Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

UBS Group AG UBS, following its acquisition of Credit Suisse, plans to cut jobs in five separate waves, starting this June. In August 2023, UBS announced its plan to lay off around one in 12 employees in Switzerland to reduce costs by more than $10 billion by 2026. In total, 50-60% of former Credit Suisse employees are likely to be made redundant. The news was reported by Reuters, which cited the SonntagsZeitung newspaper.

UBS' plan to reduce costs will mainly result from cutting its workforce. According to the source, 30,000 and 35,000 jobs are expected to be eliminated globally.

Approximately 25% to 30% of former Credit Suisse staff could be laid off in the first wave of job cuts in June. The later waves are set to take place in the months of August, September, October and November.

In June 2023, UBS Group completed the acquisition of Credit Suisse (a regulatory-assisted deal). The company is on track to complete the integration process by the end of 2026. This move is expected to enhance capabilities in wealth and asset management, as well as aid in growing its capital-light businesses.

However, after the acquisition of Credit Suisse, UBS has been facing class action suits and complaints from individual shareholders and former employees of Credit Suisse over inadequate consideration. Such successive lawsuits are expected to increase costs, thereby adversely impacting the company’s profitability. Hence, an increase in claims against the company and regulatory fines over Credit Suisse’s dealings are expected to increase litigation provisions in the near term.

Nonetheless, management is optimistic about the Credit Suisse acquisition and believes it to be the most beneficial option for the company in the upcoming period.

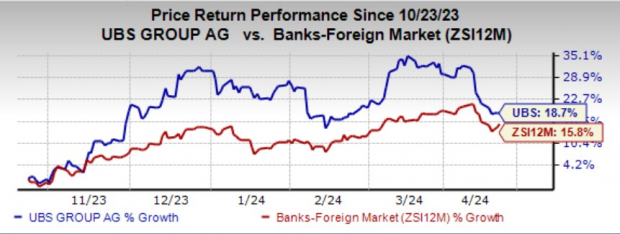

Shares of UBS have gained 18.7% on NYSE over the past six months compared with the industry’s growth of 15.8%.

Image Source: Zacks Investment Research

Currently, UBS Group sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In an effort to streamline operations and adapt to a rapidly changing operating environment, BlackRock, Inc. BLK is planning to eliminate 600 jobs. This accounts for nearly 3% of the company’s total global workforce. Per a Reuters article, the job cuts are not focused on a single team.

Despite this elimination, BLK remains positive about its future growth prospects. By the end of 2024, the company expects to employ more workforce, as it plans to expand certain parts of its business.

Citigroup Inc. C is planning to eliminate 20,000 job positions, excluding its workforce in Mexico, over the medium term. As Citigroup announced a net loss of $1.8 billion for fourth-quarter 2023, the decision will help improve its performance. In fact, these job cuts would result in savings of approximately $2-$2.5 billion over the medium term.

Such measures will help C to focus on its core strengths, thereby improving its results in the upcoming period.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks' free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.