Silver Price Prediction 2026-2030

Forecasting the future price of silver is a topic of great interest for investors, traders, and enthusiasts alike. As silver holds a significant place in the global economy and finds use in various industries, understanding its potential price trajectory provides valuable insights for informed decision-making. In this article, we delve into silver price forecasts spanning the years 2026 to 2030.

Table of Contents

KEY TAKEAWAYS

SILVER PRICE FORECAST SUMMARY

WHAT DOES THE PRICE OF SILVER DEPEND ON?

SILVER PRICE FORECAST 2026

SILVER PRICE FORECAST 2027

SILVER PRICE FORECAST 2028

SILVER PRICE FORECAST 2029

SILVER PRICE FORECAST 2030

SILVER PRICE HISTORY CHART

WAYS TO FORECAST THE PRICE OF SILVER

SILVER PRICE HISTORY CHART FOR 10–20–50 YEARS

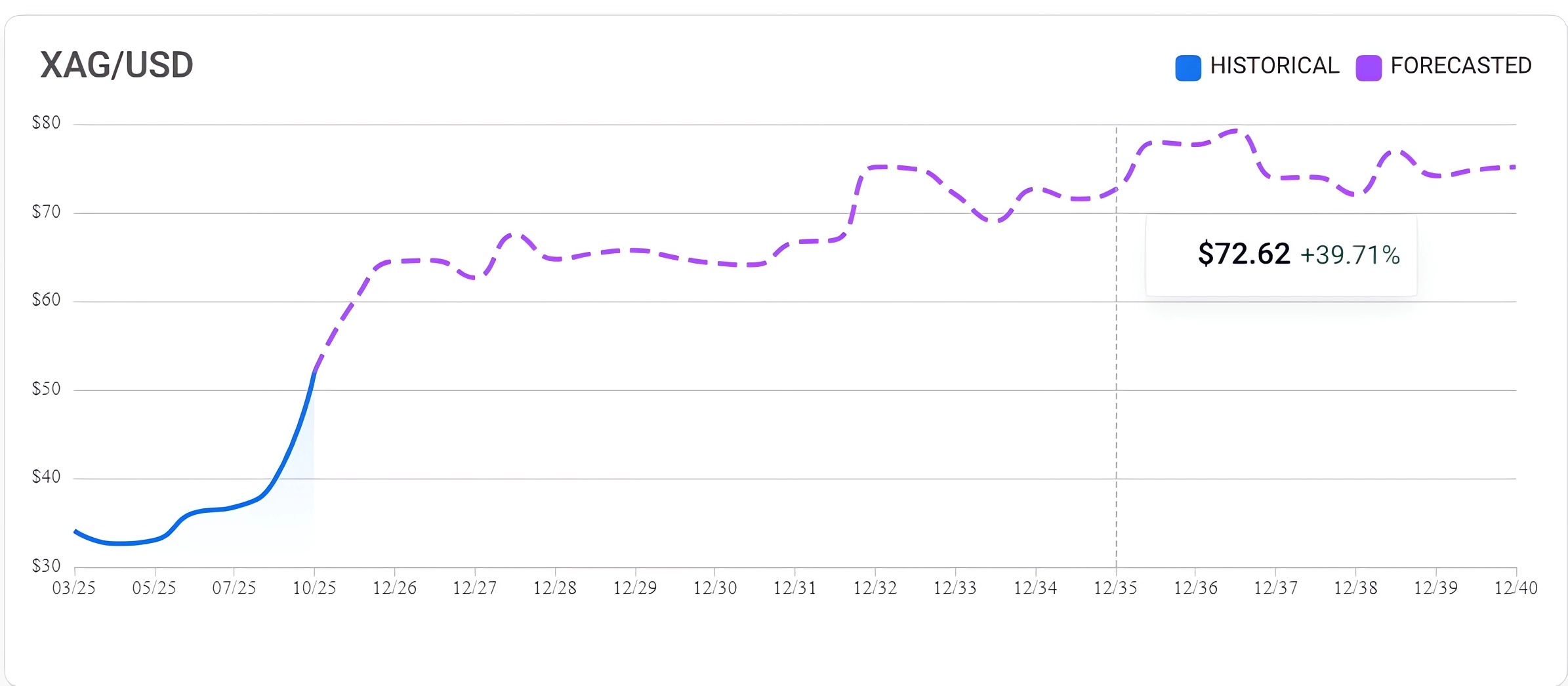

LONG-TERM SILVER PRICE PREDICTION CHART FOR 10 YEARS

SILVER TECHNICAL OUTLOOK

FAQ

Key Takeaways

- Silver's growing applications in green technologies, photovoltaics, automotive (electromobility), and medical sectors are critical factors boosting its demand and price.

- A high gold-silver ratio signals potential silver price increases, while a low ratio may indicate a decline in its value compared to gold forecast.

- Silver market prices are shaped by inflation rates, interest rates, and currency strength, with weaker USD often pushing silver prices higher.

- Analysts expect silver price predictions to range from $48 to $78 in 2026, with potential highs reaching $140 per ounce by 2030, reflecting varying financial markets expectations and external economic uncertainties.

Silver Price Forecast Summary

Analysts anticipate a steady rise in silver prices from 2026 through 2030, driven by factors such as market need, economic trends, and currency dynamics.

| Year |

Forecast Range & Key Factors |

| 2026 |

Projections indicate prices between

$48 and $78 per ounce, averaging approximately $63.

Rising industrial demand, particularly from the renewable energy sector, and ongoing inflation concerns are expected to support this growth.

|

| 2027 |

Estimates place silver prices between

$51 and $88 per ounce, with an average of about $69.5.

The expansion of green energy initiatives and increased use in emerging markets are key drivers.

|

| 2028 |

Analysts forecast prices ranging from

$54 to $109 per ounce, averaging near $81.5.

