Coffee Price Forecast: Expert Analysis and Market Predictions

)

Table of Contents

Why Are Coffee Prices So High?

State of the Coffee Market in 2026

Key Factors Driving Coffee Prices in Today's Market

Coffee Price Prediction 2027-2030

Regional Analysis: How Different Coffee-Producing Regions Will Fare

Strategies for Coffee Businesses to Navigate Price Volatility

Conclusion: Preparing for the Future of Coffee Prices

Frequently Asked Questions

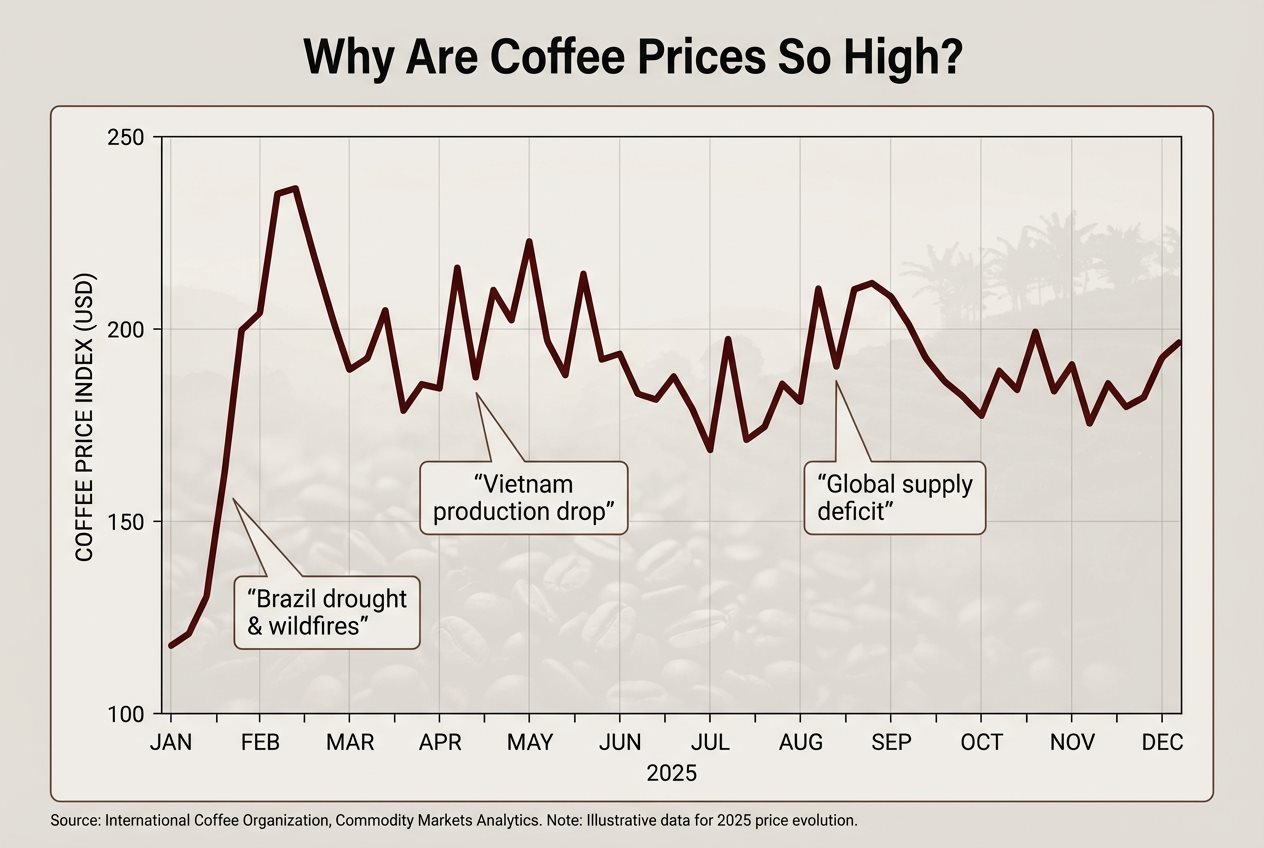

Coffee prices reached unprecedented levels in 2025, with the ICO Composite Indicator Price hitting $3.54 per pound in February—the highest monthly price on record. Climate disruptions in Brazil and Vietnam, supply chain constraints, and tight global inventories drove this surge, fundamentally reshaping market dynamics for buyers and traders.

