Trading accounts

Platforms

News

We provide the latest news

from the world of economics and finance

We provide the latest news from the world of economics and finance

Altria Group, Inc. (MO) finds itself watching a rapidly expanding e-vapor category from the sidelines as U.S. adult usage climbs to roughly 21 million consumers by the end of the third quarter of 2025. The challenge is not a lack of consumer interest, but where that interest is concentrated.

Most recent growth has come from disposable e-vapor products, which added roughly 2.4 million users by the end of the third quarter. Disposables now account for more than 60% of the category and are typically flavored, low-priced and widely available. Many of these products are not authorized by the FDA. Altria’s e-vapor business, built around the NJOY brand, is focused on authorized products, limiting its exposure to the segment driving most new adoption.

Altria has long emphasized the need for stronger enforcement against unauthorized products. Recently, federal agencies have increased actions against illicit e-vapor, including coordinated raids and large-scale seizures at the retail and distribution levels. These efforts signal greater regulatory attention on the category, though their long-term impact remains to be seen.

At the same time, Altria’s e-vapor presence remains shaped by product and legal constraints. The company recorded a $873 million non-cash goodwill impairment charge on its e-vapor business in the first nine months of 2025. The NJOY ACE device is currently not available following patent-related import restrictions and the company continues to evaluate potential pathways for future participation in the category.

Overall, the e-vapor category’s growth to roughly 21 million adult users highlights its scale, though gains remain concentrated in specific formats. For Altria, regaining share likely hinges on sustained enforcement against illicit disposables and a viable path back into competitive, authorized products.

Philip Morris International Inc. (PM) is far more directly exposed to global e-vapor growth through its VEEV brand, which continues to scale across international markets. On its third quarter of 2025earnings call Philip Morris reported that VEEV shipments more than doubled year to date, with the brand now holding a top-three closed-pod position in 15 markets and the number-one spot in eight. PM benefits from broad geographic diversification, which allows it to participate more fully in the expanding e-vapor category.

Turning Point Brands, Inc. (TPB) is seeing rapid growth in adjacent nicotine categories. In the third quarter of 2025, modern oral nicotine sales reached $36.7 million, rising 627.6% year over year and accounting for 30.8% of total company revenues. Turning Point Brands has cited distribution expansion and consumer trial as key drivers. While TPB has limited exposure to traditional e-vapor devices, its results highlight strong demand for non-combustible alternatives.

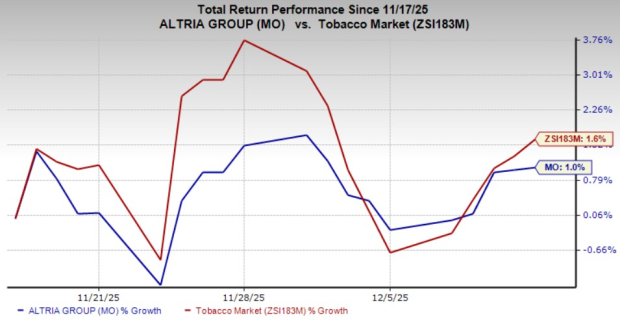

Shares of Altria have gained 1% in the past month compared with the industry’s growth of 1.6%.

Image Source: Zacks Investment Research

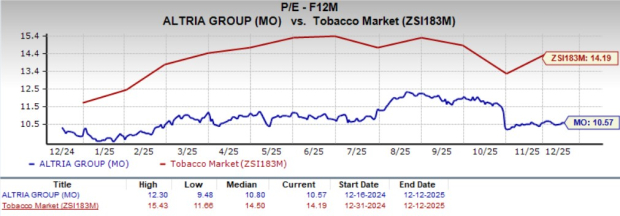

From a valuation standpoint, MO trades at a forward price-to-earnings ratio of 10.57X, down from the industry’s average of 14.19X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for MO’s 2025 earnings per share has inched up 1 cent in the past 30 days to $5.44, while the same for 2026 has slipped 1 cent to $5.56.

Image Source: Zacks Investment Research

Altria currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.