Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

The AI sector was rocked this week by a groundbreaking development from China’s DeepSeek, which unveiled a powerful large-language model (LLM), R1, that rivals its US counterparts—but potentially at a fraction of the cost. This disruptive move is forcing investors to reevaluate the market’s AI leaders, like Nvidia (NVDA), which saw its stock slide alongside other AI-related names such as Vertiv, Vistra, and Arista Networks.

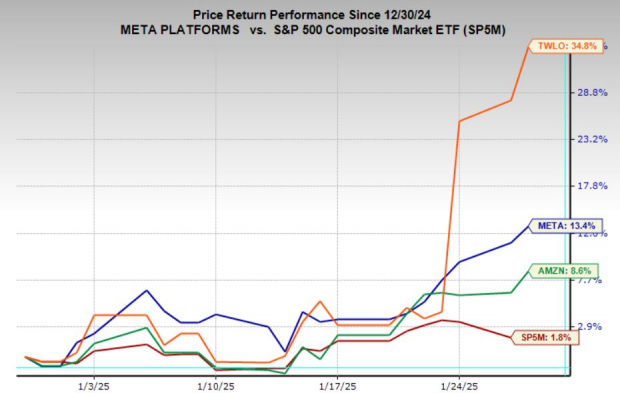

However, this isn’t the end of AI investing. Instead, it’s an opportunity to shift focus toward other areas of the tech stack where growth and value are emerging. Companies like Meta Platforms (META), Amazon (AMZN), and Twilio (TWLO) are poised to benefit from this evolving AI landscape, with strong fundamentals and improving price momentum.

Image Source: Zacks Investment Research

DeepSeek’s R1 model has altered the game by leveraging a cost-efficient approach to AI development. Operating under strict semiconductor import restrictions, the company achieved significant performance gains by optimizing low-level code and using an innovative training method that employs 8-bit floating-point numbers (FP8) instead of the traditional 32-bit precision.

This method dramatically reduces memory usage and improves performance, delivering sufficient accuracy for most AI workloads. More importantly, it undercuts the high costs associated with Nvidia's cutting-edge AI chips, which have been the backbone of recent AI advancements.

DeepSeek’s breakthrough has broad implications. By proving that cutting-edge AI can be developed more cheaply, it enables big tech companies to potentially scale their AI efforts without relying as heavily on Nvidia’s high-priced chips. This, in turn, allows these companies to reallocate spending toward other areas, like software development, which has been overlooked amid the AI hardware boom.

The iShares Expanded Tech-Software Sector ETF (IGV) is one area to watch. Once considered at risk of being commoditized by AI, software is now set to benefit as companies look to build out AI-driven applications more cost-effectively.

While Nvidia and its peers face headwinds, other stocks are emerging as compelling opportunities:

These companies exemplify how the AI narrative is shifting from expensive infrastructure to accessible, application-driven growth opportunities.

DeepSeek’s disruption is more than a headline; it signals a potential shift in the AI landscape. While hardware-focused companies like Nvidia adjust to slowing demand, the broader AI sector continues to evolve. Companies with the ability to innovate in software, services, and scalable AI applications are emerging as the new leaders.

Investors should embrace this transformation by focusing on stocks with strong fundamentals and growth potential in the changing AI environment. Meta, Amazon, and Twilio are prime examples of where the next wave of AI-driven growth could come from, offering a compelling case for a fresh approach to AI investing.

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Twilio Inc. (TWLO) : Free Stock Analysis Report

iShares Expanded Tech-Software Sector ETF (IGV): ETF Research Reports

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.