Why Are Coffee Prices So High?

Brazil's worst drought in history and Vietnam's 20 percent production drop in 2023/24 created severe supply deficits. These countries produce nearly 50 percent of global supply. Brazil experienced 110,000 wildfires across coffee regions while Vietnam faced prolonged drought, pushing prices to 47-year highs.

)

State of the Coffee Market in 2026

The ICO Composite Indicator averaged $3.30 per pound in November 2025, moderating from February's peak. Arabica declined from $4.30 to $2.80 per pound by late 2025, while Robusta fell from $2.75 to $1.73. The USDA forecasts record global production of 178.7 million bags for 2025/26, signaling supply recovery ahead.

2026 Monthly Coffee Price Forecast (Arabica):

| Month |

Price Range, $/lb |

Key Market Event |

| January 2026 |

3.15 – 3.35 |

Post-holiday demand adjustment |

| February 2026 |

3.10 – 3.30 |

Brazil harvest assessment begins |

| March 2026 |

3.05 – 3.25 |

Vietnam main harvest completion |

| April 2026 |

3.00 – 3.20 |

Global inventory reports |

| May 2026 |

2.95 – 3.15 |

Brazil flowering critical period |

| June 2026 |

2.90 – 3.10 |

Frost risk monitoring begins |

| July 2026 |

2.85 – 3.05 |

New Brazil crop year starts |

| August 2026 |

2.80 – 3.00 |

Production estimates released |

| September 2026 |

2.75 – 2.95 |

Supply recovery evidence |

| October 2026 |

2.70 – 2.90 |

Vietnam new season begins |

| November 2026 |

2.70 – 2.90 |

Year-end positioning |

| December 2026 |

2.75 – 2.95 |

Holiday demand spike |

Price Trends for Arabica vs. Robusta

Arabica experienced more dramatic swings due to Brazil's production shortfalls, with Colombian Milds averaging $4.05 per pound in March 2025. Robusta showed greater resilience despite Vietnam's challenges but still doubled year-over-year. The traditional price differential narrowed as global supply constraints affected both varieties.

Arabica vs. Robusta Price Comparison 2026:

| Factor |

Arabica |

Robusta |

| Current Price (Dec 2025) |

$2.80/lb |

$1.73/lb |

| 2026 Forecast |

$2.65 – 2.85/lb |

$1.65 – 1.85/lb |

| Primary Risk |

Brazil frost / drought |

Vietnam weather |

| Market Share |

60% global |

40% global |

| Volatility |

Higher |

Moderate |

Key Factors Driving Coffee Prices in Today's Market

Global consumption growth outpaced production, with ending inventories falling to 21.8 million bags—the tightest in years. Research indicates coffee-growing regions could shrink by 50 percent by 2050, creating long-term supply pressure.

Top Factors Influencing Coffee Prices:

- Weather volatility: El Niño conditions exacerbated droughts in Brazil and Vietnam

- Labor challenges: Aging farmer populations reducing production capacity

- Input cost inflation: Fertilizer and energy prices up 25-30 percent

- Geopolitical factors: Trade policies and tariffs affecting major markets

Coffee Price Prediction 2027-2030

The World Bank projects Arabica prices declining 13 percent in 2026 and 5 percent in 2027, following 2025's 50 percent surge. Robusta should decline 2 percent annually. However, prices will stabilize at structurally higher levels than 2020-2023, reflecting climate risks and supply constraints.

