Understanding Financial Risk: Management Strategies and Importance

)

The table of content

Key Takeaways

What Is Financial Risk?

Six Major Types of Financial Risks

What is Financial Risk Management?

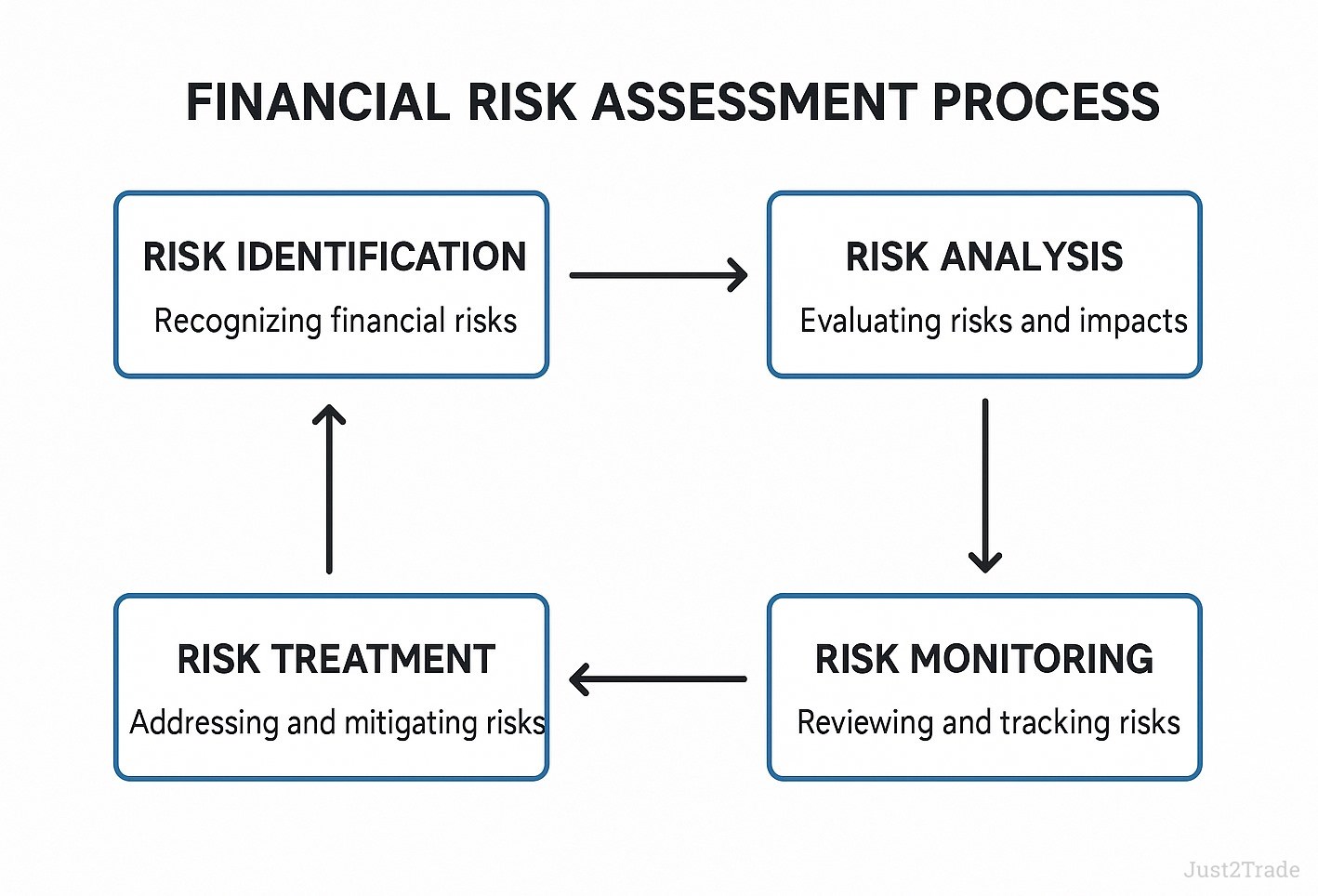

Financial Risk Assessment Process

Financial Risk Management Techniques

Using Statistical Measures for Risk Management

The Role of Finance in Risk Management

Active vs. Passive Risk Management Approaches

Practical Risk Management Implementation

Failures and Benefits of Risk Management

Conclusion

FAQs

Risk management in finance serves as the cornerstone of sound investment decisions and business operations. This critical finance function involves identifying potential downsides in financial decisions and determining whether to accept these risks or implement mitigation strategies. Effective financial risk management is an ongoing process that balances potential risks and rewards to optimize financial outcomes. Modern organizations rely on financial management software and proven methodologies to navigate complex market conditions while protecting capital.

