening of USD relative to CAD. Vice versa, a decline in the rate suggests that CAD has gained value relative to USD.

USD/CAD’s Trading Peculiarities

During the working week (Mon-Fri), the currency pair is traded nonstop, with substantial turnover volumes and peak instability observed while American traders are active. News released in Canada and the US plays a critical role in shaping the pair's currency rate. The CAD price is prone to moderate instability, but when the market is unstable, rate swings may reach 2k–3k pips per day.

Due to its wide usage and great liquidity, USD/CAD is among the most popular trading assets, which explains why the spread is minimal. A regular ECN account often has a spread between 10 and 15 pips in a normal market setting.

USD/CAD Tech Analysis for Q1 2026

In Q1 2026, the USD/CAD pair exhibited instability, influenced by economic indicators and geopolitical events. The current price hovered around 0.7313, reflecting a 0.08% rise.

The Canadian dollar faced stress due to stronger-than-expected U.S. manufacturing data, which bolstered the us dollar. Additionally, concerns over U.S. trade tariffs and Canada's manufacturing contraction contributed to the loonie's weakness.

Despite these challenges, the Canadian dollar forecast remains cautiously optimistic. Analysts suggest that the CAD to USD forecast could see the pair trading around 0.78-0.80 in Q1 2026, indicating a potential appreciation of the CAD.

Variables such as oil prices, which are a significant export for Canada, and anticipated adjustments in interest rates by the Bank play crucial roles in shaping the exchange rate dynamics. Moreover, the outcome of Canada's general elections and subsequent trade policies could influence the USD exchange rate.

Investors and traders should monitor these changes closely, as shifts in exchange rates, oil costs, and credit rates can impact investment decisions and the broader economy. Staying informed through reliable news sources and conducting thorough analysis will be essential for navigating the markets in the upcoming quarter.

CAD/USD Tech Analysis

The CAD/USD pair in Q1 2026 continued to exhibit significant volatility amid evolving monetary policy divergence between the US Federal Reserve and Bank of Canada. The pair maintained its long-term uptrend structure that began in May 2021, though recent bearish corrections have challenged this dominant pattern.

During Q1 2026, the Canadian dollar will show resilience despite facing pressures from differing central bank policies. The Bank of Canada maintained its cautious approach with rates at 2.75%, signaling a pause in further cuts while monitoring inflation dynamics closely. In contrast, the Federal Reserve held its position at 4.5%, demonstrating a more hawkish stance that continued to support USD strength.

Technical analysis reveals that CAD/USD has been trading around key levels, with the pair hovering near 0.7312 as market participants assess the sustainability of the long-term uptrend. Fibonacci retracement level. This resistance zone represents a critical juncture where bullish momentum could potentially resurface if buyers regain control.

Key technical indicators will show mixed signals during Q1 2026. The RSI oscillated under the 70 level, confirming bull bias in recent sessions, though signs of recovery from oversold conditions near 30 suggested potential for renewed buying interest. The MACD histogram remained positive around 0.004 line, reflecting buy trend.

Trade tensions continue to influence the pair's dynamics, with ongoing 25% tariffs affecting various products under the USMCA agreement. Despite temporary diplomatic tensions, including the brief suspension of trade negotiations in late June, both currencies showed resilience as markets focused more on monetary policy divergence than trade uncertainties.

Oil prices remained a crucial factor, with Canada's commodity-linked currency sensitive to energy market fluctuations. The pair's correlation with crude oil prices continued to play a significant role in short-term movements, while longer-term trends were driven by interest rate differentials and economic growth prospects.

Looking forward, the CAD/USD pair's direction will largely depend on whether sellers can break decisively below the 100-period moving average around 0.7312. A failure to do so could signal the beginning of an extended neutral phase, similar to the consolidation pattern observed in 2023.

USD/CAD Price History and Performance

In 2024, the USD/CAD exchange rate experienced notable fluctuations. The Canadian dollar began the year at 1.3245 per us dollar on January 1 and reached a peak of 1.4467 on December 19, marking an 8.66% depreciation over the period. The average exchange rate stood at 1.3702, reflecting the currency's volatility amid global market dynamics.

Key variables influencing the Canadian dollar included shifts in oil costs, which impact Canada's exports, and changes in interest rates set by the Bank of Canada. Trade tensions and tariffs also exerted pressure on the Canadian dollar, affecting its value against the USD.

Analysts' forecasts for the CAD to USD forecast suggest potential stabilization, contingent on business developments and services sector performance. The Canadian dollar forecast remains sensitive to imports and exports dynamics, with stakeholders closely monitoring market trends.