Supply constraints due to environmental regulations and mining challenges may contribute to higher prices.

|

| 2029 |

Forecasts suggest a range of

$57 to $121 per ounce, averaging around $89.

The combination of robust market need and potential supply limitations could drive prices upward.

|

| 2030 |

Projections indicate prices between

$60 and $140 per ounce, averaging approximately $100.

Continued advancements in technology and the global shift toward renewable energy are expected to sustain demand for silver.

|

These forecasts are influenced by factors including market need, particularly from sectors like electronics and renewable energy; economic trends such as inflation and currency fluctuations; and potential supply constraints due to environmental regulations. Investors should monitor these elements when considering silver as part of their portfolio.

What does the price of silver depend on?

It is not only the economic situation that determines silver prices and makes forecasting them difficult. The value of this precious metal depends on:

- Interest rates;

- Geopolitical situation;

- Inflation rates;

- Economic situation in the industry.

Silver is a metal used in the jewelry industry. However, other companies (such as tech producers) are increasingly willing to use it. Silver is used, among others, by the photovoltaic and automotive industries (mainly in electromobility).

Silver Price Forecast 2026

Analysts project a bullish outlook for silver predictions in 2026, driven by factors such as increasing industrial demand and economic uncertainties. According to InvestingHaven, silver may consolidate around $50 per ounce during this period. Similarly, CoinPriceForecast anticipates silver prices reaching approximately $78.85 by the end of 2026.

LongForecast.com provides a detailed month-by-month forecasted silver price for 2026, suggesting that silver prices could fluctuate between $57.74 and $73.84 per ounce throughout the year. These variations highlight the potential volatility in the silver market during this period.

Dukascopy's analysis emphasizes that inflation and soaring industrial demand, especially in green energy and technology sectors, are boosting silver’s long-term prospects. They predict that silver could reach $30-$35 per ounce in 2026, with higher potential if economic uncertainty and dollar weakness continue.

