Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Guess?, Inc. GES and WHP Global, a global brand management firm, completed the previously announced (on Feb 16, 2024) acquisition of rag & bone, a New York-based fashion brand. Guess? paid $57.1 million for the acquisition, apart from contributions from WHP Global.

Concurrently, GES now owns all the operating assets of rag & bone, while both parties have jointly acquired rag & bone’s intellectual property. Guess? expanded its existing asset-based revolving credit facility by $50 million to reach $200 million in relation to the acquisition.

The acquisition of rag & bone reinforces Guess?’ long-term growth strategy to make a bigger and more powerful business and delivering best products to its customers. The deal will help rag & bone accelerate its global expansion by leveraging Guess? and WHP Global’s platforms, as well as distribution and licensee partners globally. The buyout will enable it to diversify its portfolio and bring together complementary price points and customer bases.

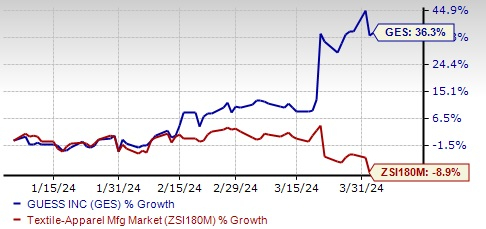

Image Source: Zacks Investment Research

Guess? is benefiting from robust brand momentum globally and strong customer response to its collections across various product categories. Management remains optimistic about its robust global platform, which will facilitate the growth and expansion of the company. These factors aided the company’s recently released fourth-quarter fiscal 2024 results, with the top and the bottom line increasing year over year and beating the Zacks Consensus Estimate.

GES is optimistic about the fiscal 2025, wherein it expects to surpass $3 billion in revenues for the first time, supported by an impressive growth plan for its core business, the integration of rag & bone into its portfolio and the introduction of Guess Jeans to cater to the demand from Generation Z consumers. Impressively, Guess? anticipates revenues to grow in the range of 11.5-13.5% in the fiscal 2025. For the first quarter of fiscal 2025, management expects revenue growth of 1-2%.

The Zacks Rank #3 (Hold) company’s shares have surged 36.3% in the past three months against the industry’s decline of 8.9%.

Ralph Lauren RL, which designs, markets and distributes lifestyle products, currently sports a Zacks Rank #1 (Strong Buy). RL has a trailing four-quarter earnings surprise of 18.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ralph Lauren’s current fiscal-year sales and earnings indicates growth of 2.7% and 22.7%, respectively, from the year-ago reported number.

Crocs CROX, which designs, develops, manufactures, markets, distributes and sells casual lifestyle footwear and accessories, currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Crocs’ current fiscal-year sales and earnings suggests growth of 3.9% and 2.9%, respectively, from the year-ago reported numbers. CROX has a trailing four-quarter earnings surprise of 14.2%, on average.

PVH Corp. PVH carries a Zacks Rank #2 at present. PVH, which operates as an apparel company, has a trailing four-quarter earnings surprise of 9.2%, on average.

The Zacks Consensus Estimate for PVH Corp.’s current fiscal-year earnings suggest growth of 11.9%, from the year-ago reported figure.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof... and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with "black gold."

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you'll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don't want to miss these recommendations.

Download your free report now to see them.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.