Key Takeaways

- Financial risk management identifies and controls potential threats to organizational financial outcomes and investment returns.

- Six major financial risks include operational, credit, market, liquidity, legal, and foreign exchange risks.

- Effective risk assessment follows systematic identification, analysis, treatment, and ongoing monitoring processes.

- Key risk management techniques include avoidance, retention, risk sharing, transference, and loss prevention – each tailored to different risk types and organizational contexts.

- Finance teams leverage statistical measures and cloud-based financial management software for proactive risk management.

What Is Financial Risk?

Financial risk represents any type of risk associated with company financing, financial transactions, and the likelihood of losing money on business investments. Understanding what is risk management in finance begins with recognizing that financial risks are inherent in virtually all investment decisions. These risks manifest as credit risk when customers fail to meet contractual obligations, currency risk from foreign exchange fluctuations, interest rate risk affecting borrowing costs, liquidity risk when insufficient cash flow threatens operations, and inflation risk that erodes purchasing power.

The relationship between risk-taking and potential returns forms the foundation of modern finance theory. Higher potential returns typically accompany greater financial risks, making risk assessment crucial for investment managers and financial institutions. Business investment decisions must account for various risk factors that could lead to capital loss, while financial instruments carry inherent risks requiring careful evaluation.

Six Major Types of Financial Risks

)

Operational Risk

Operational risk emerges from unforeseen events in day-to-day operations, including system failures, human errors, and process breakdowns. These risks arise from internal factors and can significantly impact financial performance if not properly managed.

Credit Risk

Credit risk occurs when customers, borrowers, or counterparties fail to meet their financial obligations. This fundamental risk affects banks, investment firms, and any organization extending credit or engaging in financial transactions with external parties.

Market Risk

Market risk relates to broader financial markets and includes systematic risk that affects entire market segments. Interest rates, stock prices, and commodity values contribute to market risk exposure impacting investment portfolios and corporate valuations.

Liquidity Risk

Liquidity risk manifests when organizations lack sufficient cash flow to meet immediate financial obligations. This risk can force companies to sell assets at unfavorable prices or accept expensive financing to maintain operations.

Legal Risk

Legal risk stems from regulatory compliance failures and changing legal requirements. Financial institutions face particular exposure to regulatory risk that can result in significant penalties and operational restrictions.

Foreign Exchange Risk

Foreign exchange risk affects organizations with international operations. Currency fluctuations can impact cash flow, asset values, and financial statements, requiring active management strategies to mitigate potential losses.

What is Financial Risk Management?

Financial risk management is the process organizations undertake to understand and manage financial risks as part of comprehensive enterprise risk management policies. This strategic approach involves identifying potential financial risks, analyzing their probability and impact, and implementing appropriate treatment strategies. Risk managers and finance teams collaborate to develop integrated frameworks that protect organizational assets while enabling pursuit of strategic objectives.

The management process encompasses both defensive and offensive elements. Defensively, it seeks to minimize potential financial losses through risk mitigation strategies. Offensively, it enables organizations to take calculated risks that align with their risk tolerance and strategic goals. Investment decisions require careful balance between potential rewards and acceptable risk levels, with finance leaders providing expertise to guide these critical choices.

Financial Risk Assessment Process

)

The risk assessment methodology follows a systematic approach starting with comprehensive risk identification. Financial analysts examine financial statements, market conditions, and operational data to identify potential risks that could impact organizational objectives. This identification phase requires understanding how external events and internal factors create risk exposure across different business areas.

Risk analysis involves detailed evaluation of risk probability and potential impact. Organizations use quantitative and qualitative methods to assess risks, employing risk scoring systems that enable prioritization based on severity and likelihood. This analysis considers both immediate and long-term consequences while accounting for risk interdependencies.

