Dollar to Zloty Forecast 2026 - 2030

Understanding the forex market dynamics is crucial for both novice and seasoned investors. It helps them make informed decisions and navigate the volatile currency market more smoothly. If you are interested in the short and long-term USD to PLN forecast, continue reading to get a detailed overview of the Dollar to Zloty pair for 2026, and beyond.

Table of Contents

KEY TAKEAWAYS

PRICE USD TO ZLOTY TODAY

USD TO PLN TECHNICAL ANALYSIS

WHAT AFFECTS DOLLAR TO ZLOTY RATE

HOW TO PREDICT THE USD/PLN EXCHANGE RATE

USD/PLN PRICE HISTORY

USD TO PLN FORECAST FOR 2026

USD TO PLN FORECAST FOR 2027

USD TO PLN FORECAST FOR 2028

USD TO PLN FORECAST FOR 2029

USD TO PLN FORECAST FOR 2030

CONCLUSION

FAQS

Key Takeaways

- USD/PLN indicates moderate yearly fluctuation.

- Forecasts indicate a gradual decline by 2030.

- Polish zloty may strengthen mid-decade.

- External factors heavily affect trends.

- Historical data helps guide expectations.

Price USD to Zloty today

J2T (Just2Trade) is an international analytical platform and brokerage that publishes market data and forecasts based on open sources and statistical information. We aggregate publicly available analytics to provide an objective view of currency trends. Below is an interactive USD/PLN chart from J2T, designed for easy visual comparison of market dynamics and expectations.