CAD/USD analysis for 2025 indicated the noticeable increase in the worth of the Canadian Dollar/USD cash pair, with prices hitting $0.818674 in November. The range of the anticipated fluctuation is $0.722141 to $0.818674. Investors expected a potential return on investment of 13.11%.

| Month |

Min. Price |

Avg. Price |

Max. Price |

| July 2025 |

$ 0.749014 |

$ 0.770718 |

$ 0.781520 |

| August 2025 |

$ 0.761397 |

$ 0.784374 |

$ 0.792653 |

| September 2025 |

$ 0.774685 |

$ 0.781934 |

$ 0.787658 |

| October 2025 |

$ 0.780573 |

$ 0.803435 |

$ 0.814449 |

| November 2025 |

$ 0.802426 |

$ 0.810445 |

$ 0.818674 |

| December 2025 |

$ 0.784485 |

$ 0.794419 |

$ 0.809523 |

Factors Shaping the CAD Price

There are several events and conditions that can influence CAD’s cost. Let’s quickly observe some of them.

The monetary policies of the Bank of Canada

From Q1 2022 to Q3 2023, the Canadian central bank battled rising inflation by enforcing tighter monetary regulation. Over this time, the price rose nine times; the most recent rise was noticed during July 2023. Upward price pressure has been at the level of 5% ever since. This policy helped to preserve the value of the Canadian dollar. So far, all measures taken by the Bank of Canada are aimed at meeting the 2% inflation objective.

On January 24, the organization announced it will preserve the interest rate at the level of 5%. Since there are no signs of upcoming rate cuts, the CAD value is likely to stay the same throughout the first quarter of 2024.

The monetary policies of the US Federal Reserve

To reduce inflation, the Fed increased credit rates from 0.25% to the stunning level of 5.5% during 2022-2023. This measure has already given positive outcomes, with the upward price pressure rate lowering to 3.4% by February 2024. Experts claim that during March and May 2024, the Fed may lower its credit rate.

Oil costs

Being a significant natural resources provider (especially oil), Canada regards the USA as its biggest consumer. Since oil prices influence USD/CAD to a large degree, CAD is regarded as a commodity currency.

In 2023, Brent quotations ranged from $70 to $96. The cost of oil was supported by OPEC’s production-reduction strategy. The USD to CAD exchange rate may receive significant support if commodity prices climb, and a hold over $80 might lead to a drop in the pair’s quotations. A decline in oil prices under $70 might be detrimental to the Canadian dollar, because it will strengthen the rate.

US and Canadian economic development indicators

The CAD/USD exchange rate also depends on a number of economic conditions and reports, including unemployment statistics, growth tempo, payrolls from non-farms, consumers’ confidence, ISM, trade balance for retailers, and so on.

CAD to USD Forecast Summary

As of early 2026, the CAD to USD forecast indicates a cautiously optimistic outlook for the Canadian dollar. Currently, the CAD trades at approximately $0.7313, with projections suggesting a slight decline to $0.696994 over the next month, a 0.20% decrease.

Short-term forecasts anticipate minor fluctuations, with the CAD to USD forecast predicting a rise to $0.78 by the end of the week. Over the next six months, the Canadian dollar is expected to strengthen modestly, potentially reaching $0.79.

For the remainder of 2026, the Canadian dollar is projected to trade within a range of $0.71 to $0.74, with an average annual rate of $0.79. This suggests a potential return on investment of 1.59% compared to current rates.

These projections are influenced by various variables, including economic indicators, trade balances, and market sentiment. Stakeholders and analysts continue to monitor these elements closely to inform their currency strategies.

| Period |

CAD to USD Forecast |

Analysis |

| 2026 |

1 CAD = 0.80 USD |

The Canadian dollar is projected to weaken slightly by year-end, influenced by potential U.S. trade tariffs and domestic political uncertainties. However, anticipated rate cuts by the Bank of Canada may provide some support to the legal tender. |

| 5-Year Outlook |

1 CAD = 0.76 USD |

Over the next five years, the Canadian dollar is expected to depreciate against the US dollar, with forecasts indicating a gradual decline due to ongoing economic challenges and shifting global trade dynamics. |

These projections are subject to change based on evolving economic conditions and geopolitical changes.