Risk treatment involves four primary approaches: acceptance, avoidance, transference, and mitigation. Risk acceptance means acknowledging risks while taking no specific action. Risk avoidance eliminates exposure entirely by avoiding certain activities. Risk transference shifts responsibility to third parties through insurance or contractual arrangements. Risk mitigation reduces probability or impact through control measures.

Financial Risk Management Techniques

)

Avoidance Strategy

Risk avoidance involves selection of the safest assets and elimination of high-risk activities. While this technique minimizes potential losses, it may limit growth opportunities. Organizations pursuing avoidance strategies favor government bonds and low-volatility investments.

Retention Approach

Risk retention involves accepting certain risks in pursuit of high returns. This technique requires sophisticated risk analysis to ensure retained risks align with organizational capacity. Investment managers often retain market risk while hedging specific exposures outside their expertise.

Risk Sharing

Risk sharing distributes exposure among multiple parties, reducing individual risk burden while maintaining access to opportunities. Reinsurers, syndicated loans, and joint ventures exemplify mechanisms that enable participation in large transactions while limiting individual exposure.

Risk Transfer

Risk transferring shifts exposure to specialized parties through insurance, derivatives, or contractual arrangements. This enables organizations to maintain operations while transferring specific risks to parties better equipped to manage them.

Loss Prevention

Loss prevention focuses on balancing volatile investments with conservative choices to reduce overall portfolio risk. This approach maintains growth potential while limiting downside exposure through diversification and strategic asset allocation.

Using Statistical Measures for Risk Management

Standard deviation serves as the primary statistical tool for measuring investment risk through quantification of return volatility around expected outcomes. This numeric risk evaluation helps investors understand potential fluctuations and make informed decisions based on their risk tolerance levels. The relationship between standard deviation and risk follows normal distributions, creating the bell-shaped curve representing probability ranges for investment outcomes.

Historical analysis of the S&P 500 Index demonstrates practical application of statistical risk measures. Over extended periods, the index shows average annual returns with corresponding standard deviations indicating typical variation ranges. These statistical measures enable portfolio management decisions by quantifying trade-offs between expected returns and volatility.

Investment managers use these tools to construct portfolios that align with client risk appetite while optimizing return potential. Advanced techniques also help identify systematic risk factors and correlation patterns influencing portfolio behavior across different market environments.

The Role of Finance in Risk Management

Finance leaders play critical roles in organizational risk management through both advisory and analytical functions. Their expertise in financial data analysis positions them uniquely to provide risk assessments and strategic advice to executive teams. This leadership role extends beyond traditional accounting to encompass comprehensive risk evaluation and strategic guidance.

The analytical capabilities of finance professionals enable conversion of complex financial data into actionable insights regarding risk probability, impact, and mitigation strategies. By analyzing data patterns, finance teams identify emerging risks before they materialize into significant problems. This proactive risk management approach helps organizations avoid data silos and ensures comprehensive risk visibility.

Finance departments also coordinate risk management activities across organizational units, ensuring consistent approaches and comprehensive coverage. Their understanding of financial instruments, market dynamics, and regulatory requirements enables effective coordination between operational and strategic risk management initiatives.

Active vs. Passive Risk Management Approaches

Passive Management Strategy

Passive management focuses on beta, which represents market risk and measures portfolio sensitivity to overall market movements. This approach accepts market risk while minimizing active decision-making and associated costs. Passive vehicles like index funds provide broad market exposure with minimal fees, making them attractive for investors seeking market returns.

Beta represents the relationship between portfolio returns and market returns, with values above 1.0 indicating higher volatility than the market and values below 1.0 suggesting lower volatility.

Active Management Approach

Active strategies seek alpha, which represents excess returns beyond market expectations. Fund managers pursuing active approaches attempt to outperform market benchmarks through security selection and strategic positioning. However, these approaches typically involve higher fees and greater complexity.

The cost implications of active versus passive approaches significantly impact long-term returns. While passive management minimizes fees, active management requires payment for research and portfolio management services.

Risk Reporting and Technology Solutions

Integrated risk reporting combines financial and non-financial metrics to provide comprehensive risk visibility across organizational functions. Modern reporting systems incorporate both historical performance data and forward-looking scenario analysis to support strategic decision-making.