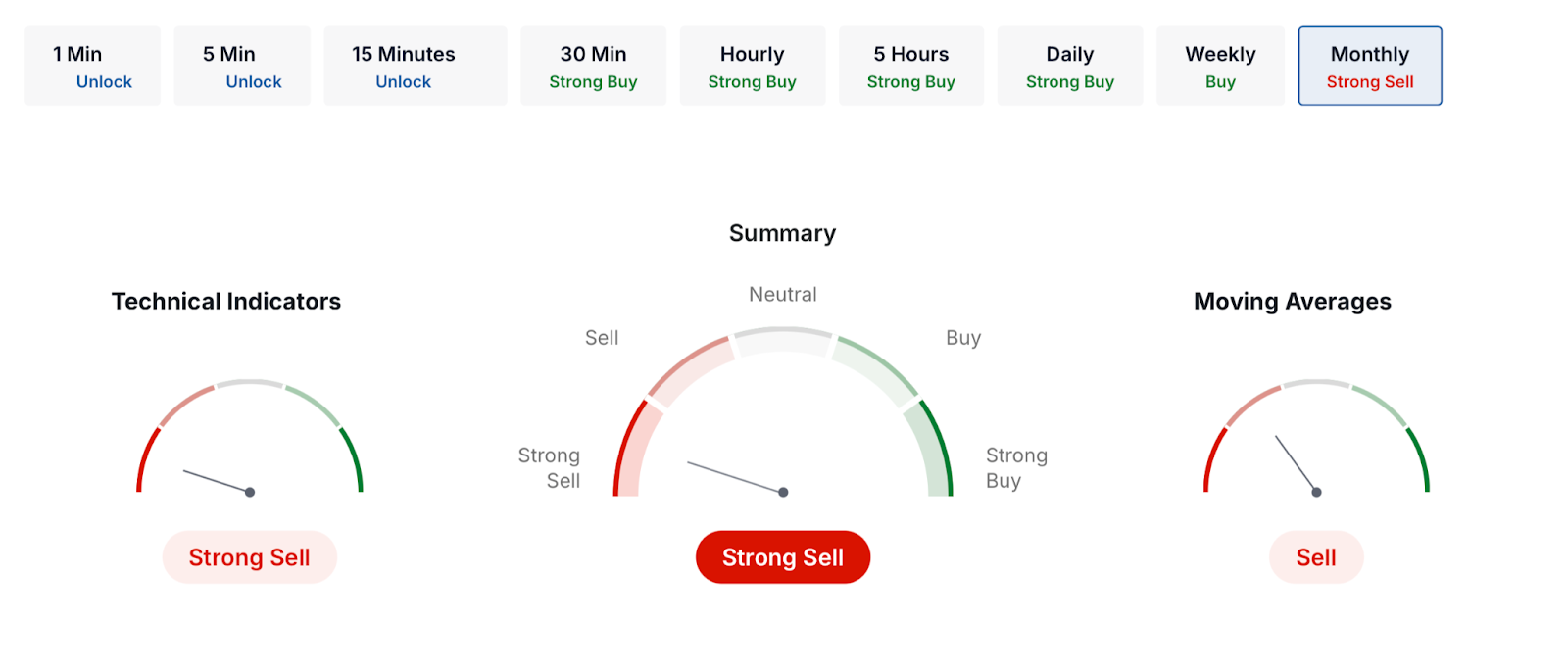

USD to PLN Technical Analysis

The USD to PLN technical setup shows a bearish short-term bias with limited upward momentum. Most indicators — RSI (40.4), MACD (–0.13), and ADX (36.6) — point to sustained selling pressure. Stochastic (17.9) and Williams %R (–81.1) highlight oversold conditions, suggesting the decline may slow but not yet reverse.

Moving averages remain mostly negative, as MA10 through MA100 signal “Sell,” while only MA5 and MA200 hint at mild buying interest. Key resistance is seen near 3.69–3.73 and support around 3.57–3.62, confirming a weak dollar outlook with limited rebound potential.

Technical Indicators:

| Name |

Value |

Action |

| RSI(14) |

55.436 |

Buy |

| STOCH(9,6) |

58.935 |

Buy |

| STOCHRSI(14) |

100 |

Oversold |

| MACD(12,26) |

-0.001 |

Sell |

| ADX(14) |

30.163 |

Neutral |

| Williams %R |

-9.279 |

Oversold |

| CCI(14) |

163.3883 |

Buy |

| ATR(14) |

0.0036 |

High Volatility |

| Highs/Lows(14) |

0.0029 |

Buy |

| Ultimate Oscillator |

59.018 |

Buy |

| ROC |

0.05 |

Buy |

| Bull/Bear Power(13) |

0.004 |

Buy |

Moving Averages:

| Name |

Simple |

Exponential |

| Value |

Action |

Value |

Action |

| MA5 |

3.5846 |

Buy |

3.5851 |

Buy |

| MA10 |

3.5829 |

Buy |

3.5843 |

Buy |

| MA20 |

3.5838 |

Buy |

3.5849 |

Buy |

| MA50 |

3.5872 |

Buy |

3.5860 |

Buy |

| MA100 |

3.5877 |

Buy |

3.5879 |

Buy |

| MA200 |

3.5916 |

Sell |

3.5951 |

Sell |

Pivot Points:

| Name |

S3 |

S2 |

S1 |

Pivot Points |

R1 |

R2 |

R3 |

| Classic |

3.5808 |

3.5827 |

3.5860 |

3.5879 |

3.5812 |

3.5931 |

3.5964 |

| Fibonacci |

3.5827 |

3.5847 |

3.5859 |

3.5879 |

3.5899 |

3.5911 |

3.5931 |

| Camarilla |

3.5880 |

3.5884 |

3.5889 |

3.5879 |

3.5899 |

3.5904 |

3.5908 |

| Woodie’s |

3.5816 |

3.5831 |

3.5868 |

3.5883 |

3.5920 |

3.5935 |

3.5972 |

| DeMark’s |

– |

– |

3.5870 |

3.5884 |

3.5922 |

– |

– |

What Affects DOLLAR TO ZLOTY Rate

Several key factors affect the movement of the PLN exchange rate and changes in the USD to PLN forecast.

