Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Earnings season is always an exciting time for investors, with companies finally revealing what’s transpired behind closed doors.

As usual, the big banks shifted the cycle into a much higher gear, with many other companies scheduled to follow suit.

And concerning next week’s docket, three notable companies reporting quarterly results include PayPal PYPL, Amazon AMZN, and Advanced Micro Devices AMD.

But how do headline expectations stack up heading into the releases? Let’s take a closer look.

PayPal

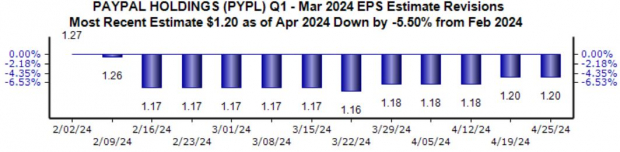

PayPal shares have primarily tracked the S&P 500 in 2024, gaining 7.2% compared to a 6.7% gain. Analysts' revisions for the upcoming release have moved higher over the last few weeks, with the current $1.20 Zacks Consensus EPS estimate suggesting a 2.5% climb year-over-year.

Image Source: Zacks Investment Research

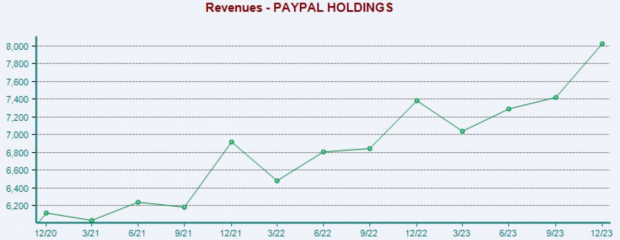

Top line expectations haven’t budged much, with the $7.4 billion consensus estimate reflecting a 6.6% jump from the year-ago period. The company’s revenue has remained on a consistent trajectory, as we can see illustrated below.

Image Source: Zacks Investment Research

Amazon

Analysts have been notably bullish for Amazon’s upcoming release, with the $0.82 Zacks Consensus EPS estimate up 15% since February and suggesting 160% growth year-over-year. Operational efficiencies have aided the company’s profitability in a big way, helping explain the outsized growth.

Image Source: Zacks Investment Research

Revenue revisions have remained flat, with the $142.5 billion expected suggesting a 12% jump from the year-ago period. The company’s revenue has seen an acceleration over the last few quarters, further illustrated below.

Image Source: Zacks Investment Research

Advanced Micro Devices

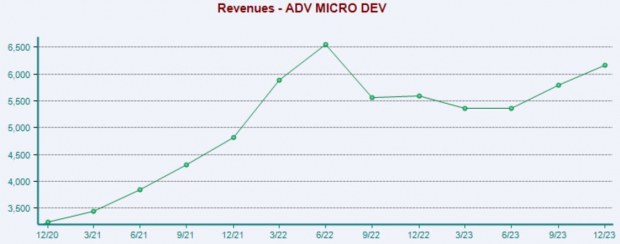

Analysts haven’t been bullish on AMD’s quarter to be reported, with the $0.60 Zacks Consensus EPS estimate down 9% since February and flat compared to the year-ago period.

Top line revisions haven’t been as harsh, down a modest 1% to $5.4 billion over the same timeframe. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Earnings season is always an exciting time for investors, with companies finally telling us what’s transpired behind closed doors.

And next week, several notable companies -- PayPal PYPL, Amazon AMZN, and Advanced Micro Devices AMD – are on the reporting docket.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%... an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.