Cloud-based financial management software enhances risk management capabilities through advanced scenario planning and modeling features. These technology solutions enable organizations to model various "what if" scenarios, testing potential impacts of different risk events on financial performance. Scenario planning capabilities help organizations prepare contingency plans and develop responsive strategies.

Technology solutions also facilitate real-time risk monitoring and automated reporting systems providing continuous oversight of key risk indicators. Integration capabilities ensure risk data flows seamlessly between different organizational systems and reporting platforms.

Practical Risk Management Implementation

Personal Finance Applications

Personal financial risk management follows a systematic process beginning with identifying financial goals and risk tolerance levels. Individuals must assess their capacity for potential losses while considering time horizons and liquidity needs. Research helps evaluate different investment options and their associated risk profiles.

Ongoing monitoring and adjustment prove essential for success. Regular portfolio reviews ensure investment allocations remain appropriate as circumstances change, while systematic rebalancing maintains desired risk levels over time.

Organizational Implementation

Companies manage operational risk through systematic identification, assessment, and control implementation supported by continuous monitoring systems. This approach addresses risks arising from day-to-day operations while ensuring alignment with strategic objectives.

Risk management implementation requires clear governance structures, defined responsibilities, and regular reporting mechanisms. Organizations must establish risk tolerance levels, implement appropriate controls, and maintain ongoing oversight to ensure effectiveness.

Failures and Benefits of Risk Management

Historical Failures

Inadequate risk management can create severe consequences, as demonstrated during the Great Recession of 2007-2008. The financial crisis resulted from widespread failures in risk assessment, particularly regarding mortgage-backed securities and related financial instruments. These failures created systemic problems affecting global financial markets.

Poor risk management practices contributed to excessive leverage, inadequate capital reserves, and insufficient understanding of complex financial products. When market conditions deteriorated, these weaknesses amplified losses and created cascading effects throughout the financial system.

Risk Management Benefits

Effective risk management enables cross-functional collaboration and process optimization while reducing potential risk impact across organizational functions. Organizations with robust risk management systems demonstrate enhanced confidence in their financial reporting and decision-making processes.

Pros & Cons of Risk Management:

| Advantages |

Disadvantages |

| Reduced potential losses |

Implementation costs |

| Enhanced decision-making |

Resource requirements |

| Improved stakeholder confidence |

Potential over-cautiousness |

| Better regulatory compliance |

Ongoing maintenance needs |

Risk management also provides competitive advantages through improved strategic planning and resource allocation. Organizations that effectively manage risks can pursue growth opportunities with greater confidence while maintaining financial stability.

Conclusion

Risk management represents an essential component of modern finance functions, enabling organizations to develop comprehensive strategies for resilience against unexpected events. Through systematic identification, analysis, and treatment of financial risks, robust risk mitigation strategy balances potential rewards with acceptable risk levels. The combination of proven risk management techniques, advanced technology solutions, and disciplined implementation helps mitigate losses while supporting strategic growth objectives.

FAQs

What is the meaning of financial risk management?

Financial risk management is the process of identifying, analyzing, and controlling potential financial risks that could negatively impact an organization's capital and earnings. It involves implementing financial risk management strategies and policies to minimize the likelihood and impact of financial losses while optimizing returns within acceptable risk parameters.

How to identify financial risk?

Financial risk identification involves systematic analysis of financial statements, market conditions, operational processes, and external factors. Key methods include reviewing historical loss data, conducting scenario analysis, monitoring key risk indicators, and assessing regulatory changes that could create new risks.

What is an example of risk management in financial management?

A practical example involves a multinational company using currency hedging to manage foreign exchange risk. The company identifies exposure from international operations, analyzes potential impact from currency fluctuations, and implements forward contracts to lock in exchange rates, reducing uncertainty in cash flows.

What are the 5 stages of risk management?

The five stages include: 1) Risk identification through comprehensive assessment, 2) Risk analysis involving probability and impact evaluation, 3) Risk evaluation and prioritization, 4) Risk treatment through avoidance, mitigation, transfer, or acceptance strategies, and 5) Risk monitoring through ongoing oversight and reporting systems using financial risk management tools.