Interest rates set by central banks such as the Federal Reserve and the National Bank of Poland can have an effect on the value of the US dollar and Polish zloty.

High levels of inflation in either nation typically have a negative impact on the national currency, impacting the exchange rate of the Polish zloty.

Economic indicators like GDP growth, unemployment rates, and trade balances have a significant impact on the Dollar to Zloty predictions.

Global Events such as political tensions, exchange deals, and market feelings are also key factors in currency rate changes.

How to predict the USD/PLN exchange rate

When making a USD to PLN forecast, pay attention to the important factors outlined above. If the central bank of Poland increases interest rates, the zloty could appreciate, leading to a decrease in the exchange rate. However, the value of the dollar is also affected by how well the U.S. economy is doing and the trend in inflation.

Monitoring global trends, especially in commodities and trade, can also help in making an accurate zloty forecast. One of the key aspects of robust predictions is your knowledge and relevance of the information you obtain, so stay informed and keep educating yourself to get good results in forecasting and trading.

USD/PLN Price History

Throughout 2024, the USD/PLN exchange rate experienced moderate fluctuations, driven by changes in global interest rates, inflation data, and geopolitical pressures. The USD to PLN forecast from early 2024 indicated short-term volatility, and the dollar to zloty forecast remained sensitive to U.S. monetary policy.

During the first half of 2025, the pair continued its downward trajectory, with the zloty gradually strengthening against the dollar. The average rate declined from around 4.05 PLN in January to approximately 3.68 PLN by June, reflecting improving Polish macroeconomic conditions and easing global inflationary pressure.

The USD to PLN history for 2025 indicates a mixed outlook, with analysts expecting fluctuations driven by economic trends, central bank actions, and global trade dynamics. The dollar to zloty analysis suggests the exchange rate may experience modest short-term changes, affected by investor sentiment and macroeconomic indicators.

The Polish zloty correlation in 2025 remained sensitive to geopolitical shifts, with potential shifts in USD PLN sentiment next 2026 year.

| Month |

Average Exchange Rate (PLN) |

| January 2024 | 4.00 |

| February 2024 | 3.98 |

| March 2024 | 3.95 |

| April 2024 | 4.02 |

| May 2024 | 4.08 |

| June 2024 | 4.12 |

| July 2024 | 4.10 |

| August 2024 | 4.07 |

| September 2024 | 4.03 |

| October 2024 | 4.00 |

| November 2024 | 3.96 |

| December 2024 | 3.92 |

| January 2025 | 4.05 |

| February 2025 | 3.98 |

| March 2025 | 3.86 |

| April 2025 | 3.81 |

| May 2025 | 3.75 |

| June 2025 | 3.68 |

| July 2025 | 3.63 |

| August 2025 | 3.65 |

| September 2025 | 3.64 |

| October 2025 | 3.64 |

| November 2025 | 3.66 |

| December 2025 | 3.61 |

USD to PLN Forecast for 2026

The USD to PLN forecast for 2026 indicates moderate volatility with a stronger dollar at the beginning of the year, followed by a steady decline through the middle months. The zloty is projected to strengthen gradually from spring onward, with the pair reaching its lowest levels between June and August before stabilizing toward year-end.

This suggests a mild downward trend overall, reflecting resilient Polish fundamentals and easing global inflation. Traders should watch for short-term corrections, as shifts in monetary policy and global risk sentiment may briefly affect the USD/PLN trajectory.

