Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

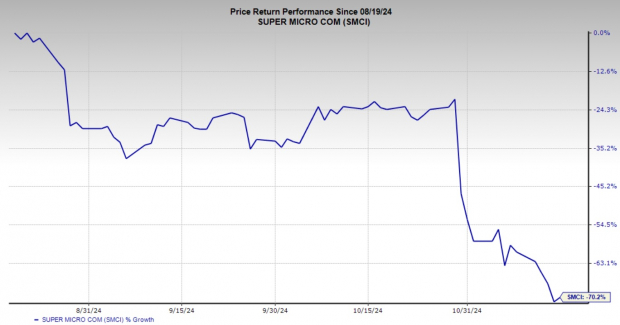

Super Micro Computer, Inc. SMCI has experienced a tumultuous period, with its stock price plummeting 70% over the past three months. This sharp decline can be attributed to a series of setbacks that have shaken investor confidence and cast a shadow over the company’s short-term outlook.

Image Source: Zacks Investment Research

The initial catalyst for Super Micro Computer’s decline came in late August when a scathing report from Hindenburg Research alleged accounting manipulations, self-dealing involving executive family members and potential violations of U.S. foreign sanctions. These allegations triggered a significant sell-off, creating waves of doubt about the integrity of the company’s financial practices.

Exacerbating concerns, Super Micro Computer’s auditor, Ernst & Young, resigned in October, citing unwillingness to be associated with the company’s financial statements. This highly unusual move raised serious red flags and deepened investor skepticism. Super Micro Computer failed to file its annual 10-K report within the required timeframe, and its quarterly 10-Q report also faced delays. The combination of these developments put the company at risk of being delisted from the Nasdaq Stock Exchange, adding more pressure on the stock.

The competitive landscape also played a role in Super Micro Computer’s troubles. Reports emerged that NVIDIA Corporation NVDA, a key partner, might be shifting orders to competitors like Cisco Systems, Inc. CSCO, adding to concerns about Super Micro Computer’s future revenue streams and market position. With a strong artificial intelligence (AI) server portfolio and reliable partnerships, Dell Technologies Inc. DELL is also likely to capitalize on SMCI’s difficulties.

Despite these significant challenges, Super Micro Computer has taken steps to stabilize its position. To avoid delisting, the company announced strategies to submit a filing plan to the Nasdaq. Reports indicate that SMCI intends to meet its obligations by submitting this plan, potentially preventing immediate delisting and restoring some degree of investor confidence.

Super Micro Computer is also working to appoint a new auditor to replace Ernst & Young, enabling it to resume its regulatory filings. By addressing these critical gaps in corporate governance and compliance, the company aims to regain investor trust and establish a more transparent operational framework.

Another positive sign is the recent acquisition of a 5.3% stake in Super Micro Computer by Susquehanna International Group through its affiliated broker-dealers. This passive investment indicates that institutional investors still see value in the company, even amid ongoing turmoil.

Despite its recent troubles, Super Micro Computer’s long-term growth prospects remain intact. The company has been a leader in providing high-performance server solutions, particularly for data centers that support AI and other advanced technologies. The global demand for AI-driven solutions continues to rise, and Super Micro Computer's role as a builder of data center infrastructure positions it well to benefit from this trend.

Moreover, Super Micro Computer’s reputation for designing and delivering energy-efficient, high-performance server systems has not been entirely overshadowed by recent events. The company’s expertise in integrating advanced graphic processing units from major tech players like Nvidia is a strategic advantage as enterprises scale their data centers to accommodate next-generation computing needs. This foundational strength suggests that Super Micro Computer is poised to bounce back once it resolves its current issues.

The current Zacks Consensus Estimate for fiscal 2025 and 2026 revenues and earnings suggests continued growth momentum.

Image Source: Zacks Investment Research

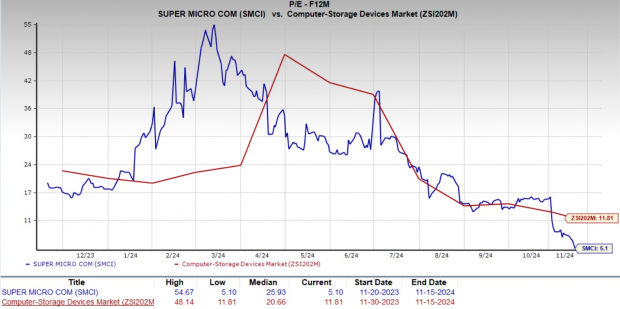

From a valuation perspective, Super Micro Computer stock is trading at an attractive level. SMCI currently trades at a 12-month price-to-earnings (P/E) ratio of 5.1X, compared to the Zacks Computer - Storage Devices industry’s 11.81X. The stock is considered cheap, especially for a company with strong ties to the booming AI sector. This low valuation provides a potential entry point for investors looking to capitalize on future growth once the company stabilizes its operations.

Image Source: Zacks Investment Research

Additionally, while risks remain, the market's reaction may have been overly severe, discounting Super Micro’s substantial assets and technological capabilities. As the company works through its regulatory and governance challenges, its underlying business strengths should offer support for a rebound.

While Super Micro Computer has faced significant setbacks, its corrective actions and strong long-term growth prospects create an intriguing investment case. The company’s efforts to file necessary reports and appoint a new auditor are steps in the right direction. Combined with its attractive valuation and leadership in AI-focused server solutions, now could be an opportune time to buy SMCI stock for investors with a higher risk tolerance. As this Zacks Rank #2 (Buy) company navigates these challenges, the potential for recovery and long-term gains makes it a compelling choice for forward-looking investors. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Zacks is the leading investment research firm focusing on stock research, analysis and recommendations. In 1978, our founder discovered the power of earnings estimate revisions to enable profitable investment decisions. Today, that discovery is still the heart of the Zacks Rank. A wealth of resources for individual investors is available at www.zacks.com.