Treasury Bonds Risk: Introduction, Risk-Free Bonds List 2025, and How to Trade Safety

In the ever-evolving world of financial investments, understanding the intricacies of Treasury bonds risk is paramount for those looking to navigate safely. Essentially, treasury bonds, such as the US or Polish treasury bonds, are debt securities issued by the Ministry of Finance to support other state budget expenses. Unlike riskier corporate bonds, these are backed by national governments, making them a preferred choice for many investors.

The landscape is vast, from one-year bonds to specialized options like four-year indexed savings. However, it's not just about buying government bonds. Crucial elements like early redemption, bond sales points, and shifting interest rates are pivotal in an investor's journey. In this article, we will delve into the characteristics and differences between various bond types and their associated risks, ensuring a comprehensive understanding of government bonds and their trading mechanism.

Table of Contents

Treasury bond: Definition and Meaning

Treasury Bonds Risk and Challenges

Why are Treasury bonds risk-free?

What type of bonds are less risky?

Investing in Treasury Bonds

In conclusion: Key Takeaways

FAQ

Treasury bond: Definition and Meaning

Treasury bonds (T- bonds), often referred to as government bonds, represent debt securities issued primarily by the Ministry of Finance. Their primary function? To fund other expenses of the state budget, such as infrastructure projects or public services. Unlike corporate bonds which are issued by companies, treasury bonds carry the weight and guarantee of a national government.

This backing often makes them a favored choice for bond buyers and financial institutions, as the associated government bonds risk is typically perceived to be lower than that of corporate or bank bonds. Notably, their interest rate is set to compensate the bond owner for lending money, and interest is paid periodically, with the bond's principal or face value repaid at maturity.

Treasury bonds, representing long-term securities, are just one component of the broader category of Treasury securities. Other two main types include:

-

Treasury Bills (T-Bills) - short-term securities with a maturity of up to one year.

- Treasury Notes (T-Notes) - middle-term securities with a maturity of up to 10 years.

A bond buyer can choose to purchase treasury bonds based on various factors like the first monthly interest period or the subsequent annual interest periods. Some of these bonds, such as the four-year indexed savings, might even be indexed to inflation, safeguarding capital gains against economic shifts.

Whether you're an individual looking to buy government bonds for safety or an investment fund seeking steady returns, it's vital to understand the bond case. Aspects like bond interest, the relationship between bank deposits and bond yields, and even the insolvency risk of certain debt securities, play a pivotal role in shaping investment decisions.

Treasury bonds: Main features

Treasury bonds, often lauded for their structured and secure nature, play a crucial role in the financial markets. They offer investors a dependable investment structure, distinguishing them from more volatile assets like stocks. Here's a breakdown of the structural components of treasury bonds:

understanding the bond case, especially the inherent government bonds risk, is pivotal.Maturity Duration: Typically, treasury bonds exhibit maturities ranging from 10 to 30 years. Both the 10-year and 30-year variants maintain a baseline face value of $1,000. What's enticing for many bond buyers is the ability to acquire these bonds in $100 increments when buying directly from sources like the U.S. Treasury.

-

Market & Purchasing Options: These securities thrive in the fixed-income market, more popularly termed the bond market, characterized by its high liquidity. While direct purchases are feasible via various trading platforms, investors also have the option to buy government bonds through financial institutions or brokers. It's worth noting, however, that purchasing through intermediaries might incur additional fees.

- Interest & Payouts: One of the hallmarks of treasury bonds is the "fixed income" nature. This implies a consistent interest rate payout to investors, usually twice a year. Moreover, upon reaching the bond's maturity date, bondholders can expect a full return on their principal investment.

- Liquidity & Safety: Bondholders have the flexibility to sell their treasury bonds before maturity or retain them until the designated maturity date. Given their resilience against sharp price fluctuations, these bonds act as a safety net, embodying an investment strategy called capital preservation. Their backing by the U.S. government amplifies their status as a near-risk-free investment.

However, as stable as they might seem, treasury bonds aren't devoid of risks. Fluctuating market interest rates can impact bond prices. For instance, a spike in interest rates might depreciate the value of these bonds, as witnessed in 2022. So, whether it's for retirement ten-year savings, or diversifying an investment portfolio.

Treasury Bonds Risk and Challenges

Investing in Treasury bonds, is generally deemed a safer choice. However, understanding the inherent risks is essential. One fundamental risk of treasury bonds revolves around interest rates. As the bond interest is generally fixed for a specific period, fluctuations in market interest rates in subsequent years can affect the bond's value. For instance, if you hold a bond from the first monthly interest period and interest rates rise during subsequent annual interest periods, the value of your bond might decrease. This is because new bonds would offer higher rates, making older bonds less attractive to bond buyers.