| Month |

Minimum Rate |

Average Rate |

Maximum Rate |

| January 2026 | zł 3.61 | zł 3.66 | zł 3.77 |

| February 2026 | zł 3.66 | zł 3.77 | zł 3.83 |

| March 2026 | zł 3.61 | zł 3.66 | zł 3.77 |

| April 2026 | zł 3.58 | zł 3.63 | zł 3.68 |

| May 2026 | zł 3.49 | zł 3.54 | zł 3.63 |

| June 2026 | zł 3.38 | zł 3.43 | zł 3.54 |

| July 2026 | zł 3.36 | zł 3.41 | zł 3.46 |

| August 2026 | zł 3.30 | zł 3.35 | zł 3.41 |

| September 2026 | zł 3.35 | zł 3.40 | zł 3.45 |

| October 2026 | zł 3.40 | zł 3.45 | zł 3.50 |

| November 2026 | zł 3.45 | zł 3.55 | zł 3.60 |

| December 2026 | zł 3.48 | zł 3.53 | zł 3.58 |

USD to PLN Forecast for 2027

The USD to PLN forecast for 2027 indicates a gradual downward trend, with the Polish zloty expected to strengthen through most of the year. The dollar may face continued pressure as global economic conditions stabilize and local monetary policy in Poland remains firm.

While short-term volatility is likely, the overall direction points to a softer USD and moderate appreciation of the PLN toward year-end. Traders should monitor inflation data and interest rate updates, as they will shape monthly fluctuations shown in the chart below.

| Month |

Minimum Rate |

Average Rate |

Maximum Rate |

| January 2027 | zł 3.40 | zł 3.45 | zł 3.53 |

| February 2027 | zł 3.35 | zł 3.40 | zł 3.45 |

| March 2027 | zł 3.40 | zł 3.47 | zł 3.52 |

| April 2027 | zł 3.32 | zł 3.37 | zł 3.47 |

| May 2027 | zł 3.37 | zł 3.44 | zł 3.49 |

| June 2027 | zł 3.38 | zł 3.43 | zł 3.48 |

| July v | zł 3.37 | zł 3.42 | zł 3.47 |

| August 2027 | zł 3.42 | zł 3.48 | zł 3.53 |

| September 2027 | zł 3.38 | zł 3.43 | zł 3.48 |

| October 2027 | zł 3.28 | zł 3.33 | zł 3.43 |

| November 2027 | zł 3.18 | zł 3.23 | zł 3.33 |

| December 2027 | zł 3.23 | zł 3.33 | zł 3.38 |

USD to PLN Forecast for 2028

The USD to PLN forecast for 2028 points to a continued downward trend, with the Polish zloty expected to strengthen steadily throughout the year. The dollar to zloty forecast indicates gradual depreciation of the USD, reflecting easing global inflation and resilient Polish fundamentals.

Market sentiment suggests limited volatility and a persistent bearish tone for the dollar. The PLN outlook remains broadly positive, supported by stable domestic growth and cautious monetary policy.

| Month |

Minimum Rate |

Average Rate |

Maximum Rate |

| January 2028 | zł 3.33 | zł 3.43 | zł 3.48 |

| February 2028 | zł 3.33 | zł 3.38 | zł 3.43 |

| March 2028 | zł 3.23 | zł 3.28 | zł 3.38 |

| April 2028 | zł 3.28 | zł 3.34 | zł 3.39 |

| May 2028 | zł 3.19 | zł 3.24 | zł 3.34 |

| June 2028 | zł 3.09 | zł 3.14 | zł 3.24 |

| July 2028 | zł 3.14 | zł 3.22 | zł 3.27 |

| August 2028 | zł 3.14 | zł 3.19 | zł 3.24 |

| September 2028 | zł 3.07 | zł 3.12 | zł 3.19 |

| October 2028 | zł 2.98 | zł 3.03 | zł 3.12 |

| November 2028 | zł 2.90 | zł 2.94 | zł 3.03 |

| December 2028 | zł 2.94 | zł 3.03 | zł 3.08 |

USD to PLN Forecast for 2029

Analysts expect the USD to PLN pair to show a mixed but stabilizing outlook in 2029. The year may begin with mild weakness in the dollar, followed by gradual recovery in the second half as global demand and monetary conditions improve. While long-term projections remain uncertain, current forecasts point to moderate appreciation toward the end of the year.