These forecasts underscore a generally optimistic outlook for the forecasted silver price in 2026, influenced by factors such as industrial demand, economic conditions, and currency fluctuations.

| Month |

Minimum |

Maximum |

| January 2026 |

$57.74 |

$64.39 |

| February 2026 |

$59.56 |

$65.82 |

| March 2026 |

$62.69 |

$69.91 |

| April 2026 |

$63.75 |

$70.47 |

| May 2026 |

$60.18 |

$67.11 |

| June 2026 |

$63.35 |

$70.64 |

| July 2026 |

$62.90 |

$69.52 |

| August 2026 |

$66.21 |

$73.84 |

| September 2026 |

$62.90 |

$70.32 |

| October 2026 |

$59.62 |

$66.21 |

| November 2026 |

$62.25 |

$68.81 |

| December 2026 |

$65.53 |

$73.07 |

These projections underscore the potential for silver to play a significant role in investment portfolios amid evolving market dynamics.

Silver Price Forecast 2027

Based on projected silver prices for 2027, the market is expected to remain relatively volatile but within a moderate range, with the highest close at $79.50 in June and the lowest at $66.59 in March. Given current global economic uncertainties, interest in precious metals such as silver is likely to persist, supporting stable demand throughout the year.

| Month |

Minimum |

Maximum |

Close |

| January 2027 |

$66.28 |

$73.26 |

$69.77 |

| February 2027 |

$65.68 |

$72.60 |

$69.14 |

| March 2027 |

$63.26 |

$69.92 |

$66.59 |

| April 2027 |

$66.59 |

$74.26 |

$70.72 |

| May 2027 |

$70.72 |

$78.60 |

$74.86 |

| June 2027 |

$74.86 |

$83.48 |

$79.50 |

| July 2027 |

$74.20 |

$82.01 |

$78.10 |

| August 2027 |

$71.21 |

$78.71 |

$74.96 |

| September 2027 |

$67.55 |

$74.96 |

$71.10 |

| October 2027 |

$71.10 |

$79.29 |

$75.51 |

| November 2027 |

$73.56 |

$81.30 |

$77.43 |

| December 2027 |

$69.00 |

$77.43 |

$72.63 |

These projections suggest that silver could play a significant role in investment portfolios amid evolving market dynamics.

Silver Price Forecast 2028

Early in 2028, according to LongForecast, the price of silver could hit $80.75. It is anticipated that the precious metal will drop to between $66.02 and $69.01 by the middle of the year. Prices are expected to fluctuate between $71.30 to $84.89 in the second half of the year, then gradually rebound to $90.15 by the end of December.

| Month |

Minimum |

Maximum |

Close |

| January 2028 |

$68.79 |

$76.03 |

$72.41 |

| February 2028 |

$72.41 |

$80.75 |

$76.90 |

| March 2028 |

$70.38 |

$77.78 |

$74.08 |

| April 2028 |

$66.02 |

$74.08 |

$69.49 |

| May 2028 |

$69.01 |

$76.27 |

$72.64 |

| June 2028 |

$72.64 |

$81.00 |

$77.14 |

| July 2028 |

$68.74 |

$77.14 |

$72.36 |

| August 2028 |

$67.74 |

$74.87 |

$71.30 |

| September 2028 |

$71.30 |

$79.51 |

$75.72 |

| October 2028 |

$75.72 |

$84.43 |

$80.41 |

| November 2028 |

$76.81 |

$84.89 |

$80.85 |

| December 2028 |

$80.85 |

$90.15 |

$85.86 |

Silver Price Forecast 2029

Analysts' silver predictions for 2029 vary significantly, reflecting different expectations based on market trends and economic indicators.

According to Coin Price Forecast, silver is projected to range between $109.80 and $121.56 per troy ounce during 2029, potentially starting the year at $109.80 and rising to $110.51 by mid-year.

Dukascopy Bank takes a more conservative stance, suggesting silver could average around $38 per ounce, fluctuating between $34 and $42.