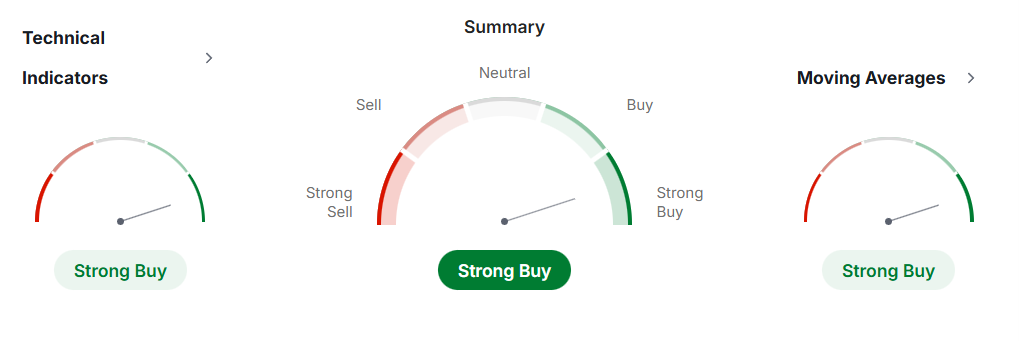

CAD to USD Technical Analysis

The CAD to USD technical outlook for early May 2025 suggests a modest upward trend for the Canadian dollar. Currently, 1 Canadian dollar equals approximately 0.7228 USD, reflecting a 3.7% increase over the past month. Short-term projections indicate a potential rise to 0.7205 USD within 24 hours, a 0.23% gain.

Looking ahead, forecasts predict the Canadian dollar could appreciate by 11.48% over the next six months, reaching 0.8039 USD, and by 11.98% over the next year, attaining 0.8076 USD. These expectations are influenced by factors such as Canada's trade balance, services sector performance, and global economic conditions.

Stakeholders are advised to monitor economic indicators and market sentiment closely, as these elements can significantly impact the tender's trajectory. Staying informed will be crucial for making strategic decisions in the evolving financial landscape.

)

Long-term USD/CAD price forecast for 2026-2030

Between 2026 and 2030, the Canadian dollar is projected to experience moderate fluctuations against the US dollar, influenced by economic indicators and policy decisions. In 2026, forecasts suggest the Canadian dollar may strengthen, with the USD/CAD exchange rate potentially reaching 0.79.

Long-term projections indicate a gradual depreciation of the Canadian dollar. By 2030, the USD/CAD rate is expected to average around 1.6798, suggesting a weakening trend. This outlook is shaped by factors such as trade balances, credit rate differentials, and global economic conditions.

Investors should monitor changes in both countries' economic policies, as shifts can impact the legal tender's trajectory. Staying informed will be crucial for making strategic decisions in the evolving financial landscape.

USD/CAD price forecast for 2026

Here's the forecast for the USD/Canadian Dollar exchange rate in 2026, based on current data and long-term money trends. Analysts expect moderate instability driven by credit rate policies, energy prices, and trade dynamics between the two countries.

| Month |

Min. Price |

Avg. Price |

Max. Price |

| January 2026 | $ 0.77903 | $ 0.786538 | $ 0.791622 |

| February 2026 | $ 0.767982 | $ 0.792076 | $ 0.799509 |

| March 2026 | $ 0.781386 | $ 0.788709 | $ 0.794471 |

| April 2026 | $ 0.791147 | $ 0.811392 | $ 0.821493 |

| May 2026 | $ 0.796718 | $ 0.817492 | $ 0.834436 |

| June 2026 | $ 0.794658 | $ 0.806512 | $ 0.818998 |

| July 2026 | $ 0.761173 | $ 0.775615 | $ 0.793780 |

| August 2026 | $ 0.747390 | $ 0.757827 | $ 0.767743 |

| September 2026 | $ 0.741869 | $ 0.750898 | $ 0.762632 |

| October 2026 | $ 0.750718 | $ 0.762834 | $ 0.774929 |

| November 2026 | $ 0.743691 | $ 0.749825 | $ 0.762952 |

| December 2026 | $ 0.713292 | $ 0.726171 | $ 0.747808 |

USD/CAD price prediction for 2027

The Canadian forecast for 2027 is expected to be low. This rise will be affected by many market factors, though.

| Month |

Min. Price |

Avg. Price |

Max. Price |

| January 2027 | $ 0.680288 | $ 0.702332 | $ 0.720120 |

| February 2027 | $ 0.707442 | $ 0.722472 | $ 0.737094 |

| March 2027 | $ 0.735888 | $ 0.753071 | $ 0.770744 |

| April 2027 | $ 0.756275 | $ 0.776177 | $ 0.795678 |

| May 2027 | $ 0.756583 | $ 0.770274 | $ 0.796809 |

| June 2027 | $ 0.760023 | $ 0.772535 | $ 0.785452 |

| July 2027 | $ 0.753402 | $ 0.764648 | $ 0.775365 |

| August 2027 | $ 0.756025 | $ 0.766623 | $ 0.779834 |

| September 2027 | $ 0.752472 | $ 0.760887 | $ 0.775839 |

| October 2027 | $ 0.742842 | $ 0.752326 | $ 0.761937 |

| November 2027 | $ 0.734266 | $ 0.740345 | $ 0.748325 |

| December 2027 | $ 0.733908 | $ 0.746386 | $ 0.760134 |

USD/CAD price forecast for 2028

Forecasted exchange rates for 2028 suggest that the USD may appreciate in value in relation to Canada's dollar. variations in credit rates, the status of the economy, and merchandise prices,