Furthermore, early redemption of bonds can result in receiving less than the bond's face value. Instruments like four-year indexed savings or two-year reference savings might be indexed to inflation, but they still carry the risk of interest rate volatility.

Another aspect to consider is the insolvency risk, although it's relatively low with government bonds. To fully grasp this, one should understand "government bonds how it works," as this provides insight into their inherent stability. When you purchase treasury bonds or even delve into retirement ten-year savings, the assumption is the government will honor its interest payment obligations.

However, extreme economic conditions or fiscal mismanagement could pose a slight risk. Comparatively, corporate bonds or bank bonds risk might be higher because financial institutions can face insolvency. In the bond case, a diversified approach, possibly through investment funds, can help in mitigating these risks. Always remember to consult with financial experts or review bond sales points before making significant investment decisions.

Are treasury bonds safe?

Treasury bonds hold a reputation as among the most secure investments one can make. These bonds, issued by the government as opposed to bank bonds, have a built-in promise: the interest will be paid, and upon maturity, the principal will be returned. The trustworthiness of this commitment is rooted in the unwavering support and credibility of the respective government, making it almost improbable for them to default on such promises.

Yet, it's crucial to understand that no investment, including treasury bonds, is wholly devoid of risks. Although the likelihood of losing the bond's face value is low, it's not impossible. As with all investments, navigating the intricacies of treasury bonds demands keen expertise and a solid strategy to handle potential market uncertainties.

Interest rate risk

Despite being considered safe-haven, treasury bonds carry their own set of risks, with interest rate risk being among the most significant. A surge in interest rates often leads to a decline in the value of existing bonds. Let’s consider an example.

Imagine you own a bond paying 2% interest, but new bonds are being issued at 3%. Investors would prefer the higher-yielding bond, making your 2% bond less attractive and worth less in the market. Conversely, if rates drop, your bond becomes more appealing, and its value can increase.

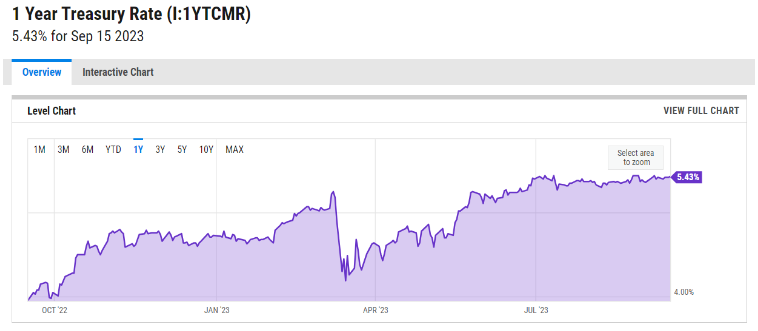

Below there is a 1-year historical chart on US treasury bond interest. As we can see, the rate has been fluctuating during the year and as of 15 September 2023 was set at 5.43%.

To mitigate treasury bond risks, especially the interest rate risk, investors can employ several strategies:

-

Laddering. By spreading investments across a range of maturity dates, investors can reduce the risk of all their bonds decreasing in value at once. As each bond matures, it can be reinvested, possibly at higher interest rates.

- Diversification. While treasuries are a solid foundation, diversifying your portfolio with other asset classes can help to balance the risk. Including corporate bonds, equities, or commodities can offer varying degrees of risk and reward.

- Duration Management. Duration indicates a bond's sensitivity to interest rate changes. Shorter-duration bonds are less sensitive to interest rate changes than longer-duration ones. If an investor believes interest rates will rise, they might prefer shorter-duration bonds to reduce potential price declines.

- Active Management. Engaging with a bond fund manager who actively adjusts a portfolio in response to expected interest rate changes can help navigate the complex bond market and mitigate potential risks.

- Hedging. Some advanced investors use financial instruments like interest rate futures or options to hedge against potential interest rate rises.

It's vital for investors to understand that while the return on a treasury bond is guaranteed if held to maturity, its market price can fluctuate with changing interest rates.

Inflation

Inflation plays a pivotal role when considering investments in treasury bonds. For instance, during subsequent annual interest periods, inflation can erode the real value of the bond interest they receive. To counteract this, some bonds, like four-year indexed savings, are indexed to inflation, ensuring that the interest paid remains aligned with purchasing power. While standard bonds, such as those for one-year bonds or retirement ten-year savings, might offer fixed interest rates, the real return can be less than anticipated if inflation spikes.

Bond buyers, especially those at bond sales points, need to be vigilant about such dynamics. It's also worth noting that financial institutions occasionally release products that offer a hedge against inflation. In the bond case, diversifying and considering options like investment funds can be a strategy to mitigate potential inflationary impacts.

Opportunity Costs

Opportunity cost is a foundational concept in economics, representing the potential benefits an individual, investor, or business misses out on when choosing one alternative over another. In the context of treasury bonds the opportunity cost can be seen through the lens of forgoing other potentially higher-yielding investments.

