Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Community Health Systems, Inc. CYH recently announced that it has partnered with Mark Cuban Cost Plus Drug Company (Cost Plus Drugs) to purchase select drugs at a low cost. With this partnership, CYH becomes the first national healthcare system to buy select drugs from Cost Plus Drugs and is expected to benefit from better affordability and high drug quality.

This move bodes well for Community Health as all the companies in the Medical space are grappling with the high cost of drugs amid inflation. This partnership will allow CYH’s hospitals in Texas and Pennsylvania to initially source drugs like norepinephrine and epinephrine, which are used to treat life-threatening diseases. These drugs are often high in demand and low in supply, leading to high costs incurred by health organizations. CYH and Cost Plus Drugs aim to reduce the rising costs of pharmaceuticals, lessen drug shortages and waste and improve patient safety.

To address drug shortages further, Cost Plus Drugs is also opening a 22,000-square-foot drug manufacturing plant in Dallas, TX. This move will improve CYH’s odds of facing a manufacturing delay in sourcing essential drugs in its Texas hospital setting. Initiatives like these are expected to aid CYH in achieving its 2024 target of adjusted EBITDA in the range of $1.475-$1.625 billion. With better margins, CYH is expected to report an improved bottom line soon.

Cost Plus Drugs will also provide alternative vial sizes to CHS-affiliated hospitals, reducing drug wastage. CYH will be able to order supplies of drugs in quantities per its needs. Offering drugs in vial sizes will also improve the quality of patient care, reducing the chances of dosage errors. Such innovations and disruptions in the healthcare segment are expected to benefit hospitals and patients alike.

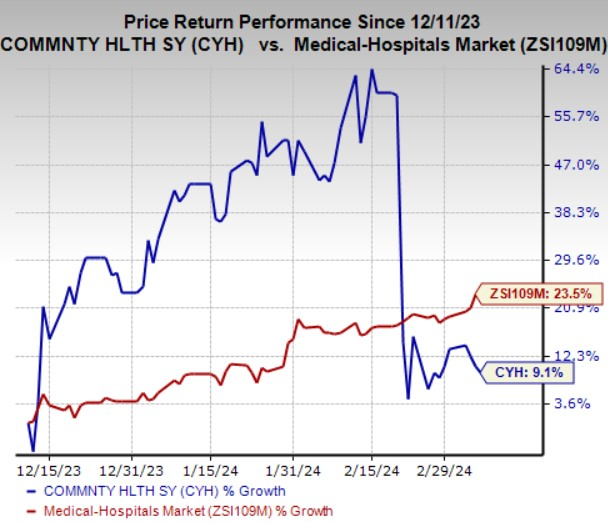

Shares of Community Health have gained 9.1% in the past three months compared with the industry’s 23.5% growth. CYH currently carries a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Some better-ranked stocks from the Medical space are HCA Healthcare, Inc. HCA, Medpace Holdings, Inc. MEDP and DexCom, Inc. DXCM. While HCA Healthcare and Medpace sport a Zacks Rank #1 (Strong Buy), DexCom carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

HCA Healthcare’s earnings surpassed the Zacks Consensus Estimate in three of the last four quarters, missing once, the average beat being 9.8%. The Zacks Consensus Estimate for HCA’s 2024 earnings and revenues suggests an improvement of 7.8% and 6.2% from the respective year-ago reported figures.

The consensus estimate for HCA’s 2023 earnings has moved 0.9% north in the past 30 days. Shares of HCA have gained 29.1% in the past year.

Medpace’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 12.4%. The Zacks Consensus Estimate for MEDP’s 2023 earnings and revenues suggests an improvement of 19.1% and 15.9% from the respective year-ago reported figures.

The consensus estimate for Medpace’s 2024 earnings has moved 5.3% north in the past 30 days. Shares of MEDP have gained 107.1% in the past year.

DexCom’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 32.8%. The consensus estimate for DXCM’s 2024 earnings and revenues suggests an improvement of 14.5% and 19% from the respective year-ago reported figures.

The consensus estimate for DexCom’s 2024 earnings has moved 1.8% north in the past 30 days. Shares of DXCM have rallied 18.2% in the past year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.