Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Albertsons Companies, Inc. ACI reported mixed fourth-quarter fiscal 2023 results, wherein earnings were in line with the Zacks Consensus Estimate, while sales missed the same. Additionally, on a year-over-year basis, the company’s top line increased marginally but the bottom line declined.

ACI’s focus on operational excellence, digital expansion, pharmacy operations and customer relationships represent a comprehensive strategy for growth and competitiveness. However, results were partly hurt by the challenges in the industry.

In the fiscal fourth quarter, ACI continued to prioritize its goal to create "Customers for Life." Investing in technology, enhancing digital platforms, improving in-store experiences and optimizing supply-chain operations are its strategies to reach the goal.

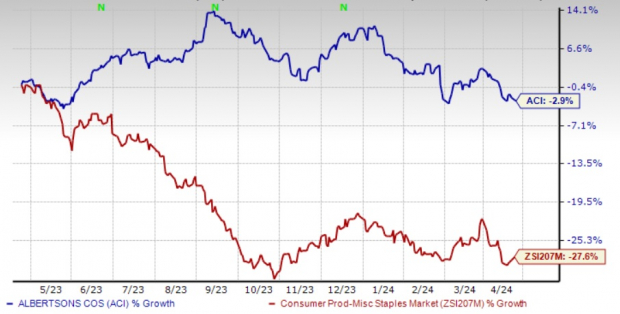

Shares of this Zacks Rank #3 (Hold) company have decreased 2.8% in the past year compared with the industry's decline of 28%.

Image Source: Zacks Investment Research

Albertsons, which entered into an “Agreement and Plan of Merger” with Kroger on Oct 13, 2022, posted adjusted quarterly earnings of 54 cents per share, in line with the Zacks Consensus Estimate. However, the bottom line declined 31.6% from 79 cents reported in the prior-year period.

Net sales and other revenues were $18,339.5 million, up 0.4% year over year. However, the top line missed the Zacks Consensus Estimate of $18,401 million. The year-over-year sales momentum can be attributable to a 1% rise in identical sales driven by strong growth in pharmacy sales. This was partly negated by a decline in fuel sales and wholesale revenues.

The gross profit of $5,144.2 million increased 1.2% year over year. The gross margin expanded 20 basis points (bps) year over year to 28.0% compared with 27.8% in fourth-quarter fiscal 2022.

Excluding the impacts of fuel and LIFO expenses, the gross margin rate decreased 58 bps year over year. This decline was primarily caused by robust growth in pharmacy operations, which generally have a lower gross margin rate and an increase in shrink. Gross margin was also affected by higher picking and delivery costs related to continued growth in digital sales. This was partly offset by procurement and sourcing productivity initiatives.

During the quarter, selling and administrative expenses decreased 0.1% to $4,717.2 million and declined 10 bps to 25.7%, as percentage of net sales and other revenues. Excluding the impact of fuel, selling and administrative expense rate increased 13 bps year over year. This was caused by higher operating expenses related to digital and omni channel development, ongoing Merger-related costs, elevated store occupancy costs and incremental third-party store security services costs. This was partly offset by reduced employee costs, including the benefits of ongoing productivity initiatives, and reduced depreciation and amortization.

Adjusted EBITDA declined 12.8% year over year to $915.8 million while adjusted EBITDA margin contracted 100 bps.

Albertsons ended the quarter with cash and cash equivalents of $188.7 million as of Feb 24, 2024. The company’s long-term debt and finance lease obligations totaled $7,783.4 million, while total stockholders' equity amounted to $2,747.5 million.

Here, we have highlighted three top-ranked stocks, namely B&G Foods, Inc. BGS, Colgate-Palmolive CL and Vita Coco Company COCO.

B&G Foods, which manufactures, sells and distributes a portfolio of shelf-stable and frozen foods, and household products, carries a Zacks Rank #2 (Buy). BGS delivered an earnings surprise of 23.8%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for B&G Foods current fiscal-year sales and earnings suggests a decline of 3.4% and 15.2%, respectively, from the year-ago reported numbers.

Colgate, a leading oral care and hygiene company, currently carries a Zacks Rank #2. CL delivered an earnings surprise of 4.2%, on average.

The Zacks Consensus Estimate for Colgate’s current fiscal-year sales and earnings suggests growth of 3.6% and nearly 8.4%, respectively, from the year-ago reported numbers.

Vita Coco, which develops, markets and distributes coconut water products, currently carries a Zacks Rank #2. COCO has a trailing four-quarter earnings surprise of 31.3%, on average.

The Zacks Consensus Estimate for Vita Coco current financial-year sales and earnings suggests growth of 1.8% and 24.3%, respectively, from the year-ago reported numbers.

Top 5 Dividend Stocks for Your Retirement

Zacks targets 5 well-established companies with solid fundamentals and a history of raising dividends. More importantly, they have the resources and will to likely pay them in the future.

Click now for a Special Report packed with unconventional wisdom and insights you simply won’t get from your neighborhood financial planner.

See our Top 5 now – the report is FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.