Annual Coffee Price Forecast 2027-2030:

| Year |

Arabica ($/lb) |

Robusta ($/lb) |

Confidence Level |

| 2027 |

2.50 – 2.80 |

1.65 – 1.85 |

75% |

| 2028 |

2.40 – 2.70 |

1.60 – 1.80 |

65% |

| 2029 |

2.35 – 2.65 |

1.55 – 1.75 |

55% |

| 2030 |

2.40 – 2.70 |

1.60 – 1.80 |

45% |

Short-term Market Outlook 2027

Brazil's 2026/27 crop is projected at 71 million bags—a 10.5 percent increase. Vietnam's recovery to 31 million bags should ease Robusta tightness. Support levels exist around $2.50 per pound for Arabica and $1.65 for Robusta.

Key Market Indicators to Track in 2027:

- Brazilian rainfall patterns during April-September 2026 flowering and fruit development stages

- Vietnam harvest progress from October 2026 through March 2027 for Robusta supply assessment

- Certified stock levels at ICE Futures US and London ICE exchanges indicating market tightness

- Currency movements in Brazilian real and Vietnamese dong affecting export competitiveness

- Global inventory reports from ICO showing consumer stock drawdown rates

2027 Monthly Coffee Price Forecast (Arabica):

| Month |

Price Range, $/lb |

Confidence |

Key Factor |