When investors buy government bonds, they essentially lock their money into a predetermined interest rate for a specified duration, be it for one-year bonds, retirement ten-year savings, or even three-month fixed-rate savings. The steady interest payment from these bonds, especially during subsequent annual interest periods, offers a sense of security. However, the government bonds risk and the modest interest rates might not always compete with the potential capital gains from, say, corporate bonds or stocks. For instance, an investor might earn a 3% yield on treasury bonds, but could potentially gain 7% or more with corporate bonds or equities.

Financial institutions often offer diverse investment options, and investment funds can sometimes provide returns indexed to inflation, mitigating the effects of rising prices. Thus, before deciding on the purchase of treasury bonds, investors should consider the bond case holistically, weighing the safety of the treasury against potential higher returns elsewhere. Such evaluations allow bond buyers to make informed choices, understanding the full spectrum of opportunity costs involved.

Why are Treasury bonds risk-free?

Treasury bonds are often touted as "risk-free" investments. But why is this the case?

One primary factor treasury bonds are deemed low-risk is because they're backed by the government's full faith and credit, making the prospect of default almost negligible. The Ministry of Finance issues these debt securities primarily to cover other expenses of the state budget. The robust financial machinery of governments, combined with the ability to generate revenue through taxation and other fiscal tools, ensures interest is paid consistently and on time.

For investors, treasury bonds present numerous opportunities for earning money. While their interest rate might be lower than riskier investments, the near-guaranteed interest payment, and the principal's safety, make them attractive, especially for long-term strategies like retirement ten-year savings or shorter commitments like three-month fixed-rate savings.

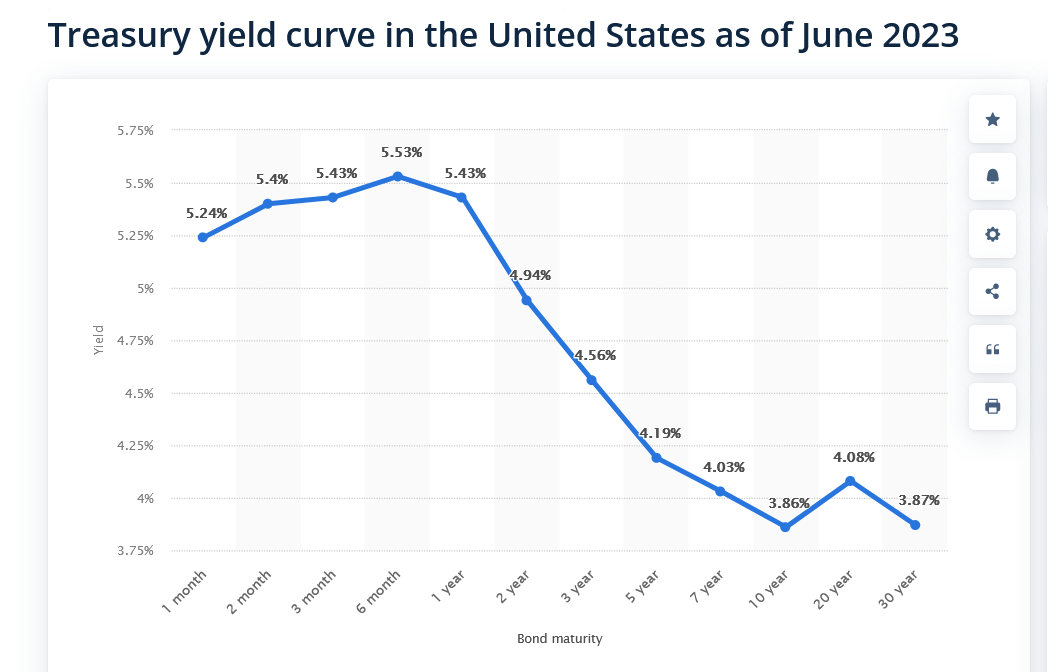

Based on data from Statista, as of June 30, 2023, the ten-year U.S. government bond had a yield of 3.86 percent, in contrast to the two-year bond's yield of 4.94 percent.

It’s important to note that the market for treasury bonds is highly liquid, meaning bond owners can easily sell bonds or make a purchase of bonds when required. The potential for capital gains, especially when interest rates fluctuate, can also not be ignored. All these factors combine to validate the expert analysis, deeming treasury bonds as a low-risk, steady-return investment avenue.

What type of bonds are less risky?

Even though bonds have established their reputation as comparatively safer trading instruments, some of them may hide serious pitfalls. However, when considering default risk, some bonds emerge as inherently safer than others. Understanding which bond carries the least risk of default can be paramount for investors looking to protect their capital and seek consistent returns. Below are the most popular and the least risky bonds.