These silver predictions highlight the uncertainty of long-term forecasts, influenced by industrial demand, inflation, and geopolitical factors.

| Month |

WalletInvestor Min–Max ($) |

LongForecast Min–Max ($) |

| January 2029 |

57.646–58.357 |

76.51–85.86 |

| February 2029 |

58.348–59.103 |

76.86–84.95 |

| March 2029 |

59.110–59.491 |

72.22–80.90 |

| April 2029 |

59.561–59.934 |

68.29–76.02 |

| May 2029 |

59.346–59.879 |

64.05–71.88 |

| June 2029 |

59.526–59.999 |

65.27–72.14 |

| July 2029 |

59.597–60.326 |

68.70–76.61 |

| August 2029 |

60.283–61.004 |

66.69–73.71 |

| September 2029 |

60.844–61.359 |

68.34–75.54 |

| October 2029 |

60.399–60.739 |

64.98–71.94 |

| November 2029 |

60.539–60.682 |

68.40–76.27 |

| December 2029 |

60.597–60.739 |

– |

These projections highlight significant differences between the two sources. WalletInvestor forecasts a relatively stable price range between approximately $57 and $60 per ounce throughout 2029. In contrast, LongForecast anticipates much higher prices, ranging from around $64 to $86 per ounce, peaking in January.

Investors should consider these varying forecasts and the underlying assumptions when evaluating potential investments in silver for 2029.

Silver Price Forecast 2030

Analysts have provided varying projections for silver prices in 2030. Below is a table summarizing the minimum and maximum price forecasts for each month from two sources: WalletInvestor and CoinCodex.

| Month |

WalletInvestor Min–Max ($) |

CoinCodex Min–Max ($) |

| January 2030 |

60.768–61.476 |

438.48–463.75 |

| February 2030 |

61.450–62.220 |

447.50–463.33 |

| March 2030 |

62.203–62.595 |

431.95–448.65 |

| April 2030 |

62.657–63.051 |

426.40–439.83 |

| May 2030 |

62.467–62.959 |

412.82–429.70 |

| June 2030 |

62.646–63.119 |

418.84–445.21 |

| July 2030 |

62.699–63.455 |

430.89–477.38 |

| August 2030 |

63.409–64.073 |

461.23–533.14 |

| September 2030 |

63.918–64.482 |

489.21–561.29 |

| October 2030 |

63.717–63.878 |

488.55–523.38 |

| November 2030 |

– |

482.53–521.09 |

| December 2030 |

– |

476.29–520.65 |

These projections highlight significant differences between the two sources. WalletInvestor forecasts a relatively stable price range between approximately $60 and $64 per ounce throughout 2030. In contrast, CoinCodex anticipates much higher prices, ranging from around $412 to $561 per ounce, peaking in September.

Investors should consider these varying forecasts and the underlying assumptions when evaluating potential investments in silver for 2030.

Silver Price History Chart

2024 silver prices experienced significant fluctuations, influenced by various economic factors and market dynamics. The year began with silver trading at $23.14 per troy ounce in January and saw a notable rise to $31.97 by September.

This upward trend was driven by increased industrial demand, particularly from the renewable energy sector, and investor interest in precious metals as safe-haven assets amid economic uncertainties. The average price of silver for 2024 was approximately $28.27 per ounce.

Below is a table detailing the monthly closing prices of silver per troy ounce for the year 2024:

| Month |

Closing Price |

| January 2024 |

$23.14 |

| February 2024 |

$22.66 |

| March 2024 |

$25.17 |

| April 2024 |

$26.29 |

| May 2024 |

$30.41 |

| June 2024 |

$29.09 |

| July 2024 |

$29.01 |

| August 2024 |

$28.87 |

| September 2024 |

$31.97 |

| October 2024 |

$34.81 |

| November 2024 |

$32.66 |

| December 2024 |

$31.91 |

These figures highlight the volatility in the silver market throughout 2024, reflecting the impact of factors such as inflation expectations, central bank policies, and shifts in market demand, especially from sectors like solar panels and electric vehicles.

Moving into 2025, silver prices have continued their upward momentum, building on the gains established in late 2024. The year has been characterized by sustained investor interest and robust industrial demand, with silver reaching $46.64 per troy ounce by September 2025.