| January 2027 |

2.70 – 2.90 |

Medium |

Holiday demand residual |

| February 2027 |

2.65 – 2.85 |

Medium |

Brazil assessment |

| March 2027 |

2.60 – 2.80 |

Medium–High |

Harvest data clarity |

| April 2027 |

2.55 – 2.75 |

High |

Production confirmation |

| May 2027 |

2.50 – 2.70 |

High |

Weather monitoring |

| June 2027 |

2.50 – 2.70 |

Medium |

Frost risk period |

| July 2027 |

2.55 – 2.75 |

Medium |

New crop arrival |

| August 2027 |

2.60 – 2.80 |

Medium |

Supply adjustment |

| September 2027 |

2.65 – 2.85 |

Medium |

Pre-harvest positioning |

| October 2027 |

2.70 – 2.90 |

Medium–Low |

Vietnam season start |

| November 2027 |

2.75 – 2.95 |

Low |

Demand seasonality |

| December 2027 |

2.80 – 3.00 |

Low |

Year-end factors |

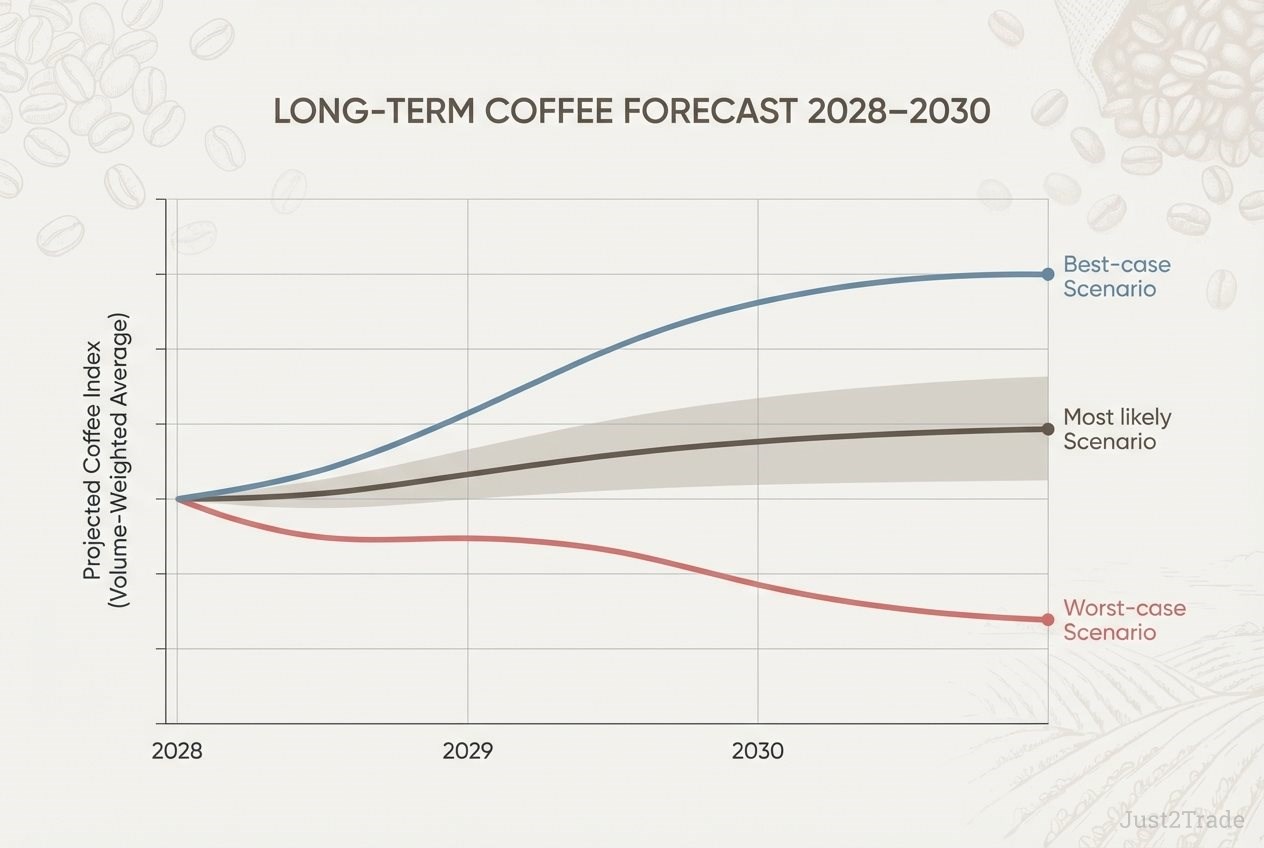

Long-term Coffee Forecast 2028-2030

Prices should stabilize at structurally higher levels as climate adaptation investments improve resilience. New plantations—particularly Robusta in Brazil's warmer regions—will increase supply but require 3-4 years to reach full production.

)

Long-term Coffee Price Forecast 2028-2030 (Quarterly):