| Month |

Minimum Rate |

Average Rate |

Maximum Rate |

| January 2029 | zł 3.02 | zł 3.07 | zł 3.12 |

| February 2029 | zł 3.07 | zł 3.16 | zł 3.21 |

| March 2029 | zł 3.16 | zł 3.25 | zł 3.30 |

| April 2029 | zł 3.10 | zł 3.15 | zł 3.25 |

| May 2029 | zł 3.15 | zł 3.24 | zł 3.29 |

| June 2029 | zł 3.19 | zł 3.24 | zł 3.29 |

| July 2029 | zł 3.24 | zł 3.32 | zł 3.37 |

| August 2029 | zł 3.31 | zł 3.36 | zł 3.41 |

| September 2029 | zł 3.21 | zł 3.26 | zł 3.36 |

| October 2029 | zł 3.26 | zł 3.36 | zł 3.41 |

| November 2029 | zł 3.32 | zł 3.37 | zł 3.42 |

| December 2029 | zł 3.34 | zł 3.39 | zł 3.45 |

USD to PLN Forecast for 2030

The USD to PLN forecast for 2030 points to a gradual strengthening of the US dollar against the Polish zloty. The dollar to zloty forecast suggests steady appreciation throughout the year, supported by improving global risk sentiment and potential monetary tightening in the US.

After a stable first quarter, the USD is expected to gain momentum, reaching its highest levels around late summer and early autumn before stabilizing toward the end of the year.

| Month |

Minimum Rate |

Average Rate |

Maximum Rate |

| January 2030 | zł 3.70 | zł 3.74 | zł 3.78 |

| February 2030 | zł 3.73 | zł 3.79 | zł 3.83 |

| March 2030 | zł 3.73 | zł 3.79 | zł 3.84 |

| April 2030 | zł 3.76 | zł 3.80 | zł 3.84 |

| May 2030 | zł 3.80 | zł 3.82 | zł 3.85 |

| June 2030 | zł 3.71 | zł 3.76 | zł 3.82 |

| July 2030 | zł 3.74 | zł 3.79 | zł 3.88 |

| August 2030 | zł 3.83 | zł 3.89 | zł 3.97 |

| September 2030 | zł 3.88 | zł 3.94 | zł 4.00 |

| October 2030 | zł 3.79 | zł 3.87 | zł 3.99 |

| November 2030 | zł 3.79 | zł 3.86 | zł 3.91 |

| December 2030 | zł 3.78 | zł 3.83 | zł 3.90 |

Conclusion

In conclusion, the USD to PLN forecast presents a mixed outlook from 2026 to 2030. While 2025 showed a slight downturn, 2026 may bring minor fluctuations in both positive and negative directions. Long-term predictions remain uncertain, with experts divided between slow growth and continued downward movement.

It’s crucial to consider that long-term forecasts may not be entirely accurate, making risk management essential when planning currency strategies.

Traders should monitor trends closely to optimize entry points. Ready to act on forecasts? Open a real forex account here.

FAQs

What is the USD to PLN prediction for 2026?

The 2026 forecast suggests moderate fluctuations, with potential strength in early months and a gradual decline later. Market sentiment, interest rates, and inflation will likely shape the yearly trend.

Is the zloty getting stronger?

Different sources come with slightly different forecasts. But mainly, the long-term trend for USD to PLN forecast is positive.

Why is PLN going down?

The PLN often weakens due to external factors like a strong U.S. dollar, global inflation, or investor risk aversion. Domestic issues, such as slower economic growth in Poland, can also drag the zloty down in the market.

How strong is the US Dollar in Poland?

The US Dollar remains relatively powerful in Poland, offering favorable exchange rates for travelers and investors. However, its strength varies with global economic shifts, central bank policies, and domestic inflation in both countries.

Is PLN a stable currency?

The Polish Zloty is relatively stable but can be volatile during global market turbulence. Its value depends on both domestic policies and external factors like the strength of the U.S. dollar, influencing the zloty forecast regularly.