Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Primerica's PRI compelling portfolio, strong market presence, sturdy distribution channel and solid capital position poise it well for growth. These, coupled with optimistic growth projections, make it worth retaining in one’s portfolio.

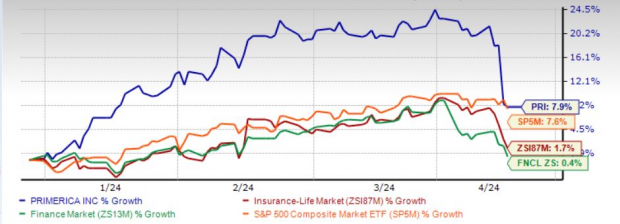

Shares of this Zacks Rank #3 (Hold) company have rallied 7.9% year to date, outperforming 1.7%, 0.4% and 7.6% growth of the industry, the Finance sector and the Zacks S&P 500 composite, respectively, in the same period. It has a VGM Score of B.

The Zacks Consensus Estimate for 2024 earnings has moved 1 cent north in the past seven days, reflecting analysts’ optimism. Primerica envisions being a successful senior health business while continuing to enhance its shareholders’ value.

The Zacks Consensus Estimate for Primerica’s 2024 earnings is pegged at $17.76 per share, indicating an increase of 10.5% on 5.6% higher revenues of $3 billion. The Zacks Consensus Estimate for Primerica’s 2025 earnings is pegged at $19.51 per share, indicating an increase of 9.8% on 4.6% higher revenues of $3.1 billion. Earnings of this second-largest issuer of term-life insurance coverage in North America have risen 17.6% in the last five years, outperforming the industry average of 5.6%.

Return on equity (ROE), a profitability measure to identify how efficiently a company is utilizing its shareholders’ funds, has been improving over the last several years. PRI’s trailing 12-month ROE of 27.8% is better than the industry average of 15.4%.

Also, the return on invested capital in the trailing 12 months was 7%, better than the industry average of 0.7%, reflecting PRI’s efficiency in utilizing funds to generate income.

Image Source: Zacks Investment Research

PRI noted that 48% of middle-income Americans will not be ready for retirement based on their investment and savings habits. This is where life-licensed sales representatives will play a major role in capitalizing on the growth opportunities. Management estimates a 3% rise in sales force size in 2024.

A strong demand for protection products should drive sales growth and policy persistency. A strong business model makes the company well-poised to cater to the middle market's increased demand for financial security.

Banking on premiums from new sales, PRI estimates adjusted direct premiums to grow 5% to 6% in 2024 at the Term Life segment. Demand should continue to remain strong on the back of its insurance products launched in the fall of 2022.

Licensed representatives act as catalysts, contributing to the operational results of the insurer. For 2024, the insurer estimates a 3-5% rise in the number of Term Life policies and a 5% rise in Investment and Savings Products sales.

Life insurers are direct beneficiaries of an improving interest rate environment. An improved interest rate environment should aid net investment income.

Apart from having solid liquidity, Primerica has been strengthening its balance sheet by improving its leverage ratio. It scores strongly with credit rating agencies.

Management believes that its solid Term-life insurance business ensures consistent free cash flow. Banking on this strength, the board recently approved a $425 million buyback program through next year. This apart, it has been hiking dividends every year since 2010. Dividends increased at a five-year CAGR of 17.1%. Notably, its free cash flow conversion has remained more than 100% over the last many quarters, reflecting its solid earnings.

Some better-ranked stocks from the insurance industry are Employers Holdings EIG, Reinsurance Group of America RGA and Manulife Financial Corporation MFC.

Employers Holdings beat estimates in the last four quarters. The stock has gained 8.5% year to date. The Zacks Consensus Estimate for EIG’s 2024 and 2025 earnings has moved 6.6% and 8.8% north, respectively, in the past 60 days. It sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Reinsurance Group delivered a four-quarter average earnings surprise of 24.39%. The stock has gained 12.9% year to date. The Zacks Consensus Estimate for RGA’s 2024 and 2025 earnings has moved 0.4% and 0.8% north, respectively, in the past seven days. It carries a Zacks Rank #2 (Buy).

Manulife delivered a four-quarter average earnings surprise of 7.01%. The stock has gained 4.7% year to date. The Zacks Consensus Estimate for MFC’s 2024 and 2025 earnings suggests growth of 5.5% and 9.7%, respectively, from a year ago. It carries a Zacks Rank #2.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s an American AI company that’s riding low right now, but it has rounded up clients like BMW, GE, Dell Computer, and Bosch. It has prospects for not just doubling but quadrupling in the year to come. Of course, all our picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.