| Quarter |

Arabica Range, $/lb |

Robusta Range, $/lb |

Key Drivers |

| Q1 2028 |

2.55 – 2.75 |

1.70 – 1.90 |

Post-harvest inventory assessment |

| Q2 2028 |

2.50 – 2.70 |

1.65 – 1.85 |

Brazil flowering outcomes |

| Q3 2028 |

2.45 – 2.65 |

1.60 – 1.80 |

Mid-year production updates |

| Q4 2028 |

2.50 – 2.70 |

1.65 – 1.85 |

Vietnam new harvest begins |

| Q1 2029 |

2.45 – 2.65 |

1.65 – 1.85 |

Supply-demand rebalancing |

| Q2 2029 |

2.40 – 2.60 |

1.60 – 1.80 |

Stable production patterns |

| Q3 2029 |

2.35 – 2.55 |

1.55 – 1.75 |

New plantation output increases |

| Q4 2029 |

2.40 – 2.60 |

1.60 – 1.80 |

Seasonal demand factors |

| Q1 2030 |

2.45 – 2.65 |

1.65 – 1.85 |

Market stabilization |

| Q2 2030 |

2.50 – 2.70 |

1.70 – 1.90 |

Climate adaptation progress |

| Q3 2030 |

2.55 – 2.75 |

1.75 – 1.95 |

Long-term supply improvement |

| Q4 2030 |

2.60 – 2.80 |

1.80 – 2.00 |

Demand growth acceleration |

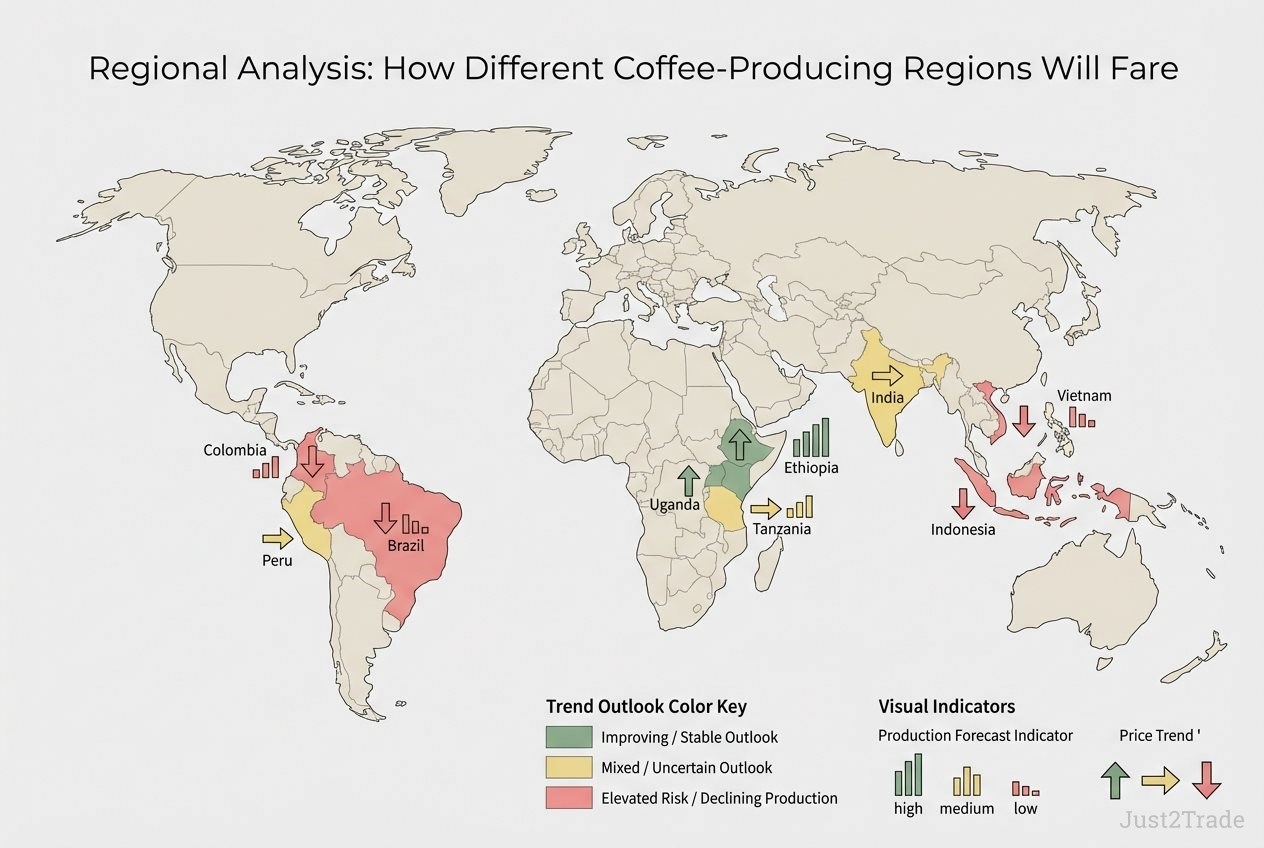

Regional Analysis: How Different Coffee-Producing Regions Will Fare

)

Regional dynamics determine whether global supply can meet 2-3 percent annual demand growth. The USDA forecasts 2025/26 production at 178.7 million bags—up 4.3 million—with Ethiopia, Vietnam, and Indonesia gains offsetting Brazil and Colombia declines.

South American Production Forecast

)

Brazil's 2024/25 production fell to 64.7 million bags due to drought and heat, recovering to 65 million in 2025/26. Colombia forecasts 12.5 million bags for 2025/26—down 5.3 percent as excessive rainfall disrupted flowering.