This progressive increase has been supported by continued expansion in renewable energy applications, ongoing inflationary pressures, and silver's strengthening position as a strategic investment asset. Below is a table detailing the monthly closing prices of silver per troy ounce for 2025:

| Month |

Closing Price |

| January 2025 |

$32.265 |

| February 2025 |

$31.496 |

| March 2025 |

$34.457 |

| April 2025 |

$32.828 |

| May 2025 |

$33.334 |

| June 2025 |

$36.172 |

| July 2025 |

$36.866 |

| August 2025 |

$40.561 |

| September 2025 |

$46.640 |

| October 2025 |

$49.44 |

| November 2025 |

$56.40 |

| December 2025 |

$68.70 |

Analysts' forecasts and silver price predictions for next 5 years suggest continued interest in silver as both an investment vehicle and a critical component in green energy technologies.

Ways to forecast the price of silver

A multitude of factors determine silver prices – here is what you should take a close look at to make correct silver price forecasts.

Investment demand

Investment demand is a key driver of silver prices, influenced by the actions of both retail and institutional investors. Tracking the volume of silver-backed ETFs, physical silver purchases, and speculative trading activity provides insights into market sentiment. Increased demand typically indicates confidence in silver's value, which can signal potential price growth.

Gold/silver ratio

The gold/silver ratio is used to gauge the relative value of gold to silver. Historically, when the ratio is high, silver tends to outperform gold, suggesting a potential increase in silver prices. Conversely, a low ratio may indicate a potential decline in silver prices relative to gold.

Inflation expectations

Investment expectations, such as increased demand for silver due to economic uncertainty or industrial usage, can impact silver prices. If investors anticipate rising inflation, they may buy silver as a hedge, boosting its price. Similarly, expectations of strong industrial growth can increase demand for silver in manufacturing, raising its value.

EUR/USD

When the dollar is strong, it can make gold and silver more expensive for buyers using other currencies. This can lead to a decrease in demand for gold and silver, which can cause the prices to fall. On the other hand, when the dollar is weak, it can make gold and silver less expensive for buyers using other currencies.

Futures market (CoT)

The Commitment of Traders (CoT) report in the futures market can help predict the price of silver by providing insights into the positions and sentiments of large traders (commercial hedgers and speculative traders). A significant imbalance in positions, with commercial hedgers taking opposite stances to speculators, may signal potential price reversals.

Silver price history chart for 10-20-50 years

)

Silver price forecasts indicate significant fluctuations over the past decades. The silver price chart shows that in 1980, the precious metal peaked at over $36 per ounce before declining to under $10. The current price of silver has been shaped by central banks' policies, interest rates, and market trends.

Silver predictions highlight a major surge in 2011, with silver reaching nearly $50 per ounce. The forecasted silver price depends on factors like booming investment demand, silver futures, and stock exchange movements. Analysts’ silver price forecast for 2026 suggests higher silver prices due to inflation and Federal Reserve policies.

The bullish silver price prediction for the second half of this decade sees silver’s prospects tied to green energy, the Silver Institute's reports, and gold price predictions. Exchange-traded funds and non-yielding assets also impact price swings. Investors rely on technical indicators, chart patterns, and intrinsic value to navigate the silver stock investor landscape.

Long-term silver price prediction chart for 10 years

)

Over the next decade, silver price forecasts suggest a potential upward trajectory for this precious metal. Analysts' silver price predictions indicate that by 2026, silver could range between $57 and $73 per ounce, influenced by booming industrial demand and market trends.

Looking further ahead, some silver price forecasts project that by 2030, silver might reach as high as $225 per ounce, driven by factors such as increased silver production and the metal's role in green technologies.

However, these silver predictions are subject to variables like the strength of the US dollar, interest rates, and overall economic conditions. Investors should consider these factors, along with potential bullish momentum and periods of lower prices, when evaluating silver's promises.

