Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Behemoth package carrier United Parcel Service (NYSE: UPS) will release Q3 earnings on Oct. 24, which should be noteworthy. Rival FedEx (NYSE: FDX) disappointed the market recently with its first-quarter 2025 earnings report amid management talk of weakening business-to-business (B2B) demand, pressure on domestic deliveries, and customers shifting to lower-priced alternatives.

Let's see what this could all mean for UPS and its shareholders.

It's never good when a key rival reports such conditions, and it's worse that FedEx cut its 2025 guidance just one quarter after initiating it. So UPS investors are rightly cautious going into the earnings report.

With UPS already lowering its guidance in its Julyearnings call will it do so again, or is the bad news already implied in its existing guidance and possibly its share price, too?

A reiteration of full-year guidance should lift the stock, and at least one Wall Street analyst believes UPS has a pathway to reaching its full-year earnings guidance. While it's tough to know what the transportation company will report and guide toward, investors can keep track of one key metric: its domestic package average revenue per piece.

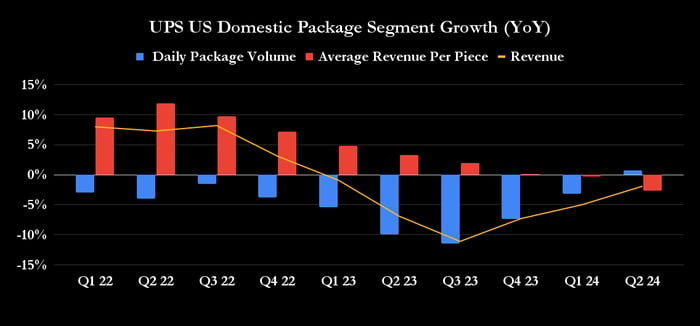

Data source: UPS presentation, chart by author.

As FedEx reported for its business, UPS is seeing a shift toward lower-yielding deliveries, but UPS management expects delivery volumes to keep growing in the third quarter. As such, it's reasonable to expect U.S. domestic package year-over-year volume growth, but where will its average revenue per piece be?

CEO Carol Tome argued in the July conference call that UPS had "new e-commerce entrants into the United States. And their volume, well, it's exploded. It was certainly more than we anticipated." Given that the "exploding" deliveries tended to be lower yielding, revenue per piece was pressured in the second quarter.

However, a doubter might argue that UPS only hit its volume growth target because it took on lower-margin deliveries. This is a matter for debate likely to continue, but the average revenue per piece number from the upcoming report should throw a lot of color on the company's results.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends FedEx. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community. Reaching millions of people each month through its website, books, newspaper column, radio show, television appearances, and subscription newsletter services, The Motley Fool champions shareholder values and advocates tirelessly for the individual investor. The company's name was taken from Shakespeare, whose wise fools both instructed and amused, and could speak the truth to the king -- without getting their heads lopped off.