South American Coffee Origin Outlook Comparison:

- Brazil: Dominant global supplier with 65 million bags forecast for 2025/26, faces highest climate risk from drought and frost, investing heavily in Robusta expansion in warmer regions, biennial cycle means alternating high/low production years

- Colombia: Premium Arabica specialist with 12.5 million bags projected, tree renewal programs supporting gradual recovery, excessive rainfall main risk factor, strong specialty market positioning maintains price premiums

- Peru: Smaller producer at approximately 4 million bags, organic and fair-trade focus, mountainous terrain provides climate advantages, limited infrastructure constrains growth potential

- Ecuador: Minor producer with 500,000 bags annually, Robusta and Arabica mix, export growth potential exists, climate relatively stable compared to larger neighbors

Asian and African Market Dynamics

Vietnam recovers to 31 million bags in 2025/26—a 6.9 percent increase. Ethiopia reaches record 11.6 million bags through higher-yielding varieties. Indonesia forecasts 11.3 million bags with gains primarily in Robusta.

Emerging Coffee Origins Ranked by Market Impact Potential:

- Ethiopia:

Record production of 11.6 million bags with higher-yielding varieties, specialty Arabica commanding premium prices, accounts for 33.8% of national export earnings, tree replacement program driving sustained growth

- Uganda: Rapidly expanding producer reaching 7 million bags, both Robusta and Arabica production, aggressive plantation expansion in southwestern regions, competitive pricing attracting buyers

- Indonesia: 11.3 million bags with Robusta dominance, Sumatra and Java prime growing areas, improving quality standards, favorable weather supporting yield increases

- India: Approximately 6 million bags with monsoon-dependent yields, both Arabica and Robusta production, domestic consumption growing rapidly, export potential constrained by internal demand

- Honduras: Central America's largest producer at 8 million bags, quality improvements attracting specialty buyers, climate risks from hurricanes, competitive labor costs

Asian and African Coffee Production Comparison:

| Country |

Annual Production |

Primary Type |

2025/26 Forecast |

Export Volume |

Key Advantage |

| Vietnam |

31 million bags |

Robusta (95%) |

+6.9% growth |

24.6 million bags |

Scale, efficiency, climate resilience |

| Ethiopia |

11.6 million bags |

Arabica |

Record high |

7.8 million bags |

Quality, specialty premium, tree renewal |

| Indonesia |

11.3 million bags |

Robusta (85%) |

+5% growth |

8.5 million bags |

Geographic diversity, improving quality |

| Uganda |

7 million bags |

Robusta (80%) |

+8% growth |

6 million bags |

Low costs, rapid expansion |

| India |

6 million bags |

Mixed |

-3% decline |

3.7 million bags |

Domestic market, monsoon patterns |

| Tanzania |

1.2 million bags |

Arabica |

Stable |

950,000 bags |

Quality potential, infrastructure challenges |

Strategies for Coffee Businesses to Navigate Price Volatility

Risk management through hedging and diversification is essential. Balanced approaches combine physical inventory management with financial instruments. Businesses maintaining diversified origin portfolios weathered recent volatility better than those concentrated in single regions.

Practical Strategies:

- Forward contracting:

Lock in 40-60 percent of annual requirements 6-12 months ahead

- Options strategies: Use puts and calls to establish price floors and ceilings

- Inventory optimization: Maintain 2-3 months coverage while avoiding excessive carrying costs

- Producer partnerships: Direct sourcing reduces intermediary costs and improves supply reliability

Risk Management Strategies Comparison:

| Strategy |

Best For |

Advantages |

Disadvantages |

| Futures Hedging |

Large importers / roasters |

Price certainty, margin protection |

Requires expertise, capital requirements |

| Options Strategies |

Mid-size businesses |

Flexibility, defined maximum cost |

Premium costs, complexity |

| Fixed-price Contracts |

Small roasters |

Simplicity, predictable budgeting |

Limited to available supply, potential missed opportunities |

| Direct Trade |

Specialty roasters |

Quality control, supplier relationships |

Time investment, limited scale |

Conclusion: Preparing for the Future of Coffee Prices

Coffee markets have entered a new era where climate change impacts intensify and supply growth struggles to match demand. Prices will moderate from 2025 peaks but remain elevated versus historical norms. Businesses investing in supply chain resilience, diversification, and sophisticated hedging will be better positioned.