| Month |

USD to CAD Forecast |

| January 2028 | 1.507 |

| February 2028 | 1.511 |

| March 2028 | 1.512 |

| April 2028 | 1.506 |

| May 2028 | 1.507 |

| June 2028 | 1.510 |

| July 2028 | 1.514 |

| August 2028 | 1.519 |

| September 2028 | 1.529 |

| October 2028 | 1.541 |

| November 2028 | 1.548 |

| December 2028 | 1.548 |

USD/CAD price forecast for 2029

Here is the monthly USD to Canada dollar exchange rate forecast for 2029, based on data from Coincodex:

| Month |

USD to CAD Forecast (Avg Price) |

| January 2029 | $ 0.80167 |

| February 2029 | $ 0.792058 |

| March 2029 | $ 0.770829 |

| April 2029 | $ 0.782 |

| May 2029 | $ 0.774046 |

| June 2029 | $ 0.75943 |

| July 2029 | $ 0.758868 |

| August 2029 | $ 0.763803 |

| September 2029 | $ 0.764886 |

| October 2029 | $ 0.765106 |

| November 2029 | $ 0.755017 |

| December 2029 | $ 0.740834 |

USD/CAD price forecast for 2030

Here is the monthly USD to Canadian Dollar exchange rate forecast for 2029, based on data from Coincodex:

| Month |

USD to Canadian Dollar Forecast (Avg Price) |

| January 2030 | $ 0.749336 |

| February 2030 | $ 0.754567 |

| March 2030 | $ 0.745206 |

| April 2030 | $ 0.744556 |

| May 2030 | $ 0.740448 |

| June 2030 | $ 0.749936 |

| July 2030 | $ 0.760669 |

| August 2030 | $ 0.750905 |

| September 2030 | $ 0.752197 |

| October 2030 | $ 0.755583 |

| November 2030 | $ 0.752630 |

| December 2030 | $ 0.756515 |

Conclusion: Is CAD a Good Investment?

The Canadian dollar can be a good investment, particularly for those seeking exposure to commodity-driven economies, as its value is closely tied to oil and natural resource prices. Canada’s legal tender offers diversification benefits in forex portfolios due to its sensitivity to global economic conditions and financial regulations.

However, its performance can be volatile, influenced by geopolitical events, trade policies, and oil market fluctuations. Investors should consider market trends, a C$ forecast, and risk tolerance when including Canadian legal tender in their investment strategy.

FAQ

-

Why is the USD/CAD forecast important?

C$ to USD forecast is important because it helps businesses, investors, and traders manage risks, plan budgets, and make informed decisions in cross-border trade, investments, and cash trading, given the pair's sensitivity to oil prices and economic ties between the U.S. and Canada.

-

What methods are used in USD/CAD forecast?

Methods to carry out C$ to USD forecast include technical analysis, fundamental analysis, sentiment analysis, and econometric modeling.

-

How accurate is the USD to CAD forecast?

A USD to C$ forecast varies in accuracy, as they depend on the quality of data, the method used, and external factors like economic shifts and geopolitical events. Forecasts are generally reliable in the short term but less so for long-term predictions due to market instability.

-

What are the risks in the USD/CAD forecast?

Risks in USD/C$ forecast include unexpected economic data releases, geopolitical events, oil price instability, credit rate changes, and market sentiment shifts, all of which can cause sudden and unpredictable currency movements.

-

What potential future events could trigger changes in the USD/CAD exchange rate?

Potential events include changes in oil costs, U.S. or Canadian credit rate adjustments, economic data releases, geopolitical tensions, trade policy shifts, and natural disasters affecting key industries.

-

Will the USD/CAD exchange rate continue to remain volatile?

The USD/C$ exchange rate is expected to remain volatile due to fluctuating oil prices, differing financial regulations between the U.S. and Canada, and global economic uncertainties. Analysts anticipate that the Canadian dollar may weaken soon but could rally in 2025 if the global economy improves.

-

How does the difference in interest rates affect the USD/CAD rate?

Differences in interest rates between the U.S. and Canada affect the USD/CAD rate by influencing capital flows; higher rates in one country attract investors, strengthening its currency relative to the other.