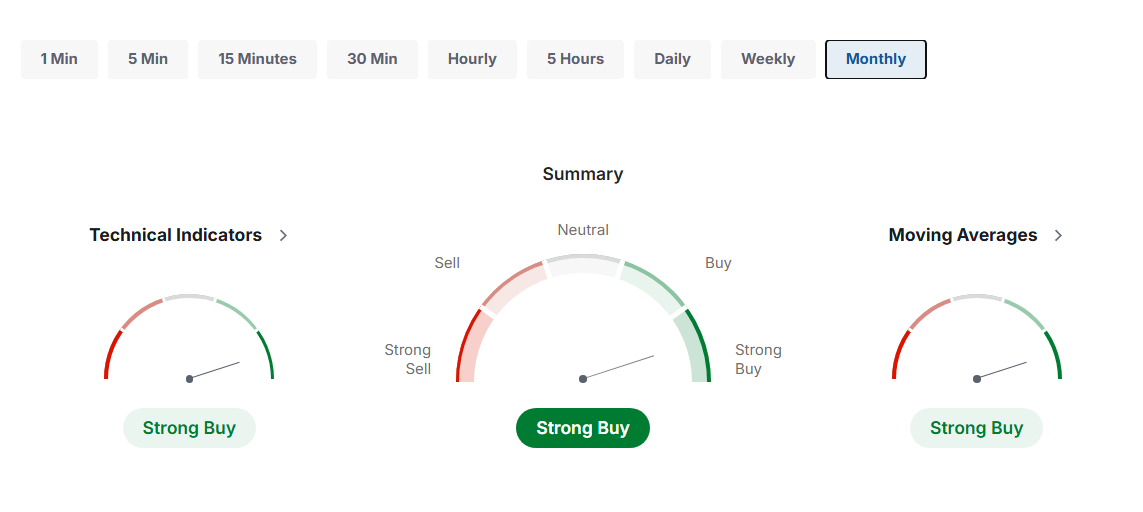

Silver Technical Outlook

Technical analysis plays a crucial role in formulating silver price forecasts by examining historical price data and market trends. Analysts utilize various tools, including the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Money Flow Index (MFI), to assess the momentum and potential direction of silver prices. These indicators help identify overbought or oversold conditions, aiding in silver price predictions.

Chart patterns, such as support and resistance levels, are also analyzed to anticipate price movements. For instance, a bullish silver price prediction may be supported by a breakout above a key resistance level, indicating potential upward momentum. Conversely, failure to maintain support levels might suggest a bearish outlook.

External factors, including fluctuations in the US dollar, interest rates, and industrial demand, significantly affect the forecasted silver price. A weaker US currency can make silver more affordable for holders of other major currencies, potentially driving up demand and prices. Additionally, economic indicators and consumer behaviours, such as the performance of mining stocks and silver ETFs, provide insights into investor sentiment and the broader market outlook.

Investors should consider these technical indicators and external factors, along with their financial objectives and risk tolerance, when evaluating silver's promises. Consulting with financial advisors is recommended to make informed investment decisions.

FAQ

-

What will silver be worth in 2030?

Silver price predictions for 2030 suggest a wide range, with silver price forecasts estimating $60-$520 per ounce. Factors that affect prices include dollar weakness and investment advice.

-

What will the silver price be in 2040?

Silver price forecasts for 2040 remain uncertain, but silver price predictions suggest a range of $100-$500 per ounce, depending on consumer behaviours, US currency, and demand.

-

Will silver ever reach $1,000 an ounce?

Silver price predictions suggest $1,000 per ounce is unlikely soon. Silver price forecasts depend on gold bull market direction, the USD, and factors affecting demand.

-

What year will silver reach $100 per ounce?

Silver price forecasts suggest silver may reach $100 per ounce by the late 2030s, depending on market direction, silver predictions, and factors affecting precious metal's price.

-

Will silver rise if the dollar collapses?

Silver price prediction indicates silver may rise if the dollar collapses, as silver forecasts often correlate with weakening USD and demand for a reliable store of value.

-

Where will silver be in 10 years?

Silver price forecasts predict silver could range from $70 to $500 per ounce in 10 years, influenced by market direction, silver predictions, and economic factors.

-

What will silver be in 2027?

Silver price prediction for 2027 suggests silver could reach $57 to $83 per ounce, depending on market direction, industrial demand, and silver price forecast adjustments.