Key Recommendations:

- Implement comprehensive hedging programs covering at least 50% of annual volume.

- Diversify supply sources across multiple origins and both Arabica and Robusta varieties.

- Build direct relationships with producers to improve supply visibility and quality control.

- Monitor climate forecasts and adjust procurement strategies quickly.

- Invest in inventory management systems balancing carrying costs against supply security.

- Consider long-term contracts with trusted suppliers to stabilize costs.

- Stay informed on production forecasts from USDA, ICO, and major analytical firms.

FAQ

-

Will coffee prices increase in 2026?

Coffee prices are expected to decline moderately in 2026 after 2025's record highs, with forecasts showing Arabica down 13 percent as production recovers in major origins. However, prices will remain significantly elevated compared to 2020-2023 levels. Climate risks in Brazil and Vietnam could disrupt the anticipated downward trajectory.

-

What is the future outlook for coffee?

The long-term coffee outlook reflects structural challenges from climate change reducing suitable growing areas by up to 50 percent by 2050. Global production for 2025/26 is forecast at a record 178.7 million bags, suggesting near-term supply improvement. Prices should stabilize at higher levels than pre-2024, with increased volatility driven by unpredictable weather patterns.

-

Why are coffee prices so high?

Brazil faced its worst drought in history while Vietnam's production dropped 20 percent in 2023/24, creating severe supply deficits in the world's two largest producers. Combined with supply chain constraints, tight global inventories at 21.8 million bags, and strong demand growth, prices surged to 47-year highs. Climate change impacts continue affecting production reliability.

-

How do climate change patterns affect long-term coffee price forecasts?

Climate change fundamentally reshapes coffee price forecasts by reducing production reliability and suitable growing areas. Increased frequency of droughts, frosts, and extreme weather events creates persistent supply risk, supporting structurally higher prices. Price volatility will likely increase as production becomes less predictable across major origins.

-

What role do major coffee-producing countries play in global price forecasts?

Brazil and Vietnam collectively account for nearly 50 percent of global coffee production, making their output levels the primary determinant of global prices. Production shortfalls in these origins immediately trigger global price spikes, while recovery enables price moderation. Brazil's forecast of 71 million bags for 2026/27 and Vietnam's 31 million bags for 2025/26 are critical benchmarks.

-

Is the price of coffee going to skyrocket in 2027?

Coffee prices are unlikely to skyrocket in 2027 barring major weather disasters, with forecasts showing Arabica declining 5 percent following 2026's 13 percent drop. Prices will remain above historical averages, potentially $2.50-2.80 per pound for Arabica. Climate risks mean significant upward price movements remain possible if major producers experience crop failures.

-

What is the expected price difference between Arabica and Robusta coffee in the coming years?

The Arabica-Robusta price differential has narrowed from historical norms during recent supply tightness, with the traditional 60-80 cents per pound premium compressing significantly. As supply normalizes, the differential should widen again to $0.70-1.00 per pound. Robusta's improving quality and climate resilience may sustain smaller-than-historical premiums through 2027-2030.

-

How do coffee futures contracts reflect market price forecasts?

Futures contracts traded on ICE provide forward-looking price discovery through market participants' collective expectations about supply, demand, and risk. The term structure comparing nearby versus distant contract prices reveals whether markets expect prices to rise or fall. Current backwardation in coffee futures reflects supply concerns, while gradual price declines in forward contracts suggest anticipated production recovery.

-

How reliable are coffee price forecasting models?

Coffee price forecasting faces significant uncertainty due to weather unpredictability, geopolitical factors, and currency movements affecting model accuracy. Models based on supply-demand fundamentals and technical analysis provide directional guidance but struggle with precise predictions. Actual prices frequently deviate 15-25 percent from projections, with climate change increasing forecast difficulty and requiring scenario-based approaches.