1. Treasury Bonds: Topping the list are treasury bonds, often regarded as the gold standard in the bond universe. Backed by the full faith and credit of the issuing government, their default risk is extremely low. For instance, U.S. treasury bonds are considered virtually risk-free because they are supported by the U.S. government. Polish treasury bonds similarly provide a safe haven for investors wary of default risks. Here's a brief dive into their features:

-

Term: Typically ranges from one-year bonds to retirement ten-year savings.

- Value: Can be bought in various denominations, often starting at $1,000.

- Purpose: Helps finance other expenses of the state budget.

- Yield: Varies based on interest rates in subsequent years but is usually lower than riskier bonds due to the safety they provide.

- Liquidity: High, with options for early redemption of bonds or selling them in secondary markets.

Corporate Bonds: These are debt securities issued by companies. Although they offer higher interest rates compared to government bonds, they come with a higher risk since their ability to repay depends on the financial health of the issuing company.

-

Term: Diverse, from short-term to subsequent annual interest periods.

- Value: Based on the company's valuation and capital needs.

- Purpose: Financing company projects, expansions, or other ventures.

- Yield: Often higher than government bonds, reflecting the increased risk.

- Liquidity: Moderate, depending on the company's size and bond market conditions.

3. Municipal Bonds: These are issued by local government entities. While their interest may be tax-free, their default risk is higher than treasury bonds but usually lower than corporate bonds.

-

Term: Varies, often linked to specific municipal projects.

- Value: Depends on the financial requirement of the local government.

- Purpose: Fund public projects like schools, roads, or infrastructure.

- Yield: Competitive, often tax-free.

- Liquidity: Moderate, depending on the bond specifics and market interest.

Below is provided a comparison table for an easier understanding

| Type | Term | Value | Purpose | Yield | Liquidity |

| Treasury Bonds | 1-10 years | Starting at $1,000 | State budget expenses | Lower, based on subsequent interest rates | High |

| Corporate Bonds | Diverse | Based on company valuation | Company ventures | Higher, reflecting risk | Moderate |

| Municipal Bonds | Linked to projects | Based on municipal needs | Public projects | Competitive, often tax-free | Moderate |

While corporate bonds may tempt with higher yields, and municipal bonds lure with tax benefits, treasury bonds stand unchallenged as the safest from a default risk perspective. Whether one is a seasoned investor or looking to buy government bonds as their first investment, it's vital to choose wisely the bond type to one's risk appetite and financial objectives.

Investing in Treasury Bonds

If you're considering investing in treasury bonds, it's crucial to be aware of some key tactics and considerations.

-

Direct Purchase: One can buy government bonds directly, eliminating the need for intermediaries and additional fees. For instance, through different trading platforms where bond buyers can purchase treasury bonds directly from the government. This direct method ensures that the investor avoids any extraneous costs often associated with financial institutions or brokerages.

- Time Your Investments: Consider the phase of your financial journey. For one-year bonds, you might be looking at short-term goals. But if you're approaching retirement, ten-year savings or even annual reference savings might be more appropriate. When younger, individuals often aim for capital gains, leaning towards riskier assets. But as retirement approaches, the focus shifts to capital preservation. Treasury bonds, with their interest rate stability and minimal risk, can be an ideal tool in this phase. Bonds indexed to inflation, like four-year indexed savings or two-year reference savings, can also be considered to preserve purchasing power.

- Diversification through ETFs: Exchange Traded Funds (ETFs) that focus on treasuries offer another avenue. Treasury ETFs, especially those with a long-term T-bond component, are cost-effective and provide a diversified approach to bond investments. They can be blended with other bond varieties, like corporate bonds or even zero coupon bonds, allowing investors to spread their risk and maximize potential returns.

In conclusion: Key Takeaways

The dynamics of government bonds, particularly treasury bonds, have been honed over decades, reflecting their integral role in the global financial system. T-bonds have long been a staple in diversified portfolios. Their allure lies not only in the relative stability and security they offer, being backed by the full faith and credit of issuing governments, but also in the steady interest income they provide.

The purchase of bonds, especially in 2023, offers a blend of stability and potential returns. However, trading them requires a keen sense of timing and market insight. When considering adding treasury bonds to one's portfolio, having a holistic view of both their benefits and the risks involved ensures informed decisions and a safer financial future.

FAQ

Is a Treasury bond high risk?

Treasury bonds are generally considered safe because of the government's consistent history of fulfilling its debt commitments. Nonetheless, they can be influenced by changes in interest rates and inflation, affecting their worth.

Are Treasury savings bonds safe?

Many traders and investors often see treasury savings bonds as a dependable place to put their money, thanks to the trustworthiness of the government behind them. They might not make you rich quickly, but they have the potential to steadily grow your savings with a